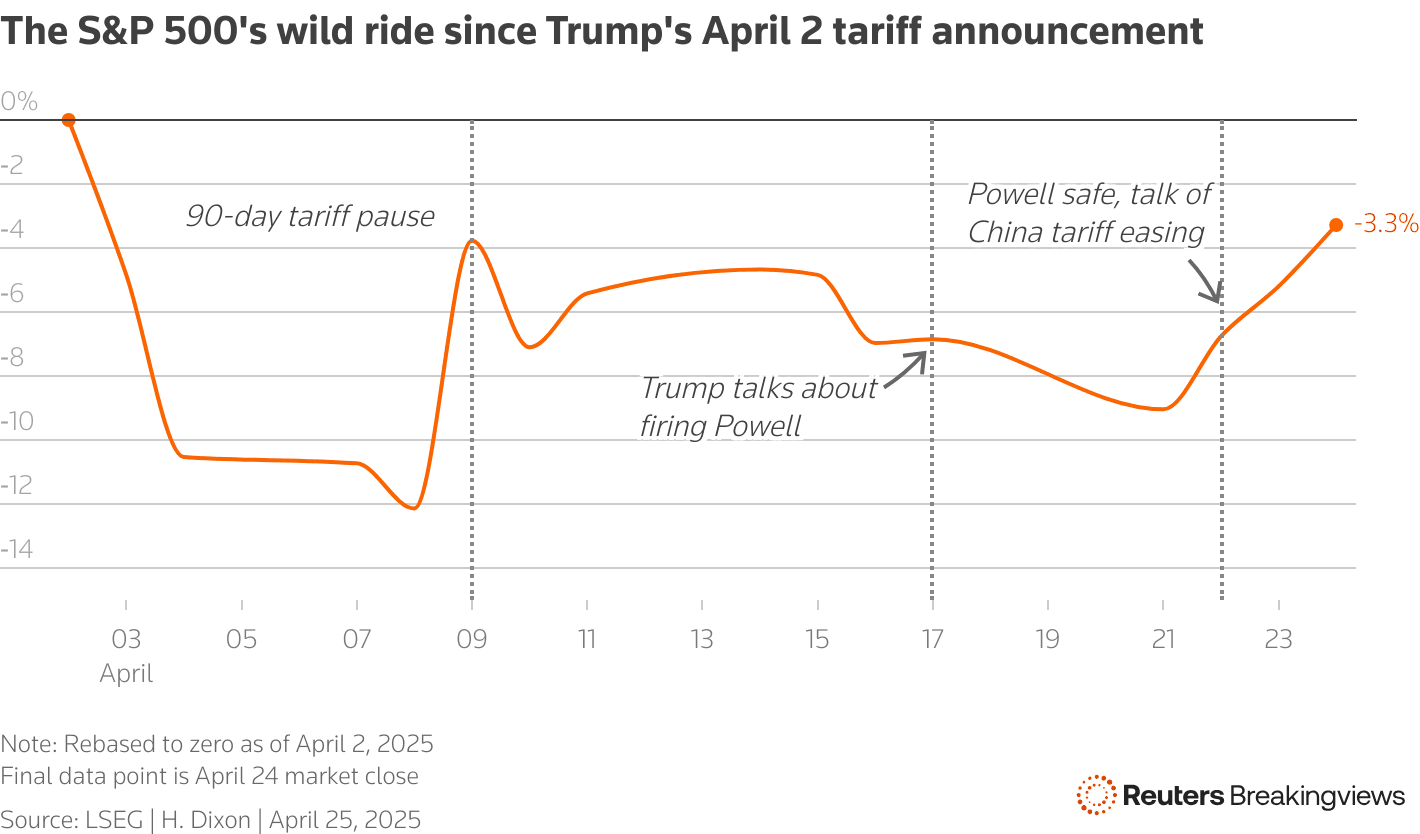

This week, global financial markets navigated a complex landscape shaped by easing trade tensions, mixed economic data, and central bank signals. While Wall Street rebounded sharply on the back of strong tech earnings and hopes of a de-escalation in U.S.-China tariffs, European markets remained cautious, weighed down by recession fears and soft PMI data.

In Asia, optimism returned as Japan and South Korea unveiled economic support measures to counter tariff impacts, while China’s industrial profits signaled fragile recovery.

Investor sentiment oscillated between relief and skepticism. The temporary softening of tariff rhetoric calmed markets, but uncertainty over long-term trade policies and inflationary pressures kept volatility in play. Technology and communication sectors led global gains, while consumer-facing industries and export-reliant economies struggled under the shadow of protectionism. Here's how the markets played out across the board.

Equities Roundup

Equity Markets React to Easing Trade Tensions and Tech Earnings

Global Equity Performance

-

S&P 500 surged 4.6%, Nasdaq jumped 6.7%, and Dow Jones rose 2.5%, driven by optimism around easing U.S.-China trade rhetoric and strong tech earnings.

-

Europe’s STOXX 600 gained 0.35%, marking its second consecutive weekly rise despite lingering recession fears.

-

Japan’s Nikkei 225 rallied 1.9%, fully recovering losses from earlier tariff shocks.

-

India’s Nifty 50 fell 1.27% amid geopolitical tensions with Pakistan.

Sector Highlights

-

Tech stocks led the rally, with Alphabet reaffirming AI investments. ServiceNow soared 14.8% on strong AI-driven demand.

-

Consumer discretionary remained under pressure due to tariff-induced inflation fears.

-

Financials and healthcare sectors showed resilience, supported by defensive positioning.

Key Corporate Events

-

Over 73.9% of S&P 500 companies reporting Q1 earnings beat expectations.

-

Market focus shifts to upcoming reports from Apple and Microsoft next week.

-

IPO activity remained muted due to market volatility.

Commodities Check

Oil Slips While Gold Remains a Safe Haven Amid Uncertainty

Crude Oil

-

Brent crude closed at $66.87, down 1.6% for the week, pressured by recession fears and fluctuating trade negotiations.

-

WTI settled at $63.02, marking a 2.6% weekly decline.

Precious Metals

-

Gold saw volatility, peaking above $3,500 before settling at $3,292.99, down 1.7% on Friday but still up YTD as investors hedge against policy unpredictability.

-

Silver and industrial metals mirrored gold’s movement, influenced by dollar strength and global growth concerns.

Drivers

Trade war developments, dollar fluctuations, and investor flight to safety continue to dictate commodity prices.

Currency & Forex Snapshot

Dollar Finds Stability While Yen Gains on Safe-Haven Flows

-

The USD Index posted its first weekly gain since March, buoyed by easing Fed concerns and trade optimism.

-

USD/JPY climbed to 143.55, reflecting risk-on sentiment but also safe-haven demand for yen earlier in the week.

-

EUR/USD slipped to 1.1377, as ECB rate cuts weighed on the euro.

-

INR remained volatile due to regional tensions but stabilized towards the weekend.

Key Influences

Central bank divergence, trade uncertainty, and shifting investor sentiment continue to dominate forex markets.

Bond Yields & Interest Rates

Yields Dip as Fed Signals Patience Amid Trade Volatility

-

The US 10-year Treasury yield fell to 4.26%, reflecting investor caution and hopes for potential Fed rate cuts later this year.

-

ECB cut rates by 25 bps to 2.25%, citing disinflation and tightening financial conditions from trade disruptions.

-

Inflation concerns remain elevated due to tariff impacts, but recession fears are tempering bond market reactions.

Crypto & Alternative Assets

Bitcoin Steady While Altcoin Volatility Persists

-

Bitcoin (BTC) held above key support levels, maintaining investor confidence despite broader market jitters.

-

Altcoins saw renewed volatility, driven by shifting regulatory narratives and DeFi developments.

-

Sentiment was mixed, with ETF inflows providing stability while hacks and liquidity concerns weighed on smaller tokens.

Global Events & Macro Trends

China’s Industrial Growth Resilient Amid Trade War Pressures

-

China’s Q1 industrial profits rose 0.8%, signaling resilience despite aggressive U.S. tariffs. However, future pressure is expected without swift policy support.

-

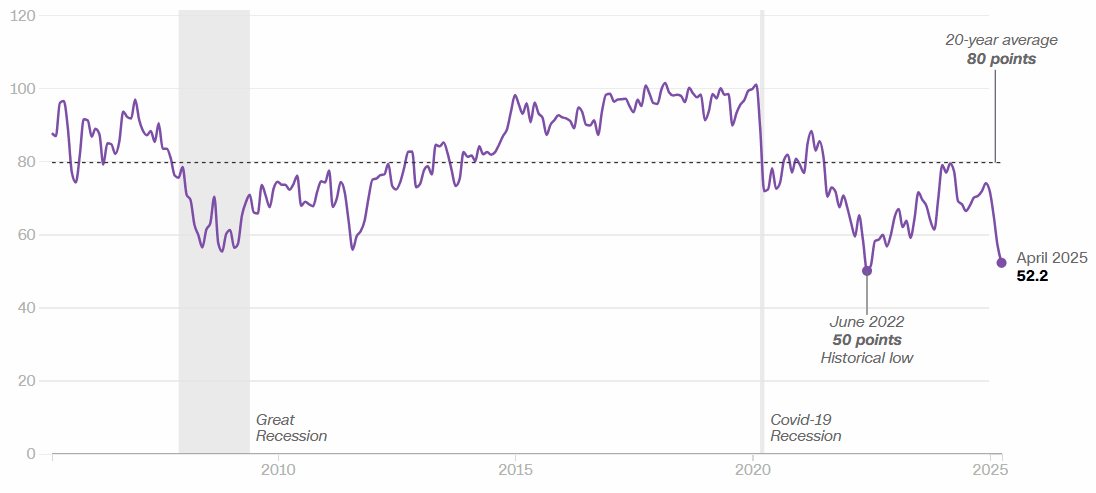

US Consumer Sentiment plunged 8% in April, reflecting deep concerns over recession risks and inflation.

-

Japan rolled out emergency economic measures to counter tariff impacts, while Tokyo’s core CPI breached 3.4%, keeping inflation worries alive.

-

India faced market downturns amid escalating tensions with Pakistan, highlighting geopolitical risks in Asia.

Closing Thoughts: Markets at a Crossroads?

Looking at the broader picture, markets seem to have entered a phase of cautious stabilization, anchored by strong corporate earnings and a slight retreat from extreme trade policy fears. Tech stocks demonstrated notable resilience, acting as a buffer against geopolitical headwinds, while commodities and bond markets reflected lingering concerns over global growth and inflation dynamics.

As we head into next week, the focus will shift to critical earnings releases, central bank meetings, and fresh economic indicators, particularly inflation and employment data. The market’s ability to sustain its rebound will hinge on tangible progress in trade negotiations and clarity from policymakers. While short-term relief rallies are likely, the undercurrent of uncertainty suggests investors should brace for renewed volatility. A contrarian view? If tech momentum holds and central banks lean dovish, we could see risk assets outperform expectations—even in a slowing global economy.