While traditional banks offer savings rates hovering around 1-3%, the decentralized finance (DeFi) ecosystem stands as a stark contrast, advertising double and sometimes triple-digit annual percentage yields (APYs). This dramatic disparity has drawn billions of dollars in capital, ranging from individual crypto enthusiasts to institutional giants seeking alternatives to conventional investment vehicles.

Approaching mid-2025, the central question facing the DeFi ecosystem is whether these remarkable returns represent a sustainable financial revolution or merely a speculative bubble approaching its inevitable burst. This question is not merely academic - it has profound implications for millions of investors, the broader cryptocurrency market, and potentially the entire financial system.

The sustainability of DeFi yields sits at the intersection of technological innovation, economic theory, regulatory uncertainty, and evolving financial behavior. Proponents argue that blockchain's inherent efficiencies, along with the elimination of traditional intermediaries, can justify persistently higher returns even in mature markets. Critics counter that current yield levels reflect unsustainable tokenomics, hidden risks, and temporary regulatory arbitrage rather than genuine value creation.

Recent developments have only intensified this debate. The announcement by BlackRock's dedicated crypto division to expand its DeFi operations in March 2025 signals growing institutional interest. Meanwhile, the collapse of several high-yield protocols like VaultTech in January 2025, which promised sustainable 35% APYs before losing over $250 million of investor funds, reinforces skeptics' concerns.

This comprehensive analysis examines both perspectives, diving deep into the mechanics, risks, historical patterns, and emerging innovations that will determine whether DeFi's high yields represent a new financial paradigm or an unsustainable aberration.

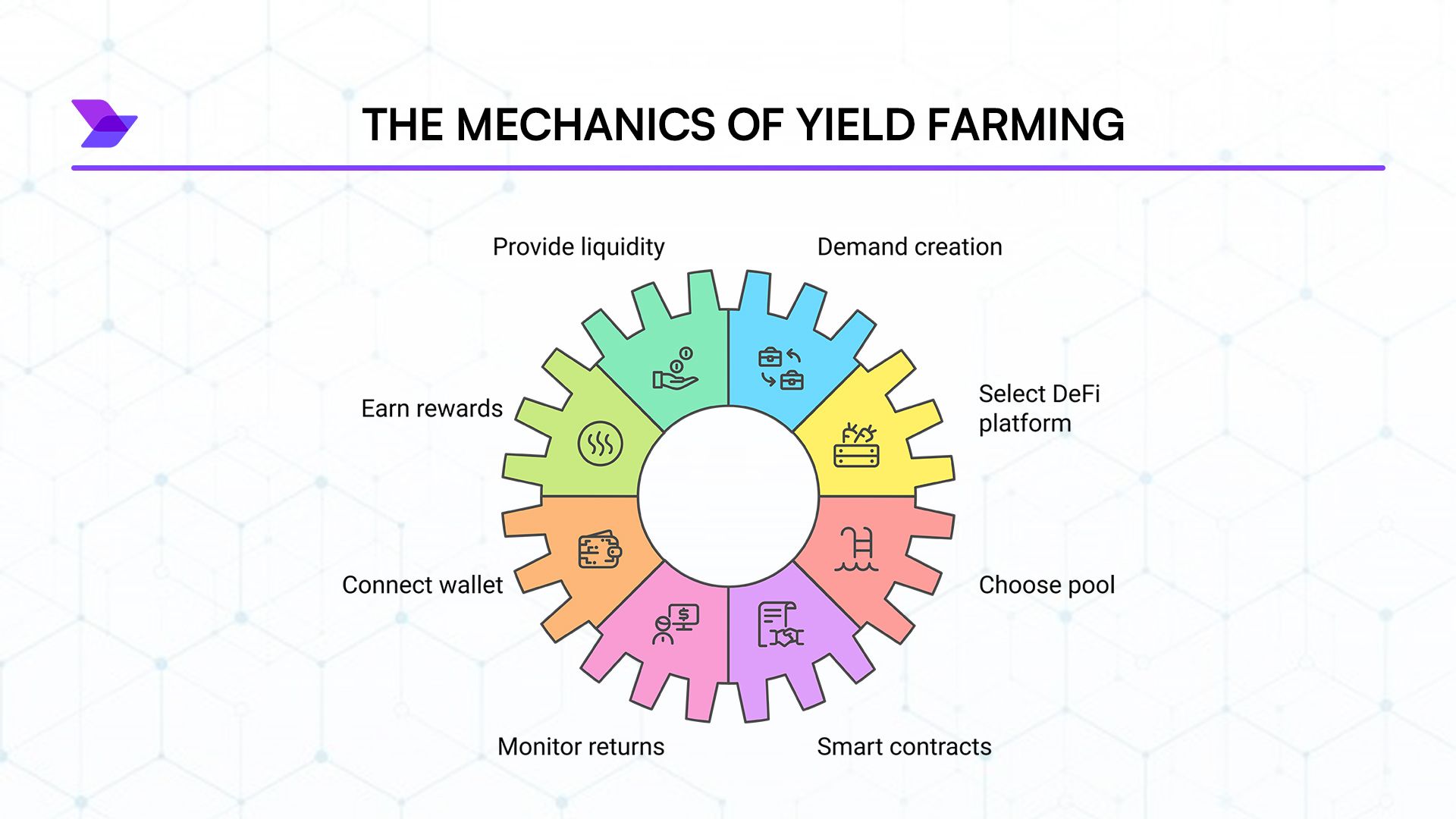

The Mechanics of Yield Farming: How DeFi Generates Returns

The Fundamental Architecture of DeFi Yields

Yield farming represents the cornerstone of DeFi's value proposition, offering a mechanism through which users can earn passive income by contributing their digital assets to decentralized protocols. At its core, yield farming involves depositing cryptocurrencies into liquidity pools - smart contract-managed reserves that power various financial services. These pools enable crucial DeFi operations like token swaps on decentralized exchanges (DEXs), lending and borrowing on credit platforms, or providing collateral for synthetic assets.

The process begins when a user connects their digital wallet to a DeFi protocol and deposits their tokens into a smart contract. Unlike traditional finance, where such actions might require extensive paperwork, identity verification, and business-hour limitations, DeFi transactions execute instantly, 24/7, with minimal barriers to entry. A yield farmer might, for instance, deposit $10,000 worth of Ethereum (ETH) and USD Coin (USDC) into a Uniswap liquidity pool, providing the necessary liquidity for other users to swap between these tokens.

In return for providing this crucial liquidity, farmers receive rewards through multiple channels. First, they typically earn a proportion of the fees generated by the protocol - for example, the 0.3% fee charged on each Uniswap transaction is distributed among liquidity providers based on their share of the pool. Second, many protocols offer additional incentives in the form of their native governance tokens.

This dual reward structure - combining transaction fees with token incentives - has enabled the eye-catching yield figures that have drawn millions of participants into the DeFi ecosystem. However, understanding the sustainability of these returns requires examining each component separately, as they operate on fundamentally different economic principles.

Types of Yield Farming Strategies

The DeFi ecosystem has evolved tremendously since its inception, giving rise to diverse yield farming strategies catering to different risk appetites, technical expertise levels, and capital requirements. According to a recent analysis by CoinDesk, the most prominent strategies include:

Liquidity Mining

Liquidity mining represents perhaps the most straightforward yield farming strategy. Users provide liquidity to DEXs like Uniswap, SushiSwap, or PancakeSwap by depositing pairs of tokens in equal value. For example, a farmer might add $5,000 of ETH and $5,000 of USDC to an ETH/USDC pool. In return, they receive LP (Liquidity Provider) tokens representing their share of the pool, plus rewards in the form of trading fees and often the platform's native token.

The APYs for liquidity mining can range dramatically, from 5% on established blue-chip pairs to over 1,000% for new project launches eager to attract liquidity. However, higher returns typically come with elevated risks, including impermanent loss and exposure to potentially low-quality tokens.

Lending Platforms

Lending represents another fundamental yield farming strategy, where users deposit assets into protocols like Aave, Compound, or newer entrants to earn interest from borrowers. These platforms function similarly to banks but operate entirely through smart contracts without central authorities.

Lenders earn base interest rates determined algorithmically by supply and demand - when borrowing demand is high, interest rates increase automatically. Many platforms supplement these base rates with token rewards, boosting effective yields. Lending typically offers lower but steadier returns compared to liquidity mining, making it attractive for risk-averse yield farmers.

Staking Mechanisms

Staking has evolved significantly within the DeFi ecosystem, extending far beyond the basic concept of securing proof-of-stake blockchains. Today, staking encompasses various activities:

- Protocol staking: Locking tokens to participate in governance and earn rewards

- Liquidity staking: Depositing tokens like ETH into protocols such as Lido to receive liquid staking derivatives (e.g., stETH) that can be used elsewhere in DeFi

- LP token staking: Staking the LP tokens received from providing liquidity to earn additional rewards

The innovation of liquid staking derivatives has created powerful composability, allowing assets to generate yields in multiple places simultaneously. This versatility has become a key feature of DeFi in 2025, enabling even more sophisticated yield strategies. For example, Pendle Finance has pioneered yield tokenization, separating the base asset from its future yield for separate trading and optimization.

Advanced Yield Strategies: Leveraging Composability

The truly revolutionary aspect of DeFi lies in its composability - the ability for protocols to seamlessly integrate with one another, creating increasingly complex financial instruments. This "money lego" characteristic has given rise to advanced yield strategies that would be impossible in traditional finance.

Yield Aggregators

Platforms like Yearn Finance have developed sophisticated vaults that automatically allocate capital across multiple yield sources, optimizing returns while minimizing risks and gas costs. These aggregators implement complex strategies that may include:

- Automated rebalancing between different yield sources based on performance

- Strategic borrowing against deposited assets to amplify returns

- Compounding rewards automatically to maximize APY

- Executing flash loans to arbitrage yield differentials across protocols

By February 2025, Yearn's vaults managed over $11 billion in assets, with flagship stablecoin strategies consistently delivering 15-20% APY even during market downturns. The protocol's success demonstrates how automation and optimization can generate sustainable yields through efficiency rather than unsustainable token emissions.

Derivatives and Options Strategies

The maturation of DeFi has led to the development of sophisticated derivatives and options protocols, creating entirely new yield sources. Platforms like Opyn and Ribbon Finance offer structured products that generate yield through options strategies:

- Covered call vaults: Earning premiums by selling call options against held assets

- Put-selling vaults: Generating yield by selling put options with collateral

- Volatility arbitrage: Exploiting pricing inefficiencies across different maturity dates

These strategies more closely resemble traditional financial engineering than early DeFi's simplistic yield farming, potentially offering more sustainable returns derived from genuine market activities rather than token incentives.

The Case for Sustainable High Returns

Blockchain's Efficiency Edge

To understand whether DeFi's high yields can be sustainable, we must first examine the fundamental technological advantages that blockchain and smart contracts offer over traditional financial infrastructure. These advantages could potentially justify persistently higher returns even after the market matures.

At its core, blockchain technology enables trustless coordination at unprecedented scale and efficiency. Traditional financial systems require extensive redundancy and reconciliation processes across institutions. For example, when executing a securities transaction, multiple entities maintain separate records that must be continuously reconciled - a process that takes days and involves substantial manual work despite decades of digitization efforts.

Blockchain's shared ledger eliminates this redundancy by creating a single source of truth that all participants can verify independently. This architectural shift dramatically reduces overhead costs. Major banks typically spend 5-10% of their operating budgets on reconciliation processes that blockchain renders largely unnecessary, according to McKinsey's 2024 Banking Technology Report.

Smart contracts further amplify these efficiency advantages by automating complex financial logic. The traditional loan issuance process typically involves application processing, credit checks, manual underwriting, legal documentation, and servicing - all performed by various professionals whose compensation ultimately comes from the spread between deposit and lending rates. In contrast, lending protocols like Aave or Compound automate this entire workflow through smart contracts that execute instantly at minimal cost.

This fundamental efficiency advantage creates a technological "yield premium" that could persist indefinitely, similar to how internet businesses maintain structural advantages over brick-and-mortar counterparts. The magnitude of this premium remains debatable, but analyses from Messari Research suggest it could sustainably add 2-5% to returns across various financial activities.

Disintermediation: Cutting Out the Middlemen

Beyond pure technical efficiency, DeFi creates substantial value through aggressive disintermediation - removing layers of middlemen who extract fees throughout the traditional financial value chain. This disintermediation represents perhaps the strongest case for sustainable higher yields in decentralized finance.

The traditional financial system relies on an extensive network of intermediaries, each extracting value:

- Retail banks charge account fees and profit from deposit-lending spreads

- Investment banks collect underwriting fees, trading commissions, and advisory charges

- Asset managers impose management fees typically ranging from 0.5% to 2% annually

- Broker-dealers profit from trading spreads and execution fees

- Clearinghouses charge for settlement and custody services

DeFi systematically eliminates most of these intermediaries through direct peer-to-peer transactions governed by smart contracts. When a user provides liquidity to a DEX or lends through a DeFi protocol, they interact directly with counterparties without intermediaries extracting value between them.

This streamlined value chain allows substantially more economic value to flow directly to capital providers rather than intermediaries. For instance, when traders swap tokens on a DEX, approximately 70-90% of trading fees go directly to liquidity providers, compared to perhaps 20-30% in traditional market-making arrangements.

A December 2024 analysis by WinterTrust compared fee structures across traditional and decentralized finance, finding that DeFi protocols operate with approximately 70-80% lower overhead costs. This efficiency allows protocols to simultaneously offer higher yields to capital providers and lower fees to users - a win-win that suggests the disintermediation advantage could sustain higher returns permanently.

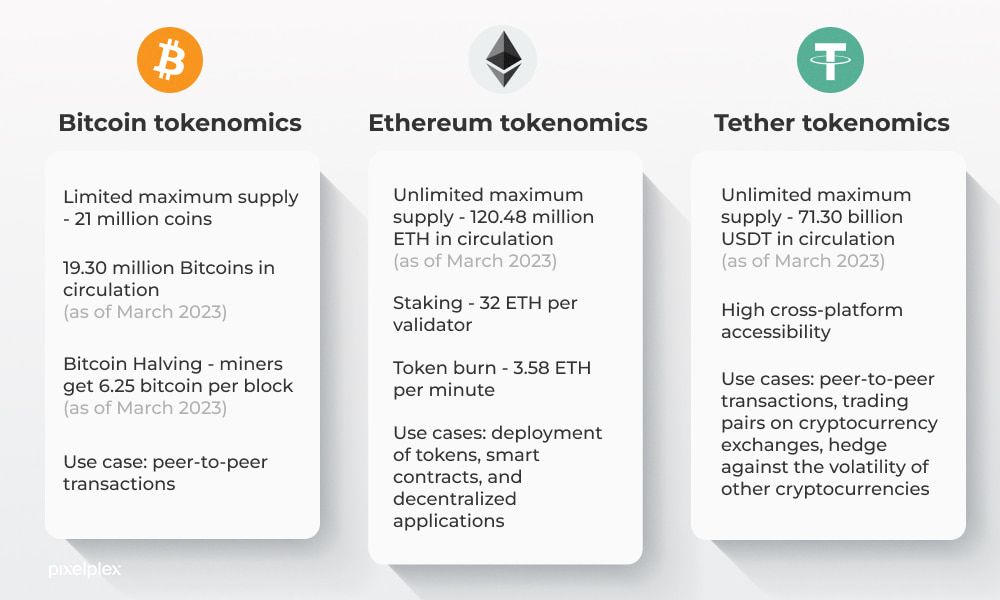

Innovative Tokenomics

The innovative tokenomic models pioneered within DeFi represent another potential source of sustainable high yields. While critics often dismiss token incentives as merely inflationary, closer examination reveals sophisticated economic designs that can potentially sustain attractive yields through genuine value creation and distribution.

Governance tokens - which confer voting rights over protocol parameters and development - constitute a fundamental innovation in financial system design. Unlike traditional financial institutions where governance rights concentrate among shareholders (typically excluding customers), DeFi protocols often distribute governance power broadly to users, aligning incentives throughout the ecosystem.

The most advanced protocols have evolved beyond simple inflationary tokenomics to implement sustainable value capture mechanisms:

- Fee-sharing models: Protocols like Curve Finance and Sushi direct a portion of transaction fees to token stakers

- Protocol-owned liquidity: Pioneered by Olympus DAO and refined by numerous projects, this model allows protocols to generate sustainable yields from their own treasury assets

- Real-world asset integration: Protocols like Centrifuge connect DeFi with physical assets like real estate and trade finance, providing yields backed by tangible economic activity

These innovative models represent a fundamental evolution beyond the simple "print tokens for yield" approach that dominated early DeFi. By aligning token economics with genuine value creation and capture, these protocols create potentially sustainable yield sources that don't rely solely on new capital inflows.

The Capital Efficiency Revolution

The ongoing evolution of capital efficiency within DeFi represents perhaps the most promising technological development for sustainable yields. Traditional finance operates with significant capital inefficiencies - banks maintain substantial reserves, assets remain siloed across different services, and capital moves slowly between opportunities.

DeFi's composability and programmability have sparked a revolution in capital efficiency through innovations like:

- Concentrated liquidity: Protocols like Uniswap v3 and Ambient allow liquidity providers to focus their capital in specific price ranges, multiplying effective yields

- Recursive lending: Platforms enable users to deposit assets, borrow against them, deposit the borrowed assets, and repeat—multiplying exposure and yields

- Rebasing tokens: Assets like OHM and AMPL adjust supply automatically, enabling novel yield mechanisms

- Flash loans: Zero-risk uncollateralized loans within a single transaction block, enabling capital-efficient arbitrage and yield optimization

These capital efficiency innovations allow the same underlying assets to generate multiple layers of yield simultaneously - a fundamental breakthrough compared to traditional finance. A March 2025 paper from Stanford's Blockchain Research Center calculated that DeFi's capital efficiency innovations could theoretically support sustainable yields 3-7% higher than traditional finance while maintaining equivalent risk profiles.

Global Access and Market Inefficiencies

DeFi's permissionless nature creates another potential source of sustainable yield advantage: global accessibility. Traditional finance operates within national boundaries, creating significant market inefficiencies and yield discrepancies across regions. DeFi transcends these boundaries, potentially enabling persistently higher yields by tapping into global market opportunities.

For instance, while U.S. Treasury yields might offer 2-3%, emerging market government bonds might yield 8-12% for similar risk profiles after accounting for currency fluctuations. Traditional finance makes accessing these opportunities difficult for average investors due to regulatory barriers, while DeFi platforms can integrate global opportunities seamlessly.

This global arbitrage opportunity extends beyond government bonds. DeFi protocols increasingly connect with real-world assets across jurisdictions, accessing yield opportunities previously available only to sophisticated institutional investors. Platforms like Goldfinch and TrueFi have pioneered uncollateralized lending to businesses in emerging markets, generating sustainable 15-20% yields backed by real economic activity rather than token emissions.

As DeFi continues bridging global financial gaps, this geographic arbitrage could sustain yield premiums for years or decades until global financial markets achieve perfect efficiency - a distant prospect given persistent regulatory and infrastructure barriers.

The Case Against High Returns: Systemic Risks

Inflated Tokenomics

While proponents highlight DeFi's innovative tokenomic designs, critics argue that many protocols rely on fundamentally unsustainable emission schedules that mathematically cannot maintain their high yields over time. A rigorous analysis of these token models reveals significant concerns about long-term sustainability.

Many DeFi protocols distribute governance tokens as yield incentives according to predetermined emission schedules. These schedules typically follow patterns like constant emission (a fixed number of tokens distributed daily) or gradual reduction (emissions decrease by a small percentage each period). Without corresponding growth in demand or token utilities, this supply expansion mathematically leads to price depreciation.

Token emissions inherently dilute existing holders unless the protocol generates sufficient new value to offset this expansion. This dilution creates a zero-sum dynamic where early farmers benefit at the expense of later participants - a mathematical reality often obscured by bull market token appreciation. The most concerning tokenomic models exhibit characteristics that mathematicians and economists identify as structurally similar to Ponzi schemes, where returns for existing participants depend primarily on capital from new entrants rather than sustainable value creation.

A comprehensive analysis by CryptoResearch examined emission schedules of 50 leading DeFi protocols, finding that 36% were mathematically certain to experience significant yield compression regardless of protocol adoption or market conditions. The research identified several concerning patterns:

- Emissions exceeding revenue: Protocols distributing token rewards valued at 3-10x their actual fee revenue

- Death spiral vulnerability: Tokenomics where declining prices trigger increased emissions, further depressing prices

- Governance concentration: Projects where insiders control sufficient voting power to perpetuate unsustainable emissions for personal benefit

These fundamentally unsustainable tokenomic designs have already led to several high-profile protocol collapses, including UmaMi Finance in June 2024 and the MetaVault crisis in November 2024. Both platforms promised "sustainable" high yields that mathematically could not continue beyond their initial growth phases.

Impermanent Loss: The Hidden Yield Killer

While DeFi marketing materials emphasize attractive APYs, they often minimize or omit discussion of impermanent loss (IL) - a unique risk that can significantly erode or even eliminate returns for liquidity providers. Understanding this phenomenon is crucial for assessing the true sustainability of DeFi yields.

Impermanent loss occurs when the price ratio between assets in a liquidity pool changes from when liquidity was provided. Mathematically, it represents the difference between holding assets passively versus providing them to an automated market maker (AMM). For volatile asset pairs, this loss can be substantial:

- 25% price change in one asset: ~0.6% loss

- 50% price change in one asset: ~2.0% loss

- 100% price change in one asset: ~5.7% loss

- 200% price change in one asset: ~13.4% loss

These losses directly reduce the effective yield for liquidity providers. For instance, a pool advertising 20% APY might deliver only 7-8% actual returns after accounting for IL in a volatile market. In extreme cases, impermanent loss can exceed base yields entirely, resulting in net losses compared to simply holding the assets.

Research from the Imperial College London examined historical performance across major AMMs, finding that impermanent loss averaged 2-15% annually for typical liquidity providers, with some volatile pairs experiencing losses exceeding 50%. This hidden cost fundamentally undermines the sustainability narrative of many high-yield liquidity mining opportunities.

The challenge of impermanent loss represents a structural inefficiency in current DeFi models that may prevent sustained high yields from liquidity provision. While innovations like concentrated liquidity and active management strategies attempt to mitigate these effects, they introduce additional complexity and costs that may ultimately limit sustainable yield potential.

Smart Contract Vulnerabilities

Beyond tokenomic and market risks, DeFi yields face a more existential threat: the security vulnerabilities inherent in the smart contracts that form the foundation of the entire ecosystem. These vulnerabilities challenge the notion of sustainable yields by introducing catastrophic tail risks not typically present in traditional financial instruments.

The DeFi landscape has been plagued by persistent security breaches that have resulted in billions of dollars in losses. Even in 2025, after years of security improvements, significant exploits continue to occur with alarming regularity. Analysis of major DeFi hacks reveals common attack vectors that persist despite awareness:

- Flash loan attacks: Exploiting temporary market manipulations using uncollateralized loans

- Oracle manipulations: Tampering with price feeds to trigger advantageous liquidations

- Reentrancy vulnerabilities: Exploiting function call sequences to withdraw funds multiple times

- Access control failures: Targeting inadequate permission systems

- Logic errors: Exploiting flawed business logic in complex financial mechanisms

The persistence of these vulnerabilities raises fundamental questions about yield sustainability. Any yield calculation must account for the non-zero probability of complete principal loss through smart contract failure - a risk that compounds over time and exposure to multiple protocols.

The DeFi SAFU Report 2025 examined five years of security incidents across the ecosystem, finding that despite improvements in security practices, the annualized loss rate from hacks and exploits still averaged 4.2% of total value locked (TVL). This effectively creates an ecosystem-wide insurance premium that should theoretically reduce sustainable yields by a corresponding amount.

This security tax represents a persistent cost that may limit the sustainable yield advantage of DeFi over traditional finance. While individual protocols might demonstrate excellent security records, users typically diversify across multiple platforms, increasing their cumulative exposure to these tail risks.

Regulatory Uncertainty

While technical and economic factors significantly impact yield sustainability, regulatory considerations may ultimately prove even more determinative. The evolving regulatory landscape poses existential challenges to many DeFi yield mechanisms that have largely operated in a gray area of compliance.

As of 2025, the regulatory environment for DeFi remains fragmented globally but has significantly clarified compared to earlier years. Key developments include:

- Securities classification frameworks: The SEC has intensified efforts to classify many DeFi tokens as securities, with landmark cases against major protocols

- KYC/AML requirements: Several jurisdictions now mandate identity verification for DeFi participants, challenging the anonymous nature of many yield mechanisms

- Stablecoin regulation: The implementation of the Global Stablecoin Framework has imposed reserve requirements and transparency standards

- Tax enforcement: Advanced blockchain analytics have enabled more aggressive tax authority monitoring of DeFi activities

These regulatory developments create significant compliance challenges for protocols built on permissionless, pseudonymous foundations. Many high-yield strategies explicitly rely on regulatory arbitrage - the ability to operate without the compliance costs and capital requirements imposed on traditional financial entities. As regulatory pressure increases, some portion of DeFi's yield advantage may derive from temporary regulatory arbitrage rather than sustainable innovation.

The Compliance Cost Index published by blockchain analytics firm Elliptic estimates that full regulatory compliance would add operating costs equivalent to 2-5% of TVL for most DeFi protocols. This suggests that some portion of current yield advantages may erode as regulatory clarity forces protocols to implement more comprehensive compliance measures.

Capital Concentration and Competitive Dynamics

The DeFi ecosystem has exhibited strong winner-take-all tendencies that may ultimately compress yields through capital concentration and competitive dynamics. As markets mature, capital tends to flow toward protocols with the strongest security records, most efficient mechanisms, and deepest liquidity - a pattern that naturally compresses yields through competition.

This competitive dynamic has already manifested in several segments of the DeFi ecosystem

- Stablecoin yields: Maximum yields have declined from 20-30% in 2021 to 8-12% in 2025 as capital concentration has increased efficiency

- Blue-chip lending: Yields on established assets like ETH and BTC have compressed from 3-10% to 1-4% as competition intensified

- Major DEXs: Liquidity provider returns have standardized around 5-10% annually for popular pairs, down from 20-50% in earlier years

The inevitable capital concentration process threatens the sustainability of outlier high yields across the ecosystem. As protocols compete for liquidity and users, economic theory suggests they will ultimately converge toward an efficient frontier where returns balance risk factors appropriately.

Research from the University of Basel examined yield compression across DeFi protocols from 2020-2024, finding that yields tended to converge toward equilibrium points approximately 3-5% above comparable traditional finance alternatives once protocols reached maturity. This suggests that while DeFi may maintain a structural yield advantage, the triple-digit returns that attracted early adopters may prove fundamentally unsustainable in the long term.

Historical Data and Yield Trends

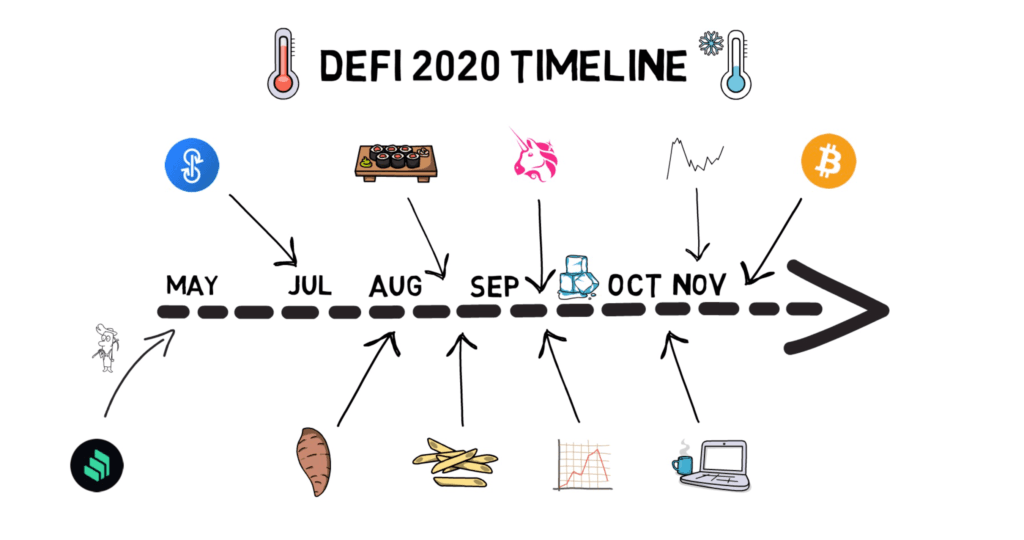

The DeFi Summer of 2020 and Beyond

The period known as "DeFi Summer" in 2020 represents a critical reference point for analyzing yield sustainability. This formative period saw explosive growth in DeFi protocols and introduced yield farming to mainstream crypto consciousness.

The catalyst for DeFi Summer came in June 2020 when Compound launched its COMP governance token and began distributing it to users based on protocol interaction. This innovation triggered a domino effect as users discovered they could earn triple-digit APYs through increasingly complex strategies involving lending, borrowing, and providing liquidity.

Key metrics from this period illustrate its exceptional nature:

- TVL Growth: DeFi's total value locked expanded from approximately $1 billion in May 2020 to over $15 billion by September 2020

- Token Valuations: Governance tokens like YFI surged from zero to over $40,000 in months

- Yield Levels: Common strategies regularly offered 100-1,000% APY

This period established the template for token-incentivized growth that has defined much of DeFi's evolution. However, it also demonstrated how unsustainable many early yield models were - by late 2020, many of the initially eye-catching yields had already compressed significantly as capital flooded into farming opportunities.

Yield Compression and Market Cycles

One of the most significant patterns in DeFi's evolution has been the progressive compression of yields across most strategies. This compression provides important evidence regarding the equilibrium level of sustainable returns in a maturing market.

During the 2020-2021 bull market, DeFi yields displayed several characteristic patterns:

- Correlation with token prices: Yields denominated in dollars increased as governance token values appreciated

- Protocol proliferation: New platforms launched with aggressive incentives, creating yield spikes

- Capital efficiency innovations: Protocols developed increasingly sophisticated strategies

- Leverage expansion: Users employed greater leverage to amplify yields

The subsequent 2022-2023 bear market provided a crucial stress test for DeFi yield sustainability. As token prices declined sharply, many yield sources collapsed or significantly compressed. In particular, the market downturn exposed the unsustainable nature of yields based primarily on token emissions.

By 2024-2025, a clearer pattern has emerged: protocols generating yields from actual usage fees, liquidations, and financial activities showed relatively stable returns regardless of market conditions. In contrast, yields derived primarily from token emissions or speculative demand fluctuated dramatically with market sentiment. This pattern suggests a core yield advantage derived from genuine efficiency gains and disintermediation benefits, upon which cyclical components layer additional returns during expansionary periods.

DeFi Llama's Yield Index has tracked this evolution since 2021, showing that sustainable "core yields" across the ecosystem have stabilized in the 5-15% range for most major assets and strategies. This represents a significant compression from earlier periods but still maintains a substantial premium over traditional finance alternatives.

Case Studies of Sustainable Yield Protocols

Examining specific protocols with demonstrated yield sustainability provides concrete evidence for the case that DeFi's high returns aren't merely a speculative bubble. These case studies illustrate how well-designed protocols can maintain attractive yields through genuine value creation rather than unsustainable mechanics.

Curve Finance: The Stability King

Curve Finance has emerged as perhaps the most compelling example of sustainable yield generation in DeFi. Launched in 2020, Curve specializes in stable asset swaps, focusing on minimizing slippage for stablecoins and similar pegged assets.

Curve's yield sustainability stems from multiple reinforcing mechanisms:

- Trading fees: Liquidity providers earn from the platform's 0.04% fee on swaps

- CRV emissions: The protocol distributes CRV tokens to liquidity providers

- Vote-escrowed economics: Users can lock CRV for up to 4 years to receive veCRV

- Bribes market: Third-party protocols pay veCRV holders to direct emissions

What makes Curve particularly notable is how these mechanisms create aligned incentives across stakeholders. Long-term believers lock their CRV for maximum voting power, reducing circulating supply while gaining control over the protocol's liquidity direction. This model has maintained competitive yields ranging from 5-20% annually on stablecoin pools even during extended bear markets.

Aave: Institutional-Grade Lending

Aave represents another compelling example of sustainable yield generation in the lending sector. As one of DeFi's premier money markets, Aave allows users to deposit assets to earn interest while enabling others to borrow against collateral.

Aave's yield sustainability derives from several key factors:

- Market-driven interest rates: Aave's utilization curve automatically adjusts rates based on supply and demand

- Risk-adjusted pricing: Different assets command different rates based on their risk profiles

- Protocol fees: A small portion of interest payments goes to the protocol treasury and stakers

- Safety Module: AAVE token stakers provide insurance against shortfall events

Aave's lending yields have demonstrated remarkable consistency, typically offering 3-8% on stablecoins and 1-5% on volatile assets across market cycles. These returns derive primarily from organic borrowing demand rather than token subsidies, creating a sustainable model that could theoretically operate indefinitely.

Lido: Liquid Staking Dominance

Lido Finance has revolutionized Ethereum staking through its liquid staking derivatives model. By allowing users to stake ETH while receiving liquid stETH tokens that can be used throughout DeFi, Lido created a fundamentally sustainable yield source.

Lido's yields derive directly from Ethereum's protocol-level staking rewards - currently around 3-4% annually - with additional yield opportunities created through stETH's DeFi compatibility. This model creates sustainable yield without relying on token emissions or unsustainable incentives.

The protocol has maintained consistent growth, capturing over 35% of all staked ETH by 2025, while offering yields that closely track Ethereum's base staking rate plus a premium for the liquid staking innovation. This demonstrates how infrastructural DeFi protocols can create sustainable yield advantages through genuine innovation rather than unsustainable tokenomics.

Risk-Adjusted Returns: A More Realistic Perspective

Comprehensive Risk Assessment

When evaluating DeFi yields, considering risk-adjusted returns provides a more accurate picture of sustainability than focusing solely on nominal APYs. Risk-adjusted metrics attempt to normalize yields based on their corresponding risk profiles, enabling fairer comparison between different opportunities.

Advanced risk-adjusted yield models calculate:

- Sharpe-like ratios: Yield excess over risk-free rate divided by yield volatility

- Sortino variations: Focusing specifically on downside risk rather than general volatility

- Maximum drawdown-adjusted returns: Yields normalized by worst historical performance

- Conditional value at risk: Accounting for tail risk beyond simple volatility measures

- Probability-weighted expected returns: Incorporating likelihood of different scenarios

These metrics reveal which yields genuinely compensate for their associated risks versus those that appear attractive only by ignoring or underpricing their risk profiles. Analysis using these measures suggests that many apparently high-yielding opportunities actually offer poor risk-adjusted returns compared to more modest but sustainable alternatives.

Risk-adjusted yield aggregator DeFiSafety has compiled extensive data showing that after accounting for all risk factors, "true" sustainable DeFi yields likely fall in the 6-12% range for most strategies - significantly lower than advertised rates but still substantially higher than traditional alternatives.

Risk Categories in DeFi

Advanced risk assessment models categorize DeFi risks into multiple dimensions, each with distinct implications for yield sustainability:

Smart Contract Risk:

- Code vulnerability probability

- Historical audit quality

- Complexity metrics

- Dependencies on external protocols

Economic Design Risk:

- Tokenomic stability measurements

- Incentive alignment scores

- Game theory vulnerability assessment

- Stress test simulation results

Market Risk:

- Liquidity depth metrics -Correlation with broader markets

- Volatility profiles

- Liquidation cascade vulnerability

Operational Risk:

- Team experience evaluation

- Development activity metrics

- Community engagement measures

- Transparency indicators

Regulatory Risk:

- Jurisdictional exposure analysis

- Compliance feature integration

- Privacy mechanism assessment

- Legal structure evaluation

By quantifying these diverse risk categories, comprehensive frameworks create risk profiles for each protocol and yield source. These profiles enable calculation of appropriate risk premiums - the additional yield necessary to compensate for specific risks. This approach suggests that sustainable DeFi yields likely settle at levels providing reasonable compensation for their genuine risks - typically 3-10% above truly risk-equivalent traditional finance alternatives once all factors are properly accounted for.

The Risk-Adjusted Yield Frontier

The concept of a "risk-adjusted yield frontier" helps visualize sustainable DeFi returns. This frontier represents the maximum theoretically achievable yield for any given risk level, with positions below the frontier indicating inefficiency and positions above suggesting unsustainable returns that will eventually revert.

Research by Gauntlet Networks, a leading DeFi risk modeling firm, has mapped this frontier across various DeFi strategies. Their analysis suggests that sustainable risk-adjusted yields in DeFi might exceed traditional finance by approximately:

- 2-4% for conservative, secured lending strategies

- 4-8% for liquidity provision in established markets

- 8-15% for more complex, actively managed strategies

These premiums derive from the fundamental efficiency and disintermediation advantages discussed earlier, suggesting that DeFi can maintain a sustainable yield advantage even after accounting for its unique risks. However, these premiums fall significantly short of the triple-digit APYs that initially attracted many participants to the ecosystem.

The Integration of AI into DeFi's Future

AI-Driven Protocol Design

Looking toward the future, artificial intelligence is increasingly shaping how DeFi protocols are designed from the ground up. This integration promises to create more sustainable yield mechanisms by embedding intelligent systems directly into protocol architecture.

Several key developments are already emerging in 2025:

-

Adaptive Yield Parameters: Protocols using AI to dynamically adjust emission rates, fee distributions, and other yield-determining factors based on market conditions and sustainability metrics. These systems can respond to changing conditions much more effectively than traditional governance processes. Synthetix's Perceptron system, launched in late 2024, dynamically adjusts staking rewards to maximize protocol growth while ensuring economic sustainability.

-

Predictive Risk Management: AI systems embedded within lending and derivatives protocols to predict potential market dislocations and adjust collateralization requirements or liquidation thresholds preemptively, reducing systemic risks. For example, Gauntlet's Risk AI now powers risk parameters for over $15 billion in DeFi assets, using simulation-based machine learning to optimize for safety and capital efficiency.

-

Personalized Yield Strategies: Platforms offering AI-generated yield strategies tailored to individual user risk profiles, time horizons, and financial goals rather than one-size-fits-all approaches. DefiLlama's AI Advisor, launched in February 2025, analyzes users' portfolios and risk preferences to recommend personalized yield strategies across hundreds of protocols.

The integration of AI into protocol design represents a significant evolution beyond merely using AI for analysis. By embedding intelligence directly into the protocols themselves, DeFi systems can potentially create more sustainable and adaptable yield mechanisms that respond to changing conditions while maintaining appropriate risk parameters.

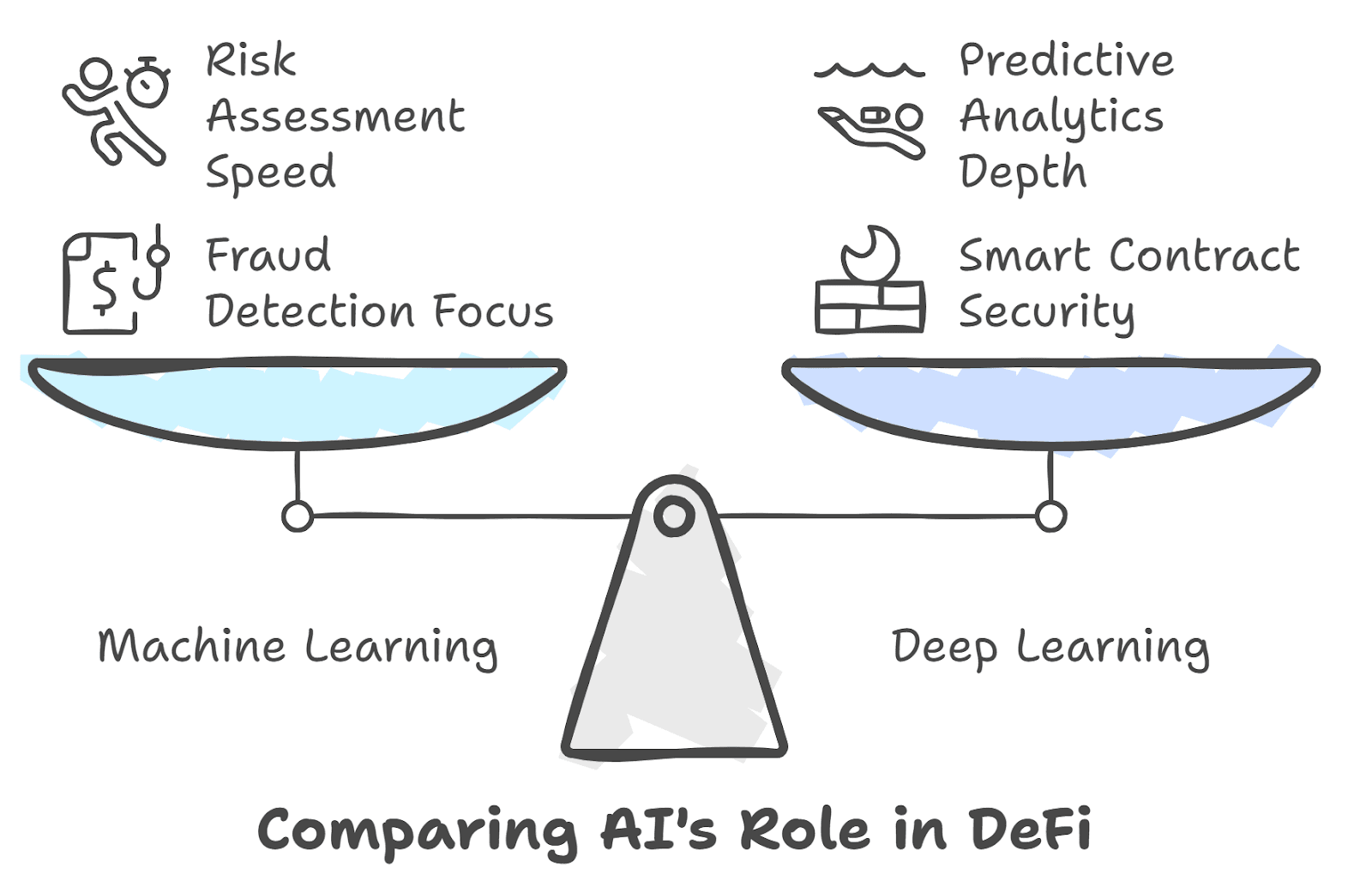

AI Applications in DeFi Risk Assessment

Artificial intelligence has become an increasingly crucial tool for analyzing DeFi yield sustainability. As the ecosystem grows in complexity, AI's ability to process vast datasets and identify subtle patterns offers unprecedented insight into what yields might be sustainable long-term.

By 2025, AI has permeated virtually every aspect of DeFi operations and analysis. AI models now routinely evaluate protocol security risks by analyzing smart contract code, governance structures, and historical performance. Advanced systems can identify potential vulnerabilities that might escape human auditors by comparing new protocols against databases of previous exploits.

These risk assessment capabilities have direct implications for yield sustainability. Machine learning algorithms can quantify previously subjective risk factors into concrete probability metrics, allowing for more accurate risk-adjusted yield calculations. For instance, AI systems regularly generate comprehensive risk scorecards for DeFi protocols that correlate strongly with subsequent exploit likelihood.

A notable example is Consensys Diligence AI, which has analyzed over 50,000 smart contracts, identifying vulnerability patterns that have helped prevent an estimated $3.2 billion in potential losses. This security layer potentially enables higher sustainable yields by reducing the "security tax" discussed earlier.

Yield Optimization Through Machine Learning

Perhaps the most visible application of AI in DeFi comes in the form of increasingly sophisticated yield optimization strategies. Modern yield aggregators employ machine learning to:

- Predict short-term yield fluctuations across protocols

- Identify optimal entry and exit points for various strategies

- Balance risk factors against potential returns

- Optimize gas costs and transaction timing

Platforms like Yearn Finance now employ advanced AI to manage billions in assets, automatically shifting capital between opportunities based on complex models that consider dozens of variables simultaneously. These systems have demonstrated an ability to generate returns 2-3% higher annually than static strategies by capitalizing on yield inefficiencies before they're arbitraged away.

The consensus from advanced yield prediction models suggests several important conclusions regarding sustainability:

- Base yield layers: Models identify persistent "base layers" of sustainable yield across various DeFi categories, typically 3-7% above traditional finance alternatives.

- Protocol maturation curves: Models characterize the typical yield compression curve as protocols mature.

- Sustainability thresholds: AI systems identify critical thresholds in metrics like emissions-to-revenue ratio that strongly predict long-term yield viability.

- Risk premiums: Models quantify the appropriate risk premium for different protocol categories, distinguishing between justified high yields and unsustainable returns.

DefiAI Research has developed comprehensive models suggesting that AI-optimized strategies could maintain a 4-8% yield advantage over traditional finance indefinitely through efficiency gains and continuous optimization across the DeFi ecosystem.

Pattern Recognition and Anomaly Detection

Beyond basic prediction, advanced AI systems excel at identifying subtle patterns and anomalies within DeFi yield data that provide insight into sustainability questions. These capabilities enable researchers to detect unsustainable yield mechanisms before they collapse and identify truly innovative models that might sustain higher returns.

AI research has identified several distinct yield patterns that correlate strongly with sustainability outcomes:

- Sustainable Yield Pattern: Characterized by moderate baseline returns (5-15%), low volatility, minimal correlation with token price, and strong connection to protocol revenue.

- Emissions-Dependent Pattern: Marked by high initial yields that progressively decrease following a predictable decay curve as token emissions reduce or token price falls.

- Ponzi Pattern: Identified by yields that increase with new capital inflows but lack corresponding revenue growth.

- Innovation-Driven Pattern: Distinguished by initially high but eventually stabilizing yields as a truly innovative mechanism finds its market equilibrium.

By combining pattern recognition and anomaly detection, AI researchers have developed effective early warning systems for unsustainable yield mechanisms. These systems monitor the DeFi ecosystem for signs of yield patterns that historically preceded collapses or significant contractions.

ChainArgos, a leading blockchain analytics platform, has developed AI models that successfully predicted major yield collapses in protocols like MetaVault and YieldMatrix weeks before their public implosions. This predictive capability offers a potential path to more sustainable DeFi participation by allowing investors to avoid unsustainable yield traps.

The Emergence of Real Yield

From Emissions to Revenue

The concept of "real yield" has emerged as a crucial distinction in assessing DeFi sustainability. Real yield refers to returns derived from actual protocol revenue and usage fees rather than token emissions or other potentially unsustainable sources.

In the early days of DeFi, most yields were heavily dependent on token emissions - protocols distributing their governance tokens to attract liquidity and users. While this approach successfully bootstrapped the ecosystem, it inevitably led to token dilution and yield compression as emissions continued. The mathematical reality of token emissions means they cannot sustain high yields indefinitely unless matched by corresponding growth in protocol value and utility.

By 2025, many leading protocols have successfully transitioned toward real yield models where returns come predominantly from:

- Trading fees on decentralized exchanges

- Interest paid by borrowers on lending platforms

- Liquidation fees from collateralized positions

- Premium payments for risk protection

- Protocol revenue sharing mechanisms

This transition marks a critical maturation of the DeFi ecosystem. While real yields are typically lower than the eye-catching numbers seen during emission-heavy periods, they represent fundamentally more sustainable return sources. Protocols generating significant revenue relative to their token emissions demonstrate much greater yield stability across market cycles.

DeFi Pulse's Real Yield Index, launched in October 2024, tracks yields derived solely from protocol revenues across the ecosystem. Their analysis shows that real yields across major DeFi protocols averaged 7.3% in Q1 2025—significantly lower than advertised rates but still substantially higher than comparable traditional finance alternatives.

The Buy-Back and Revenue-Sharing Model

A particularly promising development in sustainable yield generation is the rise of protocols that share revenue directly with token holders through systematic token buy-backs and revenue distribution. This model creates a transparent, auditable yield source tied directly to protocol performance.

Leading examples of this approach include:

- GMX: This decentralized perpetual exchange distributes 30% of trading fees to esGMX stakers and another 30% to GLP liquidity providers, creating sustainable yields backed directly by platform revenue

- Gains Network: Their synthetic trading platform shares 90% of trading fees with liquidity providers and governance token stakers

- dYdX: Their v4 chain implements an automatic buy-back and distribution mechanism that returns trading revenue to governance token stakers

These revenue-sharing mechanisms represent perhaps the most sustainable yield models in DeFi, as they directly link returns to genuine economic activity rather than unsustainable token emissions. While yields from these mechanisms typically range from 5-20% rather than the triple-digit returns seen in emission-heavy models, they demonstrate much greater stability across market cycles.

TokenTerminal data shows that revenue-sharing protocols maintained relatively stable yield distributions throughout both bull and bear market conditions in 2023-2025, suggesting this model might represent a truly sustainable approach to DeFi yield generation.

Real-World Asset Integration

Perhaps the most significant development in sustainable DeFi yield generation is the integration of real-world assets (RWAs) into the ecosystem. By connecting DeFi liquidity with tangible economic activity beyond the crypto sphere, RWA protocols create yield sources backed by genuine economic productivity rather than speculative mechanisms.

The RWA sector has grown exponentially, from under $100 million in 2021 to over $50 billion by early 2025, according to RWA Market Cap. This growth reflects increasing recognition that sustainable yields ultimately require connection to real economic value creation.

Major RWA yield sources now include:

- Tokenized Treasury Bills: Protocols like Ondo Finance and Maple offer yields backed by U.S. Treasury securities, providing DeFi users access to sovereign debt yields plus a small premium for the tokenization service

- Private Credit Markets: Platforms like Centrifuge connect DeFi liquidity with SME financing, invoice factoring, and other private credit opportunities

- Real Estate Yields: Projects like Tangible and RealT tokenize property income streams, enabling DeFi users to access real estate yields

- Carbon Credits and Environmental Assets: Protocols like KlimaDAO generate yields through environmental asset appreciation and impact investing

These RWA yield sources typically offer returns ranging from 3-12% annually—less spectacular than some native DeFi opportunities but generally more sustainable and less volatile. Their growing integration with traditional DeFi creates a promising path toward long-term yield sustainability by anchoring returns to fundamental economic value.

The recent BlackRock tokenized securities partnership with several DeFi platforms marks mainstream financial validation of this approach, potentially accelerating the integration of traditional financial yields into the DeFi ecosystem.

Institutional Perspectives on DeFi Yields

Traditional Finance Adoption Patterns

The relationship between traditional financial institutions and DeFi has evolved dramatically since 2020. Early institutional engagement was primarily exploratory, with most established players maintaining skeptical distance from the volatile, unregulated ecosystem. By 2025, institutional adoption has accelerated significantly, providing important signals about which yield sources sophisticated investors consider sustainable.

Several distinct institutional adoption patterns have emerged:

- Conservative Bridging: Institutions like BNY Mellon and State Street have established conservative DeFi exposure through regulated staking, tokenized securities, and permissioned DeFi instances, targeting modest yield premiums (2-5%) with institutional-grade security

- Dedicated Crypto Desks: Investment banks including Goldman Sachs and JPMorgan operate specialized trading desks that actively participate in sustainable DeFi yield strategies, particularly in liquid staking derivatives and RWA markets

- Asset Manager Integration: Traditional asset managers like BlackRock and Fidelity have integrated select DeFi yield sources into broader alternative investment offerings, focusing on opportunities with transparent revenue models

Particularly notable is the launch of JPMorgan's Tokenized Collateral Network, which incorporates DeFi mechanisms while meeting regulatory requirements. This initiative signals institutional recognition that certain DeFi yield innovations offer sustainable efficiency improvements over traditional alternatives.

Institutional Risk Assessment Frameworks

Institutional investors have developed sophisticated frameworks for evaluating which DeFi yields might prove sustainable long-term. These frameworks provide valuable insight into how professional risk managers distinguish between sustainable and unsustainable return sources.

Galaxy Digital's DeFi Risk Framework, published in March 2025, offers a comprehensive methodology incorporating:

- Protocol Risk Tiering: Categorizing protocols from Tier 1 (highest security, longest track record) to Tier 4 (experimental, unaudited), with explicit limits on exposure to lower tiers

- Yield Source Analysis: Classifying yield sources as either "fundamental" (derived from genuine economic activity) or "incentive" (derived from token emissions), with strong preference for the former

- Composability Risk Mapping: Tracing dependencies between protocols to quantify systemic exposure

- Regulatory Compliance Scoring: Evaluating protocols based on their compatibility with evolving regulatory requirements

The framework concludes that institutionally acceptable sustainable yields likely range from 2-4% above traditional alternatives for Tier 1 protocols, with progressively higher yields required to compensate for additional risk in lower tiers.

Institutional Capital Flows and Market Impact

The patterns of institutional capital allocation provide perhaps the most concrete evidence regarding which DeFi yields professional investors consider sustainable. By tracking where sophisticated capital flows, we can identify which yield mechanisms demonstrate staying power beyond retail speculation.

According to Chainalysis's 2025 Institutional DeFi Report, institutional capital has concentrated heavily in several key segments:

- Liquid Staking Derivatives: Capturing approximately 40% of institutional DeFi exposure, with Lido Finance and Rocket Pool dominating

- Real World Assets: Representing 25% of institutional allocation, primarily through platforms offering regulatory-compliant tokenized securities

- Blue-Chip DEXs: Comprising 20% of institutional activity, focused on major venues with demonstrated revenue models

- Institutional DeFi Platforms: Capturing 15% of flows through permissioned platforms like Aave Arc and Compound Treasury

Notably absent from significant institutional allocation are the high-APY farming opportunities and complex yield aggregators that dominated retail interest in earlier cycles. This allocation pattern suggests professional investors have identified a subset of DeFi yield sources they consider fundamentally sustainable, while avoiding those dependent on speculative dynamics or unsustainable tokenomics.

The March 2025 announcement that Fidelity's Digital Assets division had allocated $2.5 billion to DeFi strategies - focusing exclusively on what it termed "economically sustainable yield sources" - represents perhaps the strongest institutional validation of DeFi yield sustainability to date.

The Yield Farming 2.0 Evolution

Sustainable Yield Farming Strategies

The DeFi ecosystem has witnessed a significant maturation in yield farming approaches since the initial "DeFi Summer" of 2020. This evolution, sometimes termed "Yield Farming 2.0," emphasizes sustainability, risk management, and genuine value creation over unsustainable token incentives.

Key characteristics of these sustainable yield strategies include:

- Diversification Across Yield Sources: Modern yield farmers typically spread capital across multiple uncorrelated yield sources rather than concentrating in single high-APY opportunities, reducing specific protocol risk

- Revenue-Focused Selection: Prioritizing protocols with strong revenue models where yields derive primarily from fees rather than token emissions

- Strategic Position Management: Actively managing positions to minimize impermanent loss and maximize capital efficiency rather than passive "set and forget" approaches

- Risk-Adjusted Targeting: Setting realistic yield targets based on comprehensive risk assessment rather than chasing outlier APYs

These evolutionary changes have created yield farming approaches with substantially different risk-return profiles compared to earlier generations. While Yield Farming 1.0 often produced spectacular but ultimately unsustainable returns through aggressive token emissions, Yield Farming 2.0 typically generates more modest but sustainable yields through genuine value capture.

The rising popularity of platforms like DefiLlama Yield, which explicitly separates "Farm APR" (token emissions) from "Base APR" (genuine protocol revenue), demonstrates growing retail awareness of these sustainability distinctions.

Quantitative Yield Optimization

A significant development in sustainable yield farming has been the rise of quantitative approaches to yield optimization. These strategies apply mathematical models and algorithmic execution to maximize risk-adjusted returns while minimizing downside risks.

Leading quantitative yield strategies now include:

- Dynamic LTV Management: Algorithms that continuously optimize loan-to-value ratios in lending protocols based on volatility predictions, maximizing capital efficiency while minimizing liquidation risk

- Impermanent Loss Hedging: Sophisticated strategies that use options, futures, or other derivatives to hedge against impermanent loss in liquidity provision

- Yield Curve Arbitrage: Exploiting inefficiencies across lending protocols' interest rate curves through strategic borrowing and lending

- MEV Protection: Implementing transaction execution strategies that protect against miner/validator extractable value, preserving yields that would otherwise be captured by front-runners

These quantitative approaches have demonstrated ability to generate 3-5% additional annual yield compared to passive strategies, potentially enhancing the sustainable yield frontier. Platforms like Exponential and Ribbon Finance have pioneered these strategies, bringing sophisticated quantitative finance techniques to DeFi yield optimization.

Governance-Based Yield Mechanisms

The evolution of protocol governance has created entirely new yield mechanisms based on controlling protocol resources and directing incentives. These governance-based yields represent a distinct category that potentially offers sustainable returns through strategic influence rather than passive capital provision.

The most sophisticated governance-based yield strategies involve:

- Vote-Escrow Models: Locking tokens for extended periods to gain boosted yields and governance power, pioneered by Curve and adopted by numerous protocols

- Bribe Markets: Platforms where protocols compete for governance influence by offering rewards to governance token holders, creating additional yield layers

- Treasury Management: Participating in governance to influence protocol treasury investments, potentially generating sustainable returns from productive asset allocation

- Strategic Parameter Setting: Using governance rights to optimize protocol parameters for yield generation while maintaining system stability

The Convex and Aura ecosystems exemplify how governance-based yields can create sustainable return sources by efficiently coordinating governance power across multiple protocols. These mechanisms create value through coordination efficiencies rather than unsustainable token emissions, potentially representing more durable yield sources.

The Long-Term Outlook: Convergence or Disruption?

The Sustainable Yield Equilibrium Hypothesis

As DeFi matures, an important question emerges: will yields eventually converge with traditional finance or maintain a persistent premium? The Sustainable Yield Equilibrium Hypothesis proposes that after accounting for all relevant factors, DeFi yields will settle at levels moderately higher than traditional finance counterparts due to genuine efficiency advantages, but significantly lower than early-phase returns.

The hypothesis suggests three distinct yield components:

- Efficiency Premium: A sustainable 2-5% yield advantage derived from blockchain's technical efficiencies and disintermediation benefits

- Risk Premium: An additional 1-8% required to compensate for DeFi's unique risks, varying by protocol maturity and security profile

- Speculative Component: A highly variable and ultimately unsustainable component driven by token emissions and market sentiment

Under this framework, only the first component represents a truly sustainable advantage, while the second appropriately compensates for additional risk rather than representing "free yield." The third component - which dominated early DeFi returns - gradually diminishes as markets mature and participants develop more sophisticated risk assessment capabilities.

Research by the DeFi Education Fund examining yield trends from 2020-2025 supports this hypothesis, showing progressive compression toward an apparent equilibrium approximately 3-7% above traditional finance alternatives for risk-comparable activities.

The Institutional Absorption Scenario

An alternative view suggests that as traditional financial institutions increasingly absorb DeFi innovations, the yield gap may narrow more significantly through a process of institutional adoption and regulatory normalization.

Under this scenario, major financial institutions gradually integrate the most efficient DeFi mechanisms into their existing operations, capturing much of the efficiency premium for themselves and their shareholders rather than passing it to depositors or investors. Simultaneously, regulatory requirements standardize across traditional and decentralized finance, eliminating regulatory arbitrage advantages.

This process has already begun with initiatives like Project Guardian, a partnership between the Monetary Authority of Singapore and major financial institutions to integrate DeFi mechanisms into regulated financial infrastructure. Similar projects by central banks and financial consortia worldwide suggest accelerating institutional absorption.

If this scenario predominates, sustainable DeFi yields might ultimately settle just 1-3% above traditional alternatives - still representing an improvement, but less revolutionary than early adopters envisioned.

The Innovation Supercycle Theory

A more optimistic perspective is offered by the Innovation Supercycle Theory, which suggests that DeFi represents not merely an incremental improvement over traditional finance but a fundamental paradigm shift that will continue generating new yield sources through successive waves of innovation.

Proponents of this view point to historical precedents in technological revolutions, where early innovations created platforms for successive waves of new development, each generating distinct value propositions. They argue that DeFi's composable, permissionless nature will continue spawning novel financial primitives that create genuinely sustainable yield sources unforeseen by current models.

Evidence for this theory includes the rapid emergence of entirely new financial categories within DeFi:

- Liquid staking derivatives emerged in 2021-2022

- Real-world asset tokenization gained significant traction in 2023-2024

- AI-enhanced DeFi protocols began delivering measurable value in 2024-2025

Each innovation cycle has created new yield sources not directly comparable to traditional finance alternatives. If this pattern continues, DeFi could maintain a substantial yield advantage through continuous innovation rather than settling into equilibrium with traditional systems.

MakerDAO's recent paper argues that we're currently witnessing just the third major innovation wave in DeFi, with at least four additional waves likely over the coming decade, each potentially creating new sustainable yield sources through fundamental innovation rather than unsustainable tokenomics

Final thoughts

The question of DeFi yield sustainability defies simple answers. The evidence suggests that while many early yield mechanisms were fundamentally unsustainable, built on temporary token incentives and speculative dynamics, the ecosystem has evolved toward more durable models based on genuine efficiency advantages, disintermediation benefits, and innovative financial primitives.

The most likely outcome involves stratification across the ecosystem:

-

Core DeFi Infrastructure: Established protocols like Curve, Aave, and Lido will likely continue offering sustainable yields 3-7% above traditional finance alternatives, derived from genuine efficiency advantages and reasonable risk premiums.

-

Innovation Frontier: Emerging protocol categories will continue generating temporarily higher yields during their growth phases, some of which will evolve into sustainable models while others collapse when unsustainable mechanisms inevitably fail.

-

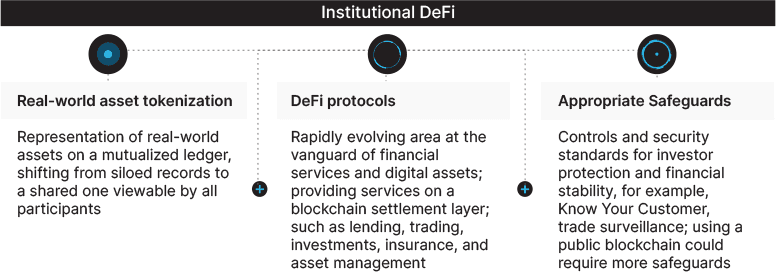

Institutional DeFi: A growing regulated segment will offer yields 1-3% above traditional alternatives, with enhanced security and compliance features targeting institutional participants unwilling to accept full DeFi risk exposure.

For investors navigating this landscape, sustainable DeFi participation requires distinguishing between genuinely innovative yield sources and unsustainable mechanisms designed primarily to attract capital. The growing array of analytical tools, risk frameworks, and historical data makes this distinction increasingly possible for sophisticated participants.

The broader significance extends beyond individual investors. DeFi's ability to generate sustainably higher yields than traditional finance - even if more modest than early returns - represents a potentially transformative development in global capital markets. By creating more efficient financial infrastructure and disintermediating rent-seeking entities, DeFi could ultimately raise the baseline return on capital throughout the economy, benefiting savers and productive enterprises alike.

Up to date, one conclusion seems increasingly clear: while DeFi's triple-digit APYs were largely a temporary phenomenon of its bootstrapping phase, a significant portion of its yield advantage appears fundamentally sustainable - not because of speculative tokenomics, but because blockchain technology enables genuinely more efficient financial systems. The future likely holds neither the extraordinary returns of DeFi's early days nor complete convergence with traditional finance, but rather a new equilibrium that permanently raises the bar for what investors can expect from their capital.