The Open Network (TON) is a decentralized, open internet platform built to provide a scalable and secure blockchain infrastructure. With the capability to handle millions of transactions per second (TPS), TON aims to achieve widespread adoption by providing cross-chain interoperability in a highly secure environment. The network leverages multiple components, including the TON Blockchain, TON DNS, TON Storage, and TON Sites, all of which contribute to the broader TON Ecosystem.

TON is designed to be a decentralized, multi-functional platform capable of handling a wide variety of services and applications, thus acting as a "superserver" for the decentralized internet. Its architecture is based on the following key components:

-

TON Blockchain: The central component, designed as a flexible, multi-blockchain platform capable of processing millions of transactions per second. TON Blockchain supports Turing-complete smart contracts, offering a robust infrastructure for decentralized applications. It introduces several novel features, such as the self-healing vertical blockchain mechanism and Instant Hypercube Routing, making the system not only scalable but also highly efficient and self-sustaining.

-

TON DNS: TON DNS enables users to assign human-readable names to blockchain accounts, services, and network nodes. This makes it easier for users to interact with decentralized applications without needing to remember long, cryptographic addresses.

-

TON Storage: This is a distributed file storage system accessible through the TON Network, designed to store archive copies of blocks and snapshots of status data. It can also be used for arbitrary file storage, giving users torrent-like access to stored data.

-

TON Sites: A decentralized platform for hosting websites and services. By leveraging TON’s secure and scalable blockchain architecture, TON Sites offers a way for users to build and access decentralized websites without relying on traditional web hosting services.

These components are designed to work together, providing a seamless and secure experience for users and developers alike. TON’s emphasis on decentralized services, smart contract flexibility, and cross-chain communication ensures that the platform can cater to a wide range of applications, from micropayments to complex DeFi systems.

Product Overview

Launch Date

TON was launched on November 2019.

Core Problem

One of the primary issues TON seeks to address is the scalability problem inherent in existing blockchain networks like Ethereum and Solana. Both of these platforms struggle with processing large volumes of transactions efficiently, especially when demand surges. Ethereum, for instance, can handle only around 15 transactions per second (TPS), leading to network congestion and high gas fees during peak usage times. Solana, while more scalable than Ethereum, still relies on a monolithic structure that limits its ability to scale effectively without running into performance bottlenecks, as evidenced by its frequent network outages.

TON tackles this problem with its asynchronous smart contract execution and dynamic sharding mechanism. By allowing transactions between smart contracts to be processed asynchronously, TON dramatically reduces network congestion. The platform’s self-healing vertical blockchain mechanism also ensures that issues such as invalid blocks can be resolved without requiring a network-wide rollback, further enhancing scalability.

Furthermore, TON’s innovative Instant Hypercube Routing allows messages and transactions to travel quickly between different shardchains, enhancing both scalability and speed. This system enables TON to process millions of transactions per second (TPS), positioning it as a more viable option for high-traffic dApps and DeFi platforms.

Market Fit

TON’s market fit is particularly strong in areas where scalability and low transaction costs are critical. Decentralized finance (DeFi), non-fungible tokens (NFTs), decentralized exchanges (DEXs), and gaming platforms represent key sectors that require the kind of high throughput TON offers. With its cross-chain interoperability, TON is well-suited to serve as the backbone for applications requiring interaction across multiple blockchain ecosystems.

Additionally, TON’s unique ability to support billions of users and transactions gives it a significant advantage in sectors like social media, decentralized storage, and even cloud computing, where large-scale, decentralized infrastructure is needed. Unlike Ethereum, which often struggles with scaling beyond its current user base due to high fees and slow transaction times, TON is designed from the ground up to handle the next generation of internet-scale applications.

Developers and enterprises looking to build scalable, decentralized applications will find TON particularly appealing due to its Turing-complete smart contracts, low fees, and user-friendly services like TON DNS and TON Storage. The platform’s architecture is designed to accommodate complex, high-throughput applications that require secure, decentralized infrastructure without compromising on performance.

Competitive Advantage

TON has several competitive advantages that position it as a next-generation blockchain platform capable of outpacing both Ethereum and Solana:

-

Asynchronous Smart Contracts: Unlike Ethereum, where smart contracts must execute synchronously, TON uses an asynchronous model, reducing the need for all transactions to be processed in the same block. This makes TON far more scalable and suitable for high-demand applications.

-

Scalability and Dynamic Sharding: TON’s dynamic sharding system automatically splits and merges shardchains based on transaction demand. This allows TON to scale efficiently without hitting performance bottlenecks, unlike monolithic blockchains such as Solana.

-

Cross-Chain Interoperability: TON’s architecture is built to facilitate seamless communication between different blockchain ecosystems. This is crucial for decentralized applications that require access to multiple blockchains, making TON a more flexible platform for developers.

-

Low-Cost Transactions: With its rent-based fee model, TON keeps transaction costs low by charging dApps for the resources they use, rather than users paying high gas fees. This makes TON more attractive for users and developers alike.

-

User-Friendly Services: TON DNS and TON Storage provide a more user-friendly interface for interacting with blockchain applications. This accessibility, combined with TON’s powerful backend, makes it a viable option for developers building mass-market dApps.

-

Instant Hypercube Routing: This innovation allows for near-instantaneous message and transaction routing between shardchains, significantly reducing latency and improving user experience. It also enhances the overall scalability of the network.

-

Self-Healing Mechanism: TON’s vertical blockchain system ensures that any invalid block can be corrected without rolling back the entire network. This feature increases the reliability and security of the platform, making it more attractive for enterprise applications.

User Impressions

User impressions of TON have been generally positive, particularly due to its ease of use, fast transaction speeds, and low costs. The platform's user-friendly nature and seamless wallet integrations make it accessible for both new users and experienced crypto traders. However, TON’s ecosystem is still in its early stages, and broader adoption will depend on further development and strategic partnerships.

Market Size

TAM: Unavailable

Product/Market Fit: TON has strong product-market fit in sectors that require high scalability and low-cost transactions. The blockchain’s architecture is specifically designed to support decentralized applications (dApps) that need to process large volumes of transactions quickly and efficiently. Its ability to operate across multiple chains also makes it attractive for dApps requiring cross-chain functionality.

Additionally, TON’s decentralized storage and DNS services provide valuable infrastructure for developers building web3 applications. These features reduce the need for centralized intermediaries and improve the overall security and privacy of applications built on the TON ecosystem.

The growing demand for scalable, decentralized applications, coupled with TON’s technical advantages, positions it as a strong contender for widespread adoption in the coming years.

Implementation: Implementing TON requires a thorough understanding of its asynchronous smart contract model and the FunC programming language, which was developed specifically for the TON Blockchain. Unlike Ethereum’s Solidity, FunC allows developers to write more flexible smart contracts that are not restricted by the synchronous limitations of earlier blockchains.

For developers, the first step in implementing solutions on TON would be to familiarize themselves with FunC and TON’s unique asynchronous processing model. Additionally, developers can take advantage of TON’s built-in services, such as TON DNS and TON Storage, to create decentralized applications that are both scalable and user-friendly.

TON’s fee structure is another important aspect of implementation. Unlike Ethereum, where users pay gas fees for every transaction, TON’s fee model is rent-based. This means that dApps on TON are responsible for covering their own storage and resource costs, rather than passing these fees onto users. This model is more sustainable for large-scale applications and helps keep user costs low.

Competitor Analysis

SWOT Analysis

Strengths

- TON is highly scalable, capable of handling millions of transactions per second.

- It uses asynchronous smart contracts, reducing network congestion.

- TON enables seamless cross-chain interoperability between different blockchains.

- The rent-based fee model ensures low transaction costs for users.

- Dynamic sharding allows for efficient scaling based on network demand.

Weaknesses

- The ecosystem is still in its early stages, with fewer dApps compared to more established platforms.

- Developer tools and support for TON are limited, which may slow adoption.

- The platform’s FunC language presents a steep learning curve for developers familiar with Solidity.

- TON lacks a clear and visible market penetration strategy.

- The regulatory environment around blockchain and crypto remains uncertain, which could pose risks.

Opportunities

- TON has strong growth potential in the decentralized finance (DeFi) and non-fungible token (NFT) sectors. Its focus on cross-chain interoperability makes it well-positioned for expanding in a multi-chain ecosystem.

- TON’s low-cost transactions make it ideal for adoption in emerging markets where high transaction fees are a barrier.

- Integration with the Web3 ecosystem and the growing metaverse presents significant opportunities for TON.

Threats

- Competition from established blockchains like Ethereum and Solana could limit TON’s market share.

- Regulatory risks, particularly in areas like DeFi, could impact TON’s adoption and growth.

- TON faces potential network security risks, including smart contract vulnerabilities and hacking attempts.

- Economic volatility in the broader cryptocurrency market could affect the value of TON tokens and investment in the ecosystem.

Competitor Comparisons

TRON: TRON is a blockchain platform that aims to build a decentralized internet and enable easy creation of decentralized applications (dApps). It is highly scalable, offering fast transaction speeds, and supports smart contracts and high-throughput infrastructure.

Solana: Solana is a high-performance blockchain supporting fast, low-cost transactions, often hailed for its scalability without sacrificing decentralization. It is particularly popular in decentralized finance (DeFi) and non-fungible token (NFT) projects due to its transaction speed and large-scale user support.

Ethereum: Ethereum is the most widely used blockchain for decentralized applications (dApps) and smart contracts. Its ability to support complex financial instruments and applications has made it the backbone of the DeFi and NFT ecosystems, although it suffers from scalability issues compared to newer platforms.

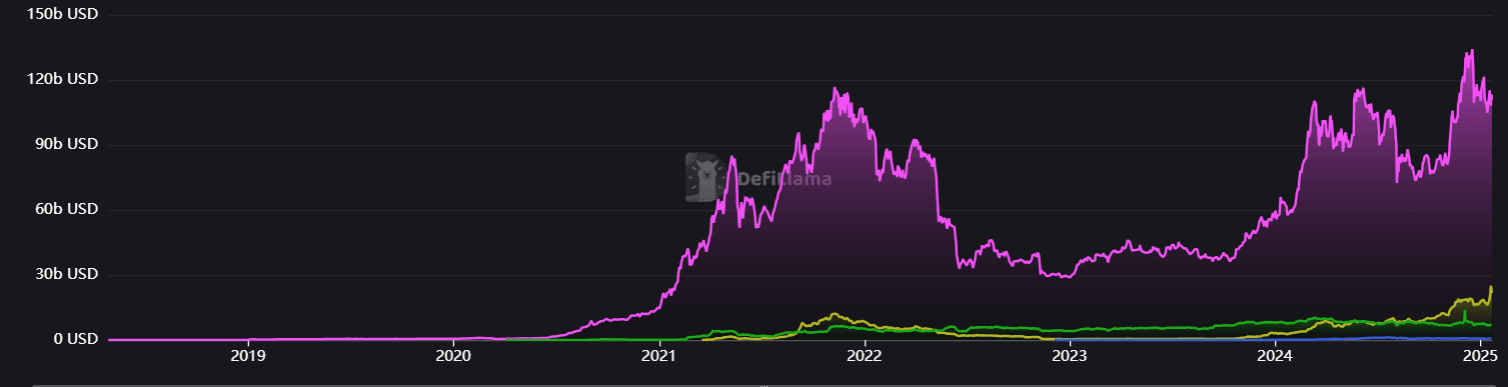

TVL comparisons of Ethereum, Solana, TRON and TON (Source: https://defillama.com/compare?chains=TON&chains=Tron&chains=Ethereum&chains=Solana)

TVL comparisons of Ethereum, Solana, TRON and TON (Source: https://defillama.com/compare?chains=TON&chains=Tron&chains=Ethereum&chains=Solana)

Team and Advisors

Founders and Key Members of TON and Its Associated Entities

TON Founders Pavel Durov: Founder Nikolai Durov: Founder

TON Labs Alexander Filatov: Co-founder, CEO Mitja Goroshevsky: Co-founder, CTO Dmitry Malyugin: Co-founder, Operations and Finance Pavel Prigolovko: Co-founder, Strategy and Governance Cyril Paglino: Partner, Business Development

TON Foundation Steve Yun: President of the Foundation Council Barbara Schüpbach: Foundation Council Member Manuel Stotz: Foundation Council Member

The Open Platform (TOP) Andrew Rogozov: Founder and CEO

Financial Metrics

Recent Raises and Backers

Toncoin raises and backers 10-12 Nov 2021: Launchpool (OKX Jumpstart) - 1,000,000 TON allocated, 100% unlock 17 Nov 2022: Undisclosed Investment Round (DWF Labs (Lead)) - $10 million 16 May 2023: Undisclosed Investment Round (Mask Network) - N/A 04 Oct 2023: Undisclosed Investment Round (MEXC) - N/A 28 Nov 2023: Undisclosed Investment Round (Animoca Brands) - N/A 01 Dec 2023: Undisclosed Investment Round (KuCoin Ventures) - N/A 06 Mar 2024: Undisclosed Investment Round (Mirana Ventures) - $8 million 02 May 2024: Undisclosed Investment Round (Pantera Capital) - N/A 11-18 Jul 2024: Launchpool (Gate.io Startup) - 2,000 TON allocated, 100% unlock 15 Aug - 03 Sep 2024: Launchpool (Binance) - 7,650,000 TON allocated, 100% unlock 04-09 Sep 2024: Launchpool (Gate.io Startup) - 1,200 TON allocated, 100% unlock 09-19 Sep 2024: Launchpool (Gate.io Startup) - 0% allocation, CATI to TON pools 18 Sep 2024: Strategic Investment Round (Foresight Ventures, Bitget) - $30 million

TON Foundation $90 million ecosystem fund Backers Apr 2022: Backers of $250 million ecosystem fund - Huobi Incubator, Kucoin Ventures, MEXC Pioneer Fund, 3Commas Capital, Orbs, TON Miners, Kilo Fund Donations Apr 2022: Worth over $1 billion, 18 donations over 10M TON, 37 donations over 4M TON - Large Holders (176 donations)

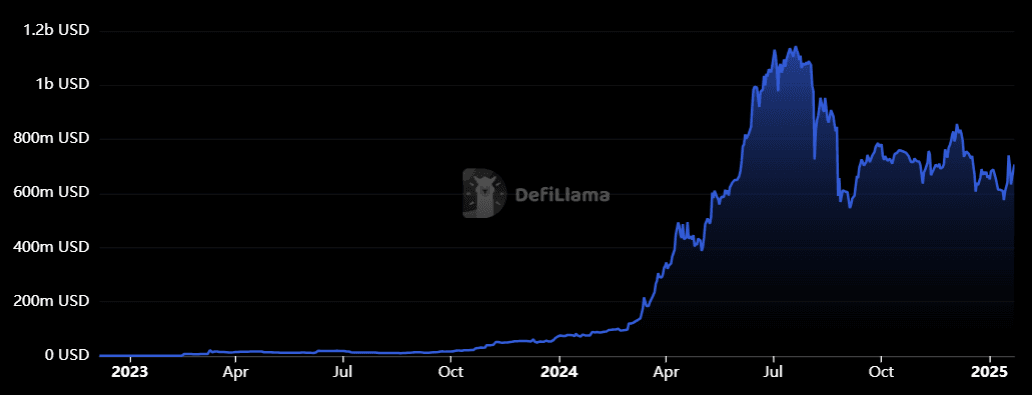

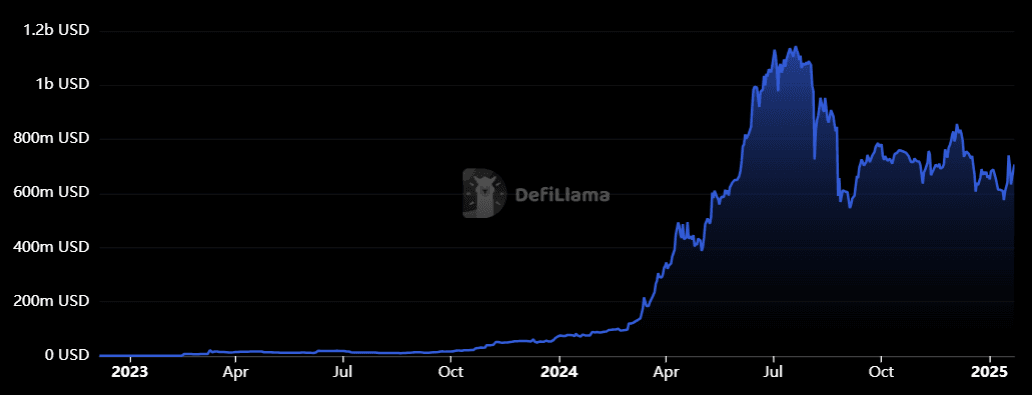

Total Value Locked (TVL)

The TVL of TON as on 08.10.24 is $404.02m.

TVL of TON (As of 22.01.25) (Source: https://defillama.com/chain/TON)

TVL of TON (As of 22.01.25) (Source: https://defillama.com/chain/TON)

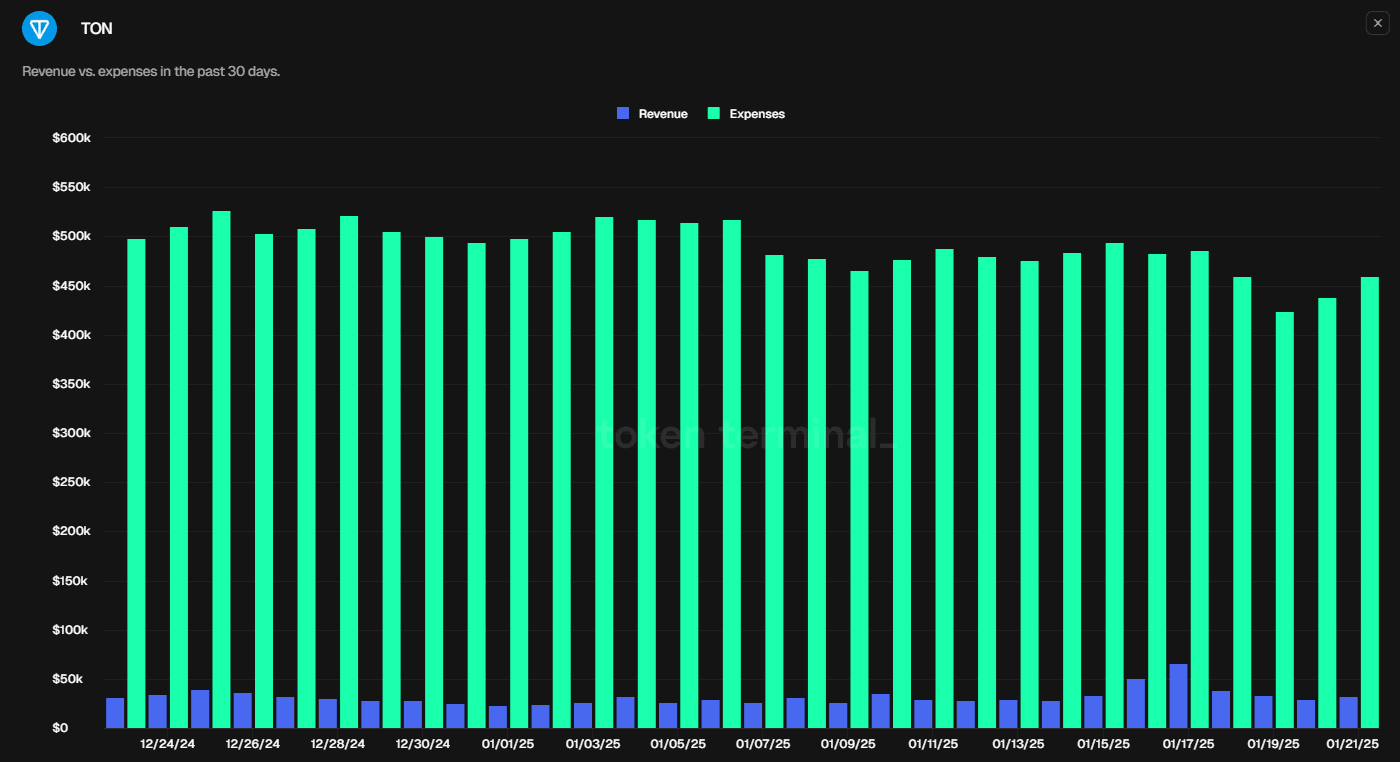

Revenue and Expenses

TON has historically more expenses than revenue. In the last 30 days, it has generated a revenue of $973.33k. While expenses have been 15x times of it at $14.72m.

Revenue and Expense comparison of TON (Source: https://tokenterminal.com/explorer/projects/the-open-network?sourceType=chart&v=YWZhNzQyNGFmOWQwNjAyNGQ4ODI3MmFl)

Revenue and Expense comparison of TON (Source: https://tokenterminal.com/explorer/projects/the-open-network?sourceType=chart&v=YWZhNzQyNGFmOWQwNjAyNGQ4ODI3MmFl)

Token Distribution

TON initially utilized an Initial Proof-of-Work (IPoW) mechanism from July 2020 until June 2022, after which it transitioned to a Proof-of-Stake (PoS) model. The total initial token supply was set at 5 billion TON, with 1.45% (72.5 million TON) allocated to the team. The remaining 98.55% (approximately 4.93 billion TON) was pre-mined.

Pre-mined Distribution

- 85.8% of the IPoW-mined tokens were minted by a small group of interconnected miners associated with the TON Foundation.

- 1.081 billion TON from 171 accounts were voted to be frozen for 48 months. These genesis accounts have yet to initiate any transactions.

Locked TON

- The TON Believers Fund allowed holders to lock their tokens for five years, with a two-year cliff followed by a three-year linear release. 1.033 billion TON were locked during this period, totaling 1.317 billion TON including rewards.

- Starting from October 2025, approximately 37 million TON will enter circulation every 30 days over 36 installments.

These mechanisms have effectively removed around 2.4 billion TON from the circulating supply for the immediate future.

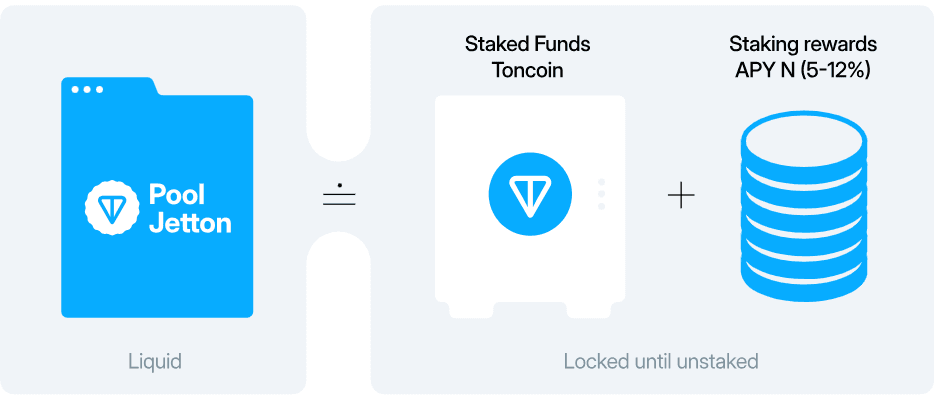

Staking Rewards Under the PoS system:

- The masterchain adds 1.7 TON per block.

- Each shardchain adds 1 TON per block.

- These rewards are distributed to validators and nominators at the end of each epoch.

TON holders also have the option to earn rewards via liquid staking, where they can stake their tokens while maintaining liquidity.

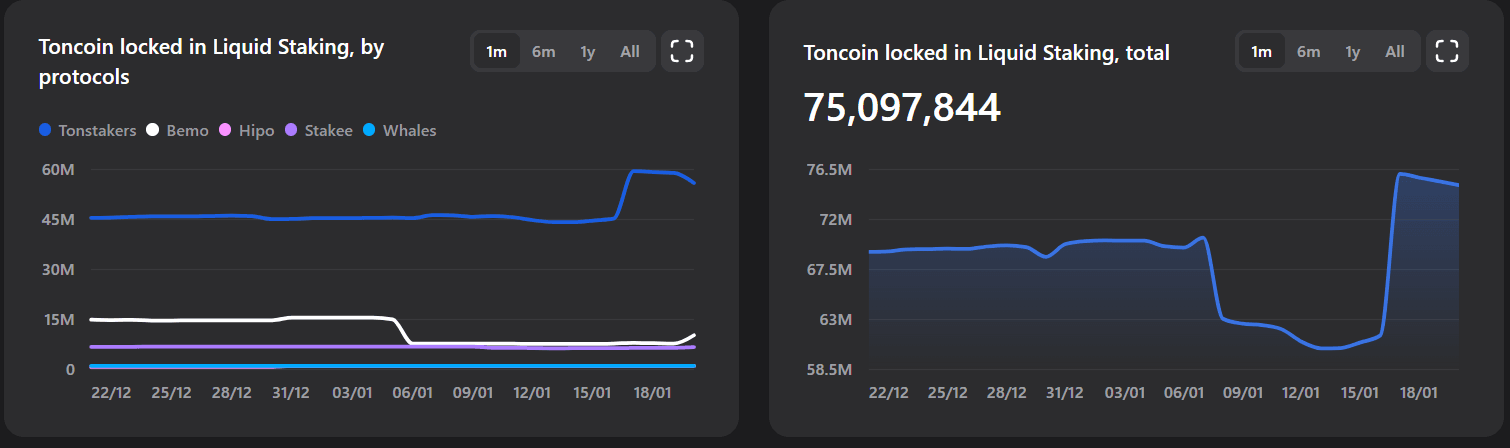

The amount of TON liquid staked (right) and by node operators (left) (Source: https://www.tonstat.com/)

The amount of TON liquid staked (right) and by node operators (left) (Source: https://www.tonstat.com/)

Key Metrics

TVL and Transaction Dynamics

TON TVL (Source: https://defillama.com/chain/TON?tvl=true)

TON TVL (Source: https://defillama.com/chain/TON?tvl=true)

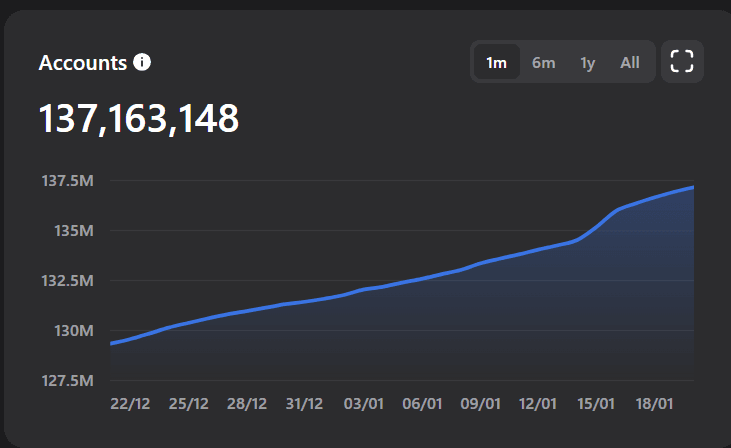

User Count

Accounts on TON refer to any type of smart contract on the network. These include wallets, NFTs, staking contracts, and other similar entities.

Accounts on TON as on 22.01.25 (Source: https://www.tonstat.com/)

Accounts on TON as on 22.01.25 (Source: https://www.tonstat.com/)

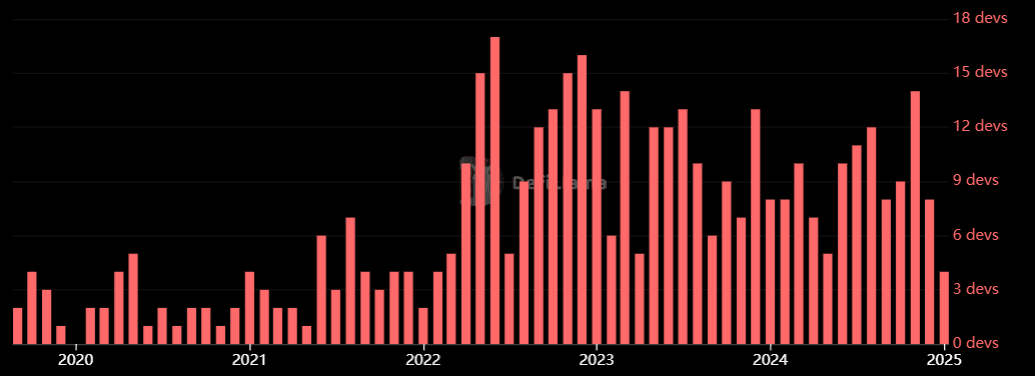

Developer Activity

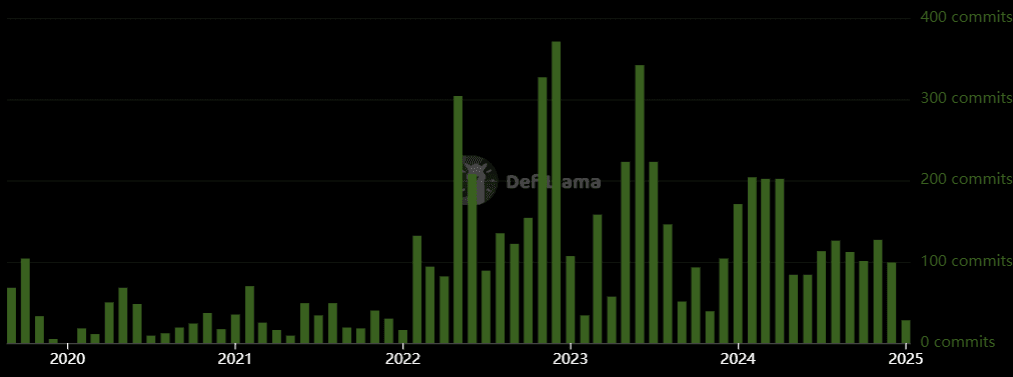

Core Developers of TON (Source: https://defillama.com/chain/TON?developers=true&devsCommits=false&tvl=false)

Core Developers of TON (Source: https://defillama.com/chain/TON?developers=true&devsCommits=false&tvl=false)

Developer commits for TON (Source: https://defillama.com/chain/TON?developers=false&devsCommits=true&tvl=false)

Developer commits for TON (Source: https://defillama.com/chain/TON?developers=false&devsCommits=true&tvl=false)

On-Chain Metrics

Transaction Count

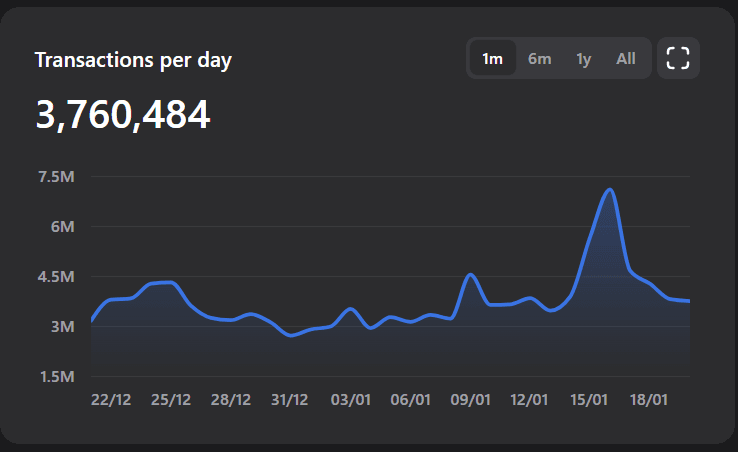

Transactions per day volume in one year as on 07.10.24 (Source: https://www.tonstat.com/)

Transactions per day volume in one year as on 07.10.24 (Source: https://www.tonstat.com/)

Transaction Value

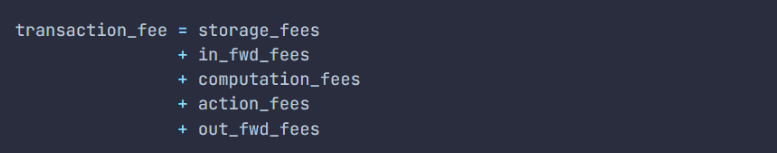

The transaction fees on TON are determined by gas units required for various operations. Unlike other blockchains, TON has fixed gas prices set by the network configuration, and users cannot adjust them. Fees are composed of multiple components, including storage, computation, and forwarding costs.

Gas Fee Structure Gas Price per Unit

- Basechain: 400 nanotons (0.0000004 TON)

- Masterchain: 10,000 nanotons (0.00001 TON) Average Transaction Cost

- Basechain: ~0.005 TON

Average Transaction Costs Sending TON: 0.0055 Sending Jettons: 0.037 Minting an NFT: 0.08 Saving 1 MB Data for 1 Year: 6.01

Fee Calculation Formula

Storage Fees: Cost for storing smart contracts on the blockchain. Inward Forwarding Fees: Charges for importing external messages. Computation Fees: Costs for executing smart contract code. Action Fees: Fees for outgoing messages and contract updates. Outward Forwarding Fees: Charges for sending messages to off-chain services.

This showcases that TON has a very transparent way of fixing gas prices since it is set by network consensus. Hence, users cannot alter it. It also has very low transaction costs (~0.005 TON). Furthermore, the fees remain low even with an increase in TON value. TON also allows validators to adjust prices, if needed, providing a lot of freedom in usage.

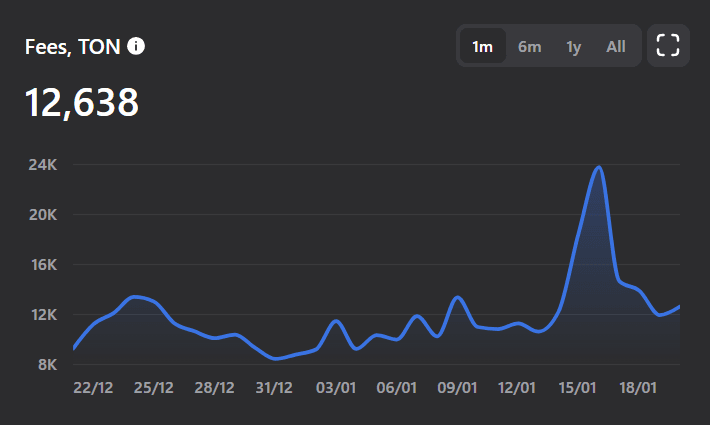

Fees Paid

Total fees paid by users of TON till date (Source: https://www.tonstat.com/)

Total fees paid by users of TON till date (Source: https://www.tonstat.com/)

Staking Data

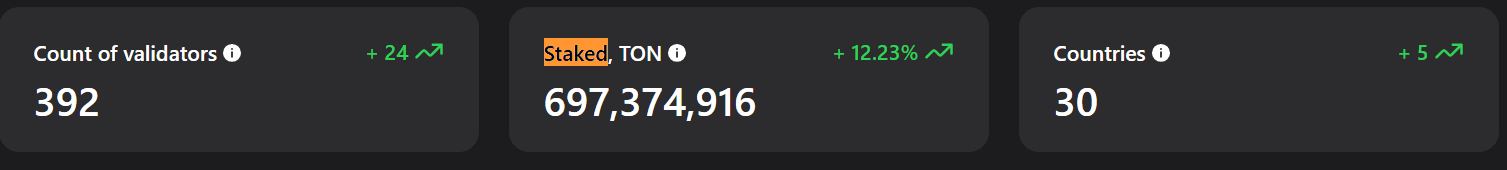

The number of validators for TON is 392. The total sum of Toncoin (TON) that has been staked by validators is 697,374,916. The validators are spread across 30 countries.

_Staking data (Source: https://www.tonstat.com/) _

_Staking data (Source: https://www.tonstat.com/) _

Tokenomics

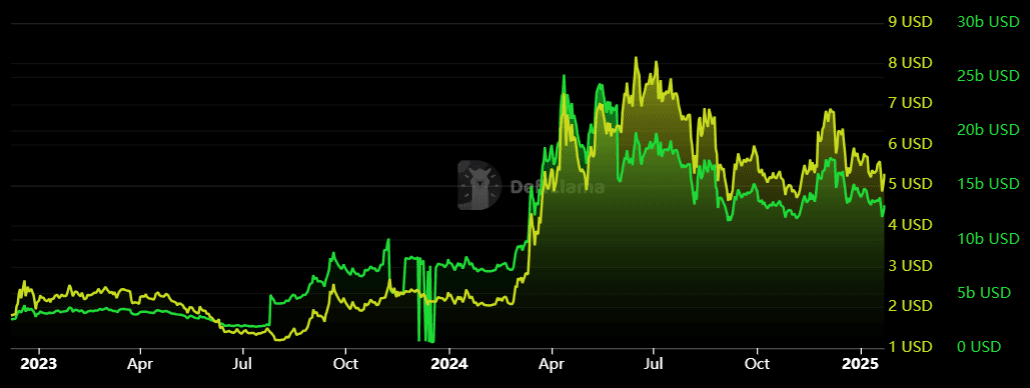

Current Price and Market Cap

Current Price: $5 (20.01.2025) Market Price: $12.465 billion

TON current price (Source: https://defillama.com/chain/TON?developers=false&devsCommits=false&tvl=false&chainTokenPrice=true)

TON current price (Source: https://defillama.com/chain/TON?developers=false&devsCommits=false&tvl=false&chainTokenPrice=true)

Utility

TON tokens play a versatile role within the TON ecosystem. They primarily function as a payment token, used for various services such as transaction fees, decentralized applications (dApps), DNS services, storage solutions, advertisements, proxies, and cross-chain activities. Beyond this, TON tokens are also used as a staking token for validators and nominators, providing essential incentives to secure the network and ensure its continued functionality.

Additionally, TON tokens have a governance role. While governance is currently centralized under the TON Foundation, the ton.vote platform allows TON holders and validators to participate in decision-making by voting on proposals. However, it is important to note that these votes are advisory in nature, and the results are not legally binding.

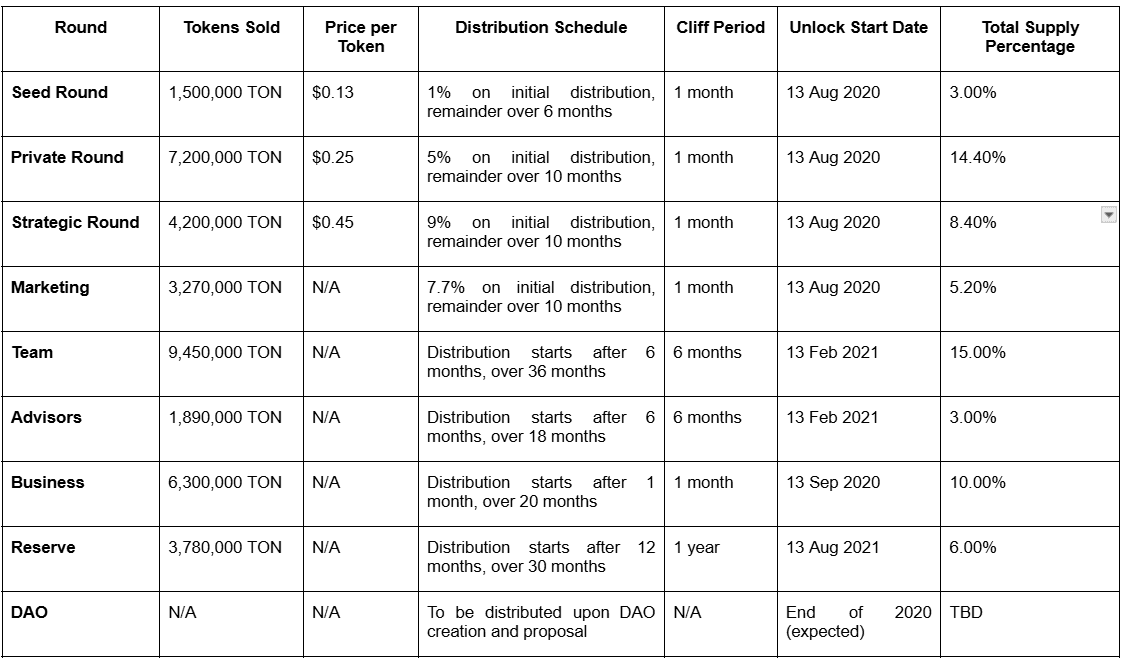

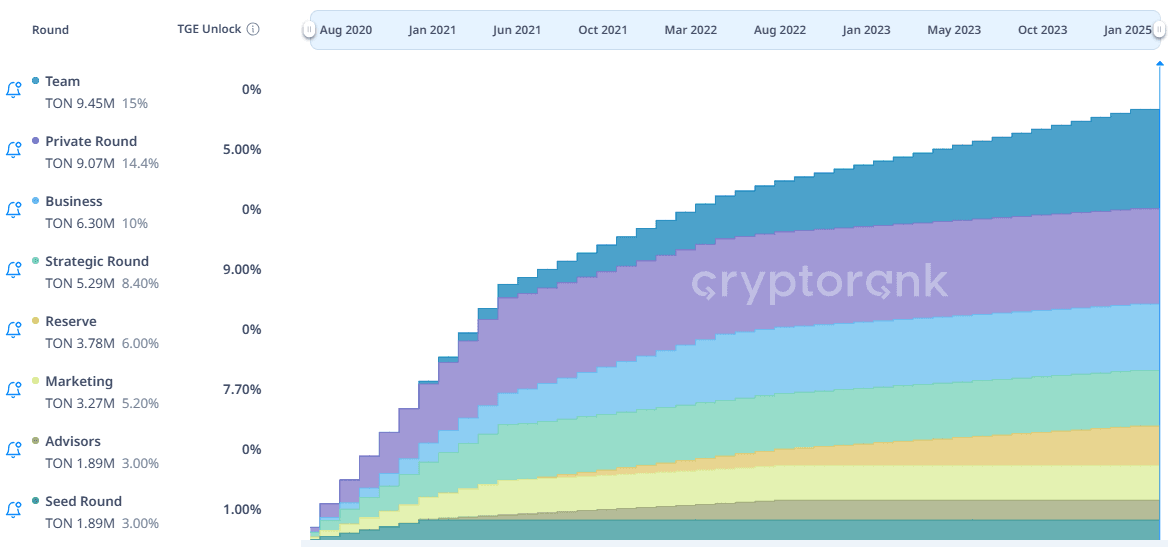

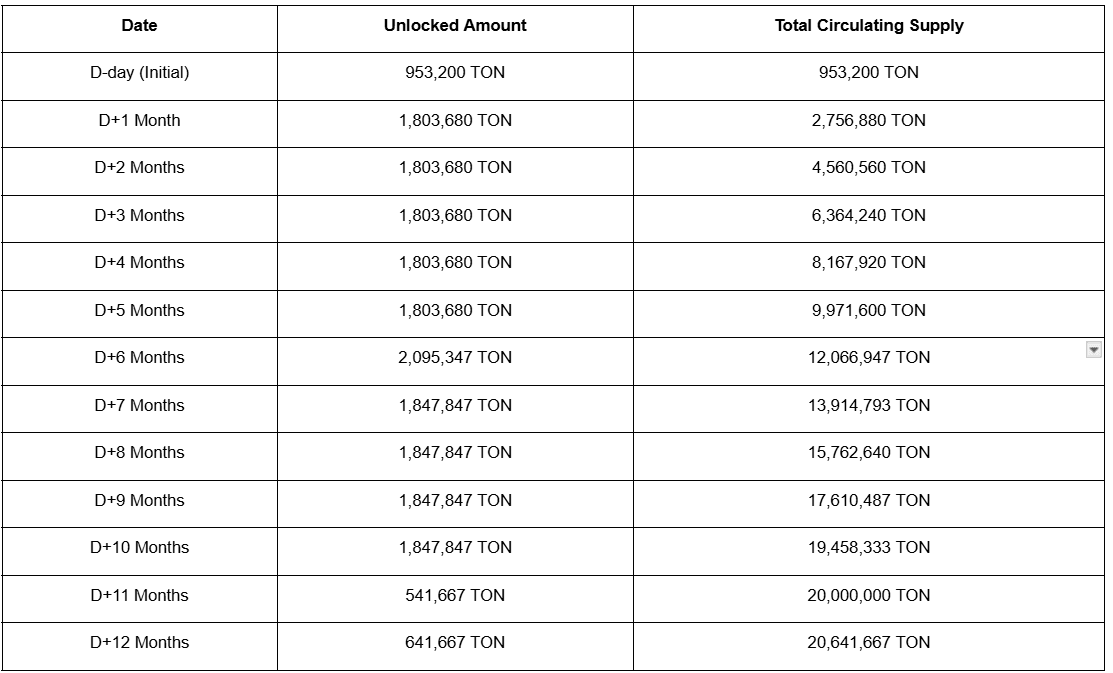

Vesting Timeline and Investor Distrbution

(Source: https://cryptorank.io/price/tokamak-network-new/vesting)

(Source: https://cryptorank.io/price/tokamak-network-new/vesting)

_Vesting Schedule (Source: https://cryptorank.io/price/tokamak-network-new/vesting) _

_Vesting Schedule (Source: https://cryptorank.io/price/tokamak-network-new/vesting) _

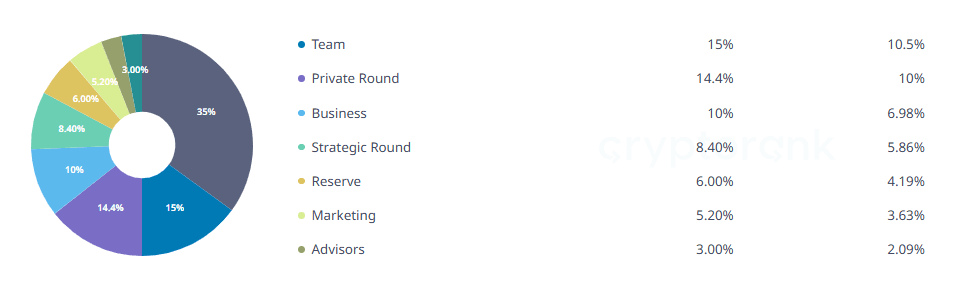

Investor Distribution

_(Source: https://medium.com/tokamak-network/tokamak-network-token-economics-en-kr-97f105ef8517) _

_(Source: https://medium.com/tokamak-network/tokamak-network-token-economics-en-kr-97f105ef8517) _

Allocation (Source: https://cryptorank.io/price/tokamak-network-new/vesting)

Allocation (Source: https://cryptorank.io/price/tokamak-network-new/vesting)

Key Indicators and Ratios

NVT Ratio (Network Value to Transactions)

NVT Ratio = 1.79

- Market Cap (Circulating): $12.91 billion

- Token Trading Volume (30d): $7.21 billion

A Network Value to Transactions (NVT) ratio of 1.79 suggests that the market capitalization is 1.79 times the transaction volume. This indicates relatively higher speculation compared to actual usage.

MVRV Ratio (Market Value to Realized Value)

MVRV Ratio = 1,090.88

- Market Value (Circulating Market Cap): $12.91 billion

- Realized Value (Annualized Revenue): $11.84 million

An MVRV ratio of 1,090.88 suggests that the market value is significantly higher than the realized value. This indicates a highly speculative market where the token price is valued much above its actual revenue generation.

Stock-to-Flow Model

Stock-to-Flow Ratio = 183.82

- Circulating Supply: 89.38 million

- Annualized Production (Token Minting): 487,500

The high Stock-to-Flow ratio indicates that TON is scarce, with limited new tokens being introduced relative to the existing supply. This scarcity suggests strong long-term value.

Risk Analysis

Volatility

The TON ecosystem, like many blockchain projects, exhibits significant price volatility. As seen with the fluctuation in token trading volume and market cap changes (with the market cap increasing by 3.05% over the past 30 days), this indicates that external factors such as market sentiment, macroeconomic conditions, and investor behavior can lead to substantial price swings. Investors in TON should be prepared for high levels of volatility, which can both provide opportunities and increase risk, especially during bearish market cycles.

Regulatory Risks

The regulatory landscape surrounding cryptocurrencies is continuously evolving. TON operates globally, which means it faces the possibility of varying and changing regulations in different jurisdictions. Governments or financial authorities may impose restrictions or legal requirements on blockchain projects, potentially affecting TON's operations, market accessibility, and token value. Given the decentralized nature of TON but centralized governance structure (under the TON Foundation), there is an inherent risk of compliance challenges, especially with growing scrutiny on blockchain-based projects.

Market Risks

The cryptocurrency market is still in its nascent stages, and as such, it is highly susceptible to market corrections, sentiment-driven price movements, and broader macroeconomic factors like inflation or interest rate hikes. Despite TON's significant market cap, the broader market downturn or a shift in investor interest towards other blockchain projects could lead to a decrease in demand for TON tokens. Additionally, TON's reliance on adoption and the continued interest of developers and users in its ecosystem makes it vulnerable to changes in the competitive landscape, including the rise of competing blockchain platforms.

Security Risks

TON takes security seriously, offering a comprehensive bug bounty program that encourages developers and hackers to find critical vulnerabilities. These include bugs in the core blockchain, wallets, smart contracts, and bridges. A reward of up to $100,000 in Toncoins is offered, ensuring continuous improvement in the system’s integrity. This proactive approach mitigates many common blockchain security risks, such as theft or loss of funds.

Additionally, TON employs TON Connect for secure wallet interactions, which enhances security by encrypting data between wallets and apps. This ensures users have explicit control over shared data, reducing the risk of data leaks. Furthermore, TON Connect 2.0 has introduced stronger cryptographic authentication systems, reinforcing security for decentralized applications (dApps) and allowing more streamlined and secure user interactions.

Despite these proactive measures, there is always a risk of governance manipulation due to large holders, as seen with TON’s centralized decision-making structure. Additionally, the upgradability of smart contracts, while beneficial for future developments, can pose risks if not managed transparently and securely. Continuous audits, an active bug bounty program, and reputable development teams are essential to maintaining the security of the network.

Liquidity and Market Risks

While TON boasts a high circulating market cap of $13.25 billion and has several backers (like DWF Labs and Animoca Brands), liquidity could become an issue during periods of high volatility or market downturns. The relatively low trading volume compared to market cap ($10.44 billion, a 50.1% decrease in trading volume) raises concerns about liquidity during times of stress. Furthermore, the token’s reliance on centralized exchanges like KuCoin and MEXC for liquidity increases its vulnerability to exchange-specific risks, such as regulatory crackdowns, hacking incidents, or delistings. These factors could significantly hinder the ability of users to buy and sell large quantities of TON without slippage or at fair prices.

Community Engagement

TON has a massive following on X with 2.5 million followers.

The Open Network community on Telegram also has 10 million subscribers.

The TON foundation on Linkedin has almost 11K followers.

On GitHub, TON has 4k followers.

On CoinMarketCap, Ton is on 624K watchlists.

Conclusions and Recommendations

The Telegram Open Network (TON) demonstrates a well-rounded blockchain ecosystem with a unique approach to solving major scalability issues, particularly through its innovative asynchronous smart contract execution and dynamic sharding mechanisms. Its high throughput capacity and cross-chain interoperability position it well for applications in decentralized finance (DeFi), non-fungible tokens (NFTs), and decentralized storage, making it highly relevant for next-generation decentralized applications.

However, despite its strong technical foundations, TON is still in its early stages of ecosystem development. It faces significant challenges, including regulatory uncertainties and the need for further developer adoption and tool creation. To capitalize on its strengths, TON should continue focusing on expanding its ecosystem through developer engagement, fostering strategic partnerships, and ensuring compliance with evolving regulations.

Investors looking for a high-potential blockchain project with a focus on scalability and low transaction costs should find TON appealing. However, they should remain cognizant of the project's inherent risks, especially in the areas of security, liquidity, and market volatility.

Summary of Strengths

-

Scalability: TON's ability to handle millions of transactions per second gives it a significant edge over legacy platforms like Ethereum and newer competitors like Solana.

-

Cross-Chain Interoperability: TON is designed to seamlessly connect with other blockchain ecosystems, a crucial feature for decentralized applications requiring cross-chain functionality.

-

Low Transaction Costs: TON's rent-based fee model ensures minimal transaction fees, making it an attractive platform for developers and users alike.

-

Asynchronous Smart Contracts: TON’s asynchronous execution model reduces network congestion and enhances scalability, positioning it for high-demand decentralized applications.

-

Robust Infrastructure: TON’s decentralized services, such as TON DNS and TON Storage, offer user-friendly access to the blockchain and enhance the ecosystem’s overall usability.

-

Proactive Security Approach: A comprehensive bug bounty program, alongside secure wallet interactions through TON Connect 2.0, strengthens the network’s security architecture.

Identified Challenges

-

Regulatory Uncertainty: As with most blockchain projects, TON is exposed to the risk of changing regulations in different jurisdictions, which could impact its operations, market access, and adoption.

-

Developer Tooling and Adoption: The FunC language presents a steep learning curve for developers familiar with Solidity. Limited developer tools and support may slow down the platform’s growth and adoption.

-

Market Volatility: TON has experienced notable price volatility, which poses risks for both investors and users. Its reliance on centralized exchanges for liquidity also increases exposure to exchange-specific risks.

-

Ecosystem Maturity: Although TON shows immense potential, its ecosystem is still in the early stages. There are fewer decentralized applications (dApps) compared to more established platforms, and further expansion is required to drive adoption.

Future Outlook

TON is well-positioned to capitalize on the growing demand for scalable, low-cost blockchain infrastructure. Its ability to process millions of transactions per second, combined with its cross-chain interoperability, makes it an attractive platform for developers looking to build high-throughput decentralized applications. The platform's adoption in key sectors like DeFi, NFTs, and decentralized storage could drive future growth, provided it can overcome its current challenges.

TON’s upcoming developments, such as further decentralized governance through the TON DAO and the ongoing strategic investments from major backers, will play a crucial role in determining its future success. Additionally, TON’s proactive security measures, including the bug bounty program and the introduction of TON Connect 2.0, indicate the platform’s focus on maintaining long-term stability and security.

Investment Outlook

From an investment perspective, TON presents a compelling opportunity for those interested in next-generation scalable blockchain platforms. With a high Network Value to Transactions (NVT) ratio of 1.79 and a Stock-to-Flow ratio of 5,128.21, the asset demonstrates significant scarcity and long-term growth potential.

However, the exceptionally high Market Value to Realized Value (MVRV) ratio of 1,090.88 highlights a highly speculative market valuation, suggesting that the current price significantly exceeds its revenue-generation capacity.

Investors should carefully consider the platform’s potential for growth alongside the inherent risks of market volatility and regulatory uncertainties. While TON’s innovative technology and expanding ecosystem are strong advantages, challenges such as its dependency on centralized exchanges for liquidity and the increasingly competitive blockchain space could impact its long-term trajectory. Ultimately, TON offers a high-reward but high-risk investment opportunity, making it suitable for those willing to navigate the uncertainties of early-stage blockchain ventures.