As global markets ride a wave of cautious optimism driven by strong corporate earnings and easing trade tensions, the crypto space is seeing its own set of standout performers.

Tokens like XYO, ALPACA, and PENGU have captured investor attention with double-digit gains, while ONDO and SUI continue to push boundaries through regulatory engagement and real-world utility expansion. From memecoins to DeFi innovators, today's crypto movers reflect a broader appetite for risk as markets adjust to shifting geopolitical narratives and tech-fueled growth.

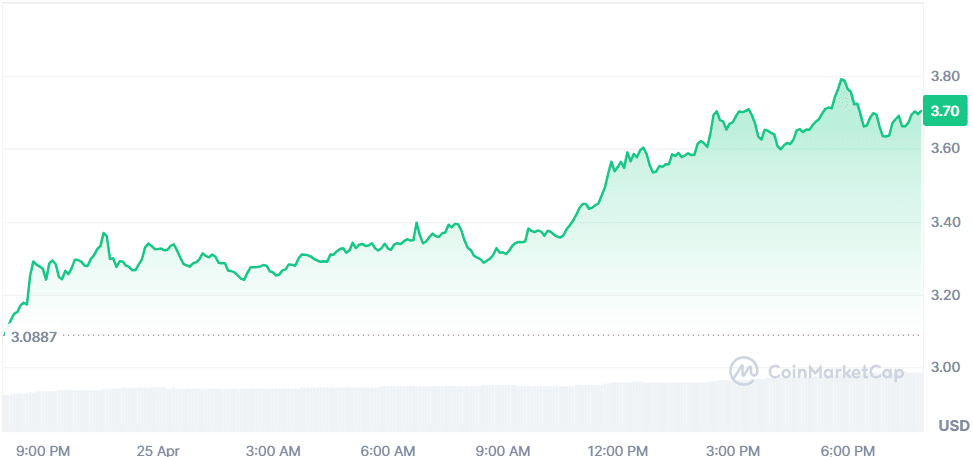

Sui (SUI)

Price Change (24H): +17.14% Current Price: $3.70

What happened today

Sui made headlines by partnering with xPortal and xMoney to launch a revolutionary virtual Mastercard, enabling direct SUI payments integrated with Apple Pay and Google Pay. This move bridges crypto with real-world commerce, enhancing SUI's utility. Additionally, DeFi activity on the Sui network surged, pushing TVL to $1.46B and driving strong demand for SUI amidst a broader market downturn.

Market Cap: $12.04B 24-Hour Trading Volume: $3.91B Circulating Supply: 3.24B SUI

Ondo (ONDO)

Price Change (24H): +3.29% Current Price: $1.00

What happened today

Ondo Finance surged after a strategic meeting with the SEC’s Crypto Task Force, discussing regulatory frameworks for tokenizing U.S. securities. The engagement signaled positive momentum towards regulatory clarity, boosting investor confidence. Ondo also reclaimed a $3B market cap, driven by rising interest in its tokenized financial products like OUSG and USDY.

Market Cap: $3.18B 24-Hour Trading Volume: $491.4M Circulating Supply: 3.15B ONDO

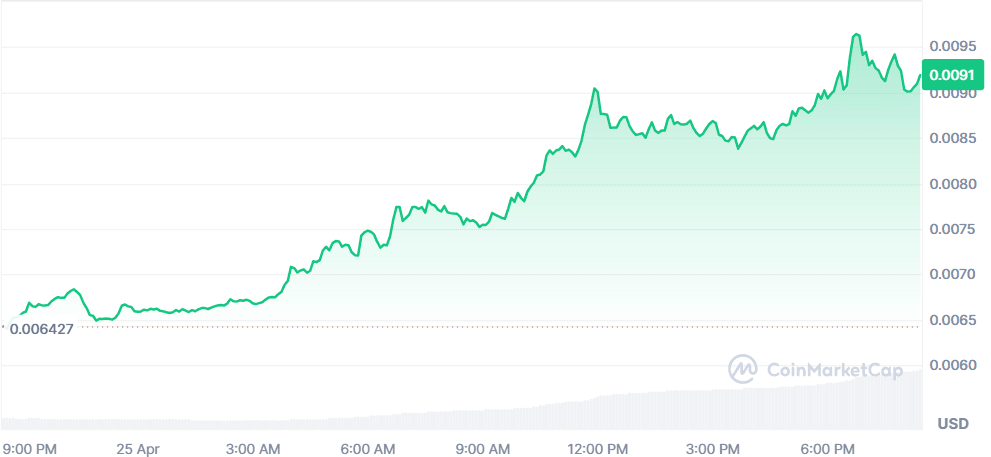

Pudgy Penguins (PENGU)

Price Change (24H): +42.85% Current Price: $0.009192

What happened today

PENGU spiked after Luca Netz teased the unboxing of the Pudgy Penguins x Lotte Limited Edition Collectible, sparking excitement in the NFT and memecoin communities. The buzz around this collaboration drove significant trading volume and pushed PENGU to its highest level since early March.

Market Cap: $577.83M 24-Hour Trading Volume: $340.45M Circulating Supply: 62.86B PENGU

Alpaca Finance (ALPACA)

Price Change (24H): +164.55% Current Price: $0.1549

What happened today

Despite Binance announcing plans to delist ALPACA, the token saw a massive surge due to community-driven trading on alternative exchanges. The decision not to mint additional tokens after a request from the market maker also contributed to bullish sentiment, leading to a sharp price rally.

Market Cap: $23.33M 24-Hour Trading Volume: $316.31M Circulating Supply: 150.65M ALPACA

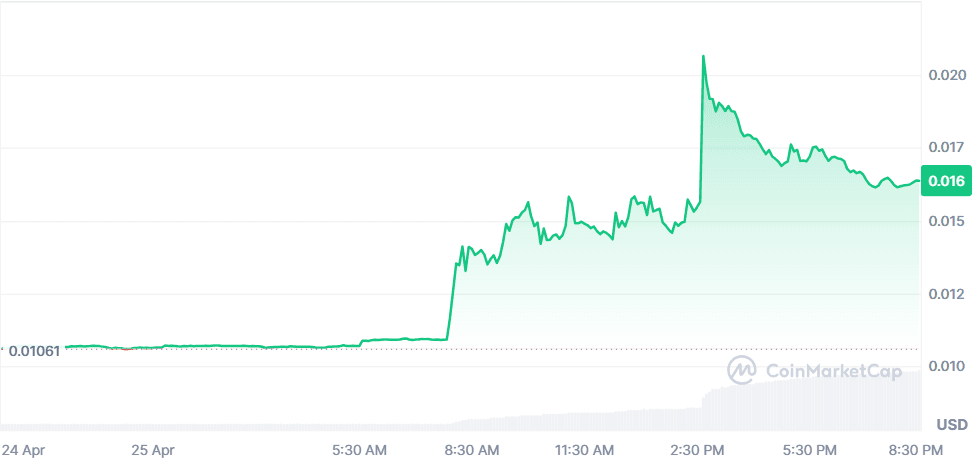

XYO (XYO)

Price Change (24H): +53.65% Current Price: $0.01639

What happened today

XYO soared following the announcement of its listing on Bithumb, one of South Korea's largest exchanges. The rally was further fueled by ecosystem growth, including the launch of XYO’s Layer-1 blockchain public beta and strong DeFi engagement. On-chain data shows whale accumulation and a bullish breakout above key moving averages.

Market Cap: $220.96M 24-Hour Trading Volume: $60M Circulating Supply: 13.47B XYO

Global Market Snapshot

Markets are holding steady in a delicate balance between optimism and caution. Strong earnings from tech giants like Alphabet have injected confidence into Wall Street, helping the S&P 500 edge towards its longest winning streak since January.

Positive signals from U.S.-China and U.S.-South Korea trade talks, alongside China's potential tariff exemptions, have further calmed investor nerves after weeks of tariff-fueled volatility. However, lingering uncertainties around President Trump's aggressive trade stance and weak forecasts from companies like Intel and Procter & Gamble serve as reminders that this rally is walking a tightrope.

Meanwhile, European markets are buoyed by solid corporate results from Nestle and Merck, while Asian indices followed suit with Japan’s Nikkei climbing over 2%. The U.S. dollar's strength against major currencies hints at a risk-on sentiment, but with consumer staples dragging and geopolitical tensions simmering - particularly in Ukraine - the global outlook remains mixed. Eyes are now on upcoming earnings from hyperscalers like Microsoft and Amazon, as well as further trade developments, to see if this momentum can sustain.

Closing Thoughts

Both global equities and crypto markets are showing signs of resilience, driven by strong earnings and hopes of de-escalation in trade conflicts. Investor sentiment is cautiously bullish, with tech leading Wall Street's recovery and altcoins dominating crypto conversations.

The surge in tokens like XYO, ALPACA, and PENGU signals a renewed appetite for speculative plays, while ONDO’s regulatory strides and SUI’s push into mainstream payments highlight growing interest in real-world blockchain applications.