While global markets struggled under renewed tariff anxieties, the crypto space delivered its usual dose of volatility with sharp moves across trending tokens. From AirSwap's impressive rally driven by institutional-grade trades to POL’s strategic airdrop buzz, investors were quick to chase opportunities.

Meanwhile, TRUMP coin lost steam after its recent hype cycle, and ALPACA caught attention despite delisting news. Legacy projects like ARDR also resurfaced, proving that in today’s market, both narratives and speculation are driving the spotlight.

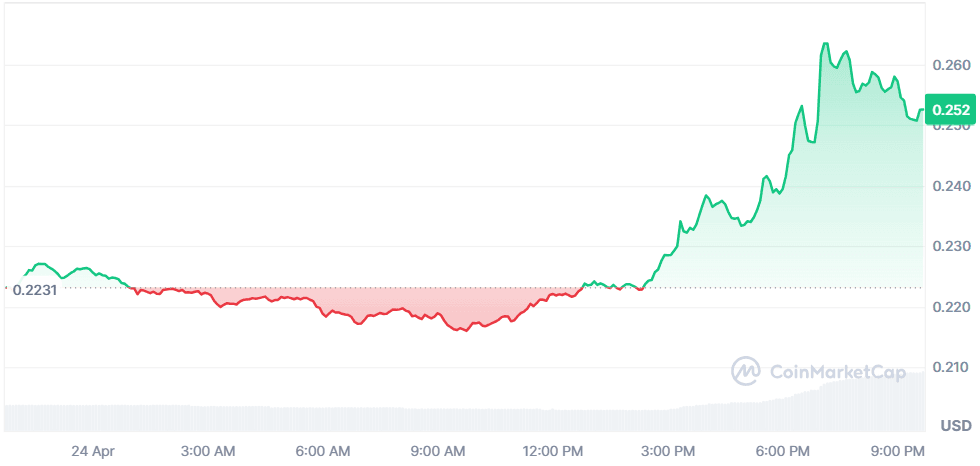

POL (POL)

Price Change (24H): +13.11% Current Price: $0.2524

What happened today

Polygon announced the launch of its Agglayer Breakout Program, aimed at accelerating ecosystem growth through strategic airdrops for POL stakers. Backed by Polygon Labs and the Polygon Foundation, this initiative will offer 5–15% token airdrops from projects like Miden and Privado ID. With a focus on boosting liquidity and solving the "cold start" problem for new chains, this program is set to drive significant value to POL holders and expand Agglayer’s network effect. The announcement sparked investor enthusiasm, pushing POL’s price up by over 13% today.

Market Cap: $2.62B 24-Hour Trading Volume: $317.64M Circulating Supply: 10.41B POL

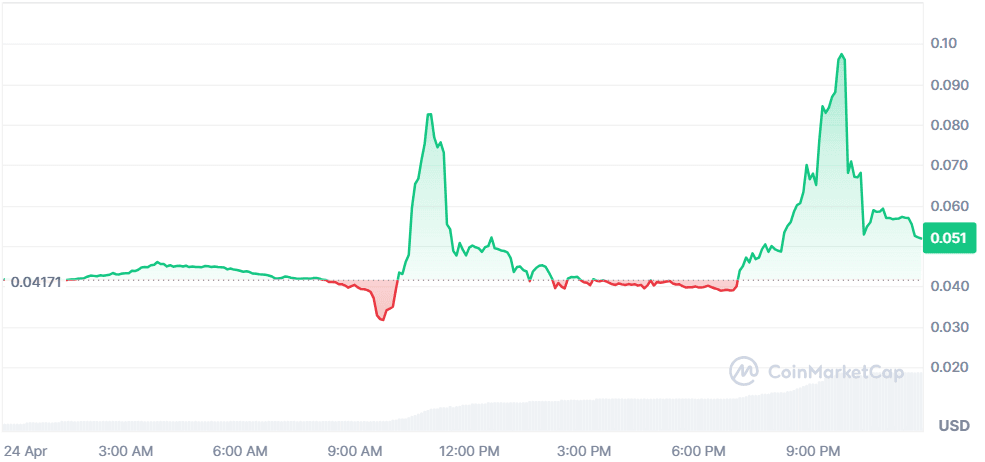

Alpaca Finance (ALPACA)

Price Change (24H): +22.58% Current Price: $0.05097

What happened today

Alpaca Finance surged over 22% despite negative news, as Binance announced the delisting of ALPACA along with other tokens. While delistings usually trigger sell-offs, speculative trading and short-term interest appear to have driven a temporary price spike, with volumes soaring over 550%. Traders are likely capitalizing on volatility ahead of the delisting event.

Market Cap: $7.68M 24-Hour Trading Volume: $140.31M Circulating Supply: 150.65M ALPACA

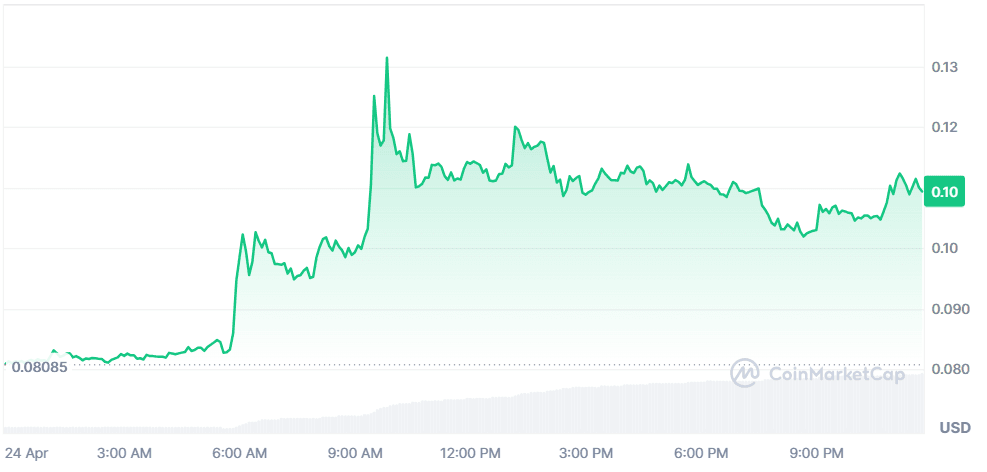

Ardor (ARDR)

Price Change (24H): +35.14% Current Price: $0.1091

What happened today

Ardor saw a sharp 35% increase today, though no major news was directly linked to the surge. The spike could be attributed to renewed interest in legacy blockchain platforms amid growing discussions around scalable multichain ecosystems. With a strong trading volume boost of over 740%, ARDR appears to be benefiting from speculative momentum in the altcoin market.

Market Cap: $109M 24-Hour Trading Volume: $291.33M Circulating Supply: 998.46M ARDR

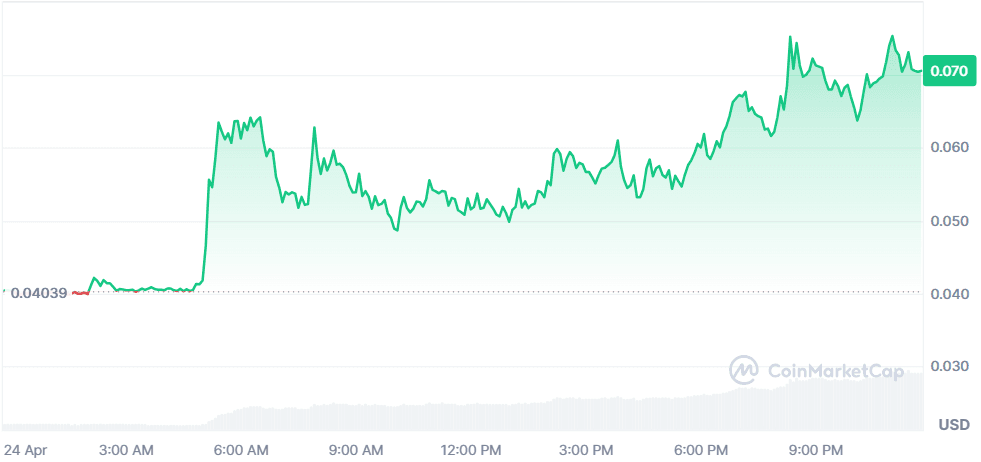

AirSwap (AST)

Price Change (24H): +79.36% Current Price: $0.07235

What happened today

AirSwap skyrocketed nearly 80% following announcements highlighting its OTC trading platform, which facilitates large-volume token trades without market impact. The reveal of their largest OTC trade worth $30M has bolstered confidence in AirSwap’s utility, driving significant interest from investors looking for efficient, private trading solutions.

Market Cap: $12.62M 24-Hour Trading Volume: $19.42M Circulating Supply: 174.47M AST

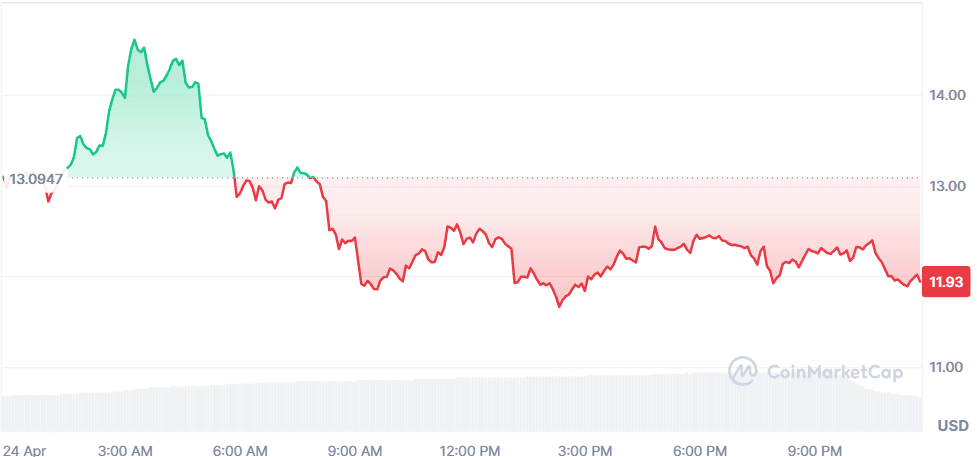

OFFICIAL TRUMP (TRUMP)

Price Change (24H): -9.12% Current Price: $11.93

What happened today

After an initial surge driven by Donald Trump’s announcement of exclusive gala dinners and VIP receptions for top TRUMP coin holders, the token has corrected by over 9% today. Despite recent hype, including promises of ETFs and crypto-related executive orders, skepticism in the market regarding the token’s long-term value has led to profit-taking. The coin remains volatile, reflective of its meme status and speculative nature.

Market Cap: $2.38B 24-Hour Trading Volume: $3.2B Circulating Supply: 199.99M TRUMP

Global Market Snapshot

Markets turned cautious today as optimism from earlier gains faded under the weight of renewed U.S.-China tariff concerns and unpredictable White House policies. After a brief rally driven by hopes of softer trade measures, both U.S. and European equities slipped, with investors questioning if recent momentum was just a temporary rebound. Weak business sentiment in Europe, coupled with volatility in currency markets and lingering fears over global economic stability, kept risk appetite subdued despite resilient corporate earnings from select sectors.

Closing Thoughts

The broader market sentiment today was driven by a combination of geopolitical easing and investor hunger for high-risk, high-reward assets. With President Trump softening his stance on both the Fed and trade tariffs, global markets rallied, pulling crypto along for the ride. This shift triggered a rotation back into speculative sectors, particularly memecoins and trending altcoins, where participation spiked noticeably.

Memecoins like TURBO and GRIFFAIN thrived on hype cycles, while DEEP showcased how institutional moves can sustain momentum in DeFi tokens. ZEREBRO’s transparency boosted community trust, reflecting how narrative control can impact price action. Overall, today's activity highlights a market leaning into risk, but with underlying caution as traders remain alert to sudden pivots in both global finance and crypto trends. Whether this optimism holds will depend on sustained liquidity, macro stability, and how long investors are willing to chase momentum.