Altcoins took center stage today, rallying sharply despite a downbeat mood in traditional markets. From unexpected comeback narratives to surging DeFi interest and speculative breakouts, each of these tokens has drawn retail and short-term trader attention.

Their spikes come amid growing concerns in global finance, where U.S. indices tumbled after Fed Chair Jerome Powell signaled slowing economic growth and inflation risks driven by tariff pressures.

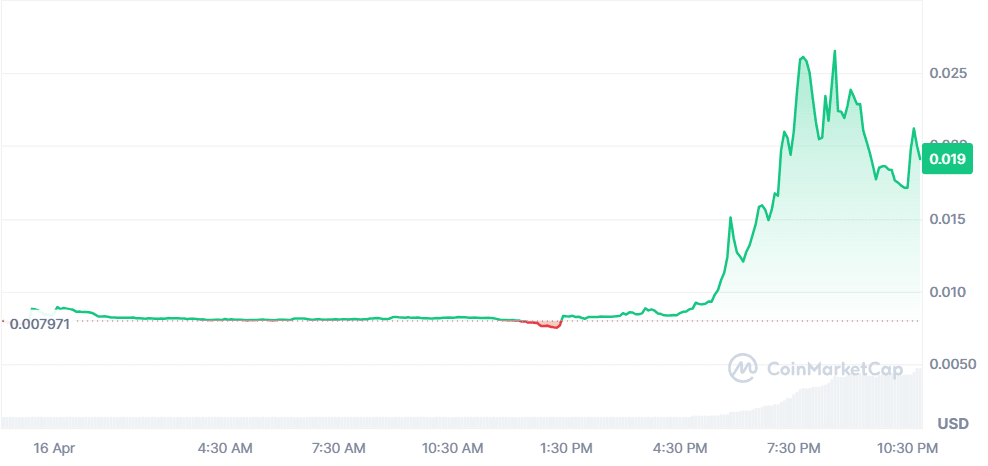

COMBO (COMBO)

Price Change (24H): +148.41% Current Price: $0.01909

What happened today

COMBO saw a massive one-day surge, gaining over 148% in price alongside a 386.80% spike in trading volume. The sharp uptrend seems fueled by renewed investor attention after its rebranding from Cocos BCX to COMBO, drawing focus back to the project’s fundamentals and potential utility. The sudden price action appears speculative but reflects broader market enthusiasm for low-cap assets with recent identity refreshes.

Market Cap: $1.57M 24-Hour Trading Volume: $2.12M Circulating Supply: 82.46M COMBO

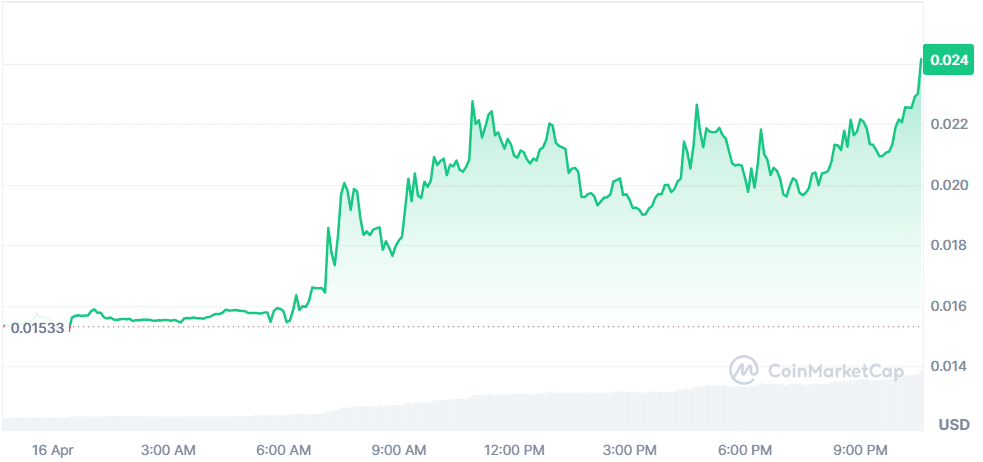

Sperax (SPA)

Price Change (24H): +58.55% Current Price: $0.02435

What happened today

Sperax rallied strongly today, driven by rising demand for its yield-generating stablecoin USDs and enhanced on-chain metrics. As a DeFi protocol built on Arbitrum, its passive-income strategy through auto-yield stablecoins has attracted new users. Increased wallet activity, social buzz, and over $23M in trading volume contributed to SPA's spike. Speculative momentum around its low market cap and governance utility also added to the rally.

Market Cap: $41.19M 24-Hour Trading Volume: $23.03M Circulating Supply: 1.69B SPA

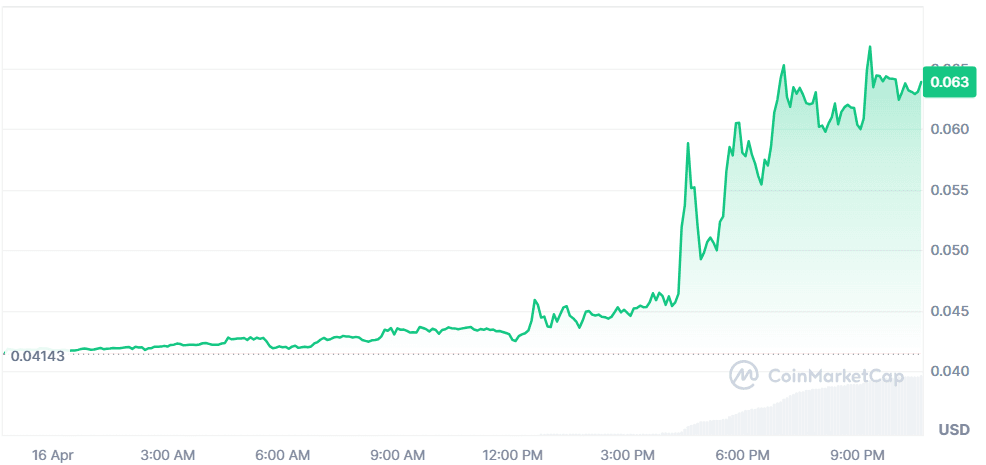

Stratis [New] (STRAX)

Price Change (24H): +51.78% Current Price: $0.06348

What happened today

STRAX continued its strong uptrend, marking a 51% daily gain with volume surging over 8100%. This rally is likely a combination of rising interest in modular blockchain infrastructure and growing community support. With a circulating supply of 1.95B and renewed investor attention, STRAX seems to be benefiting from mid-cap DeFi and infrastructure narrative growth.

Market Cap: $124.07M 24-Hour Trading Volume: $274.03M Circulating Supply: 1.95B STRAX

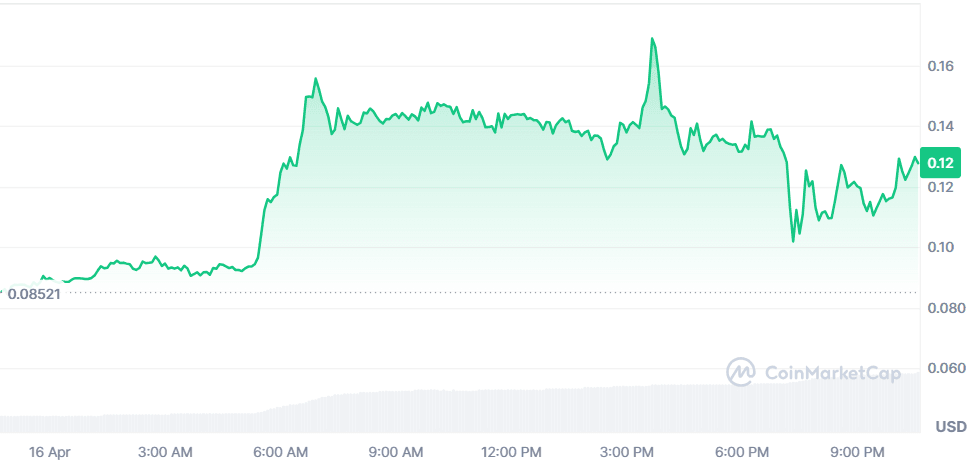

Ardor (ARDR)

Price Change (24H): +40.66% Current Price: $0.1225

What happened today

Ardor defied expectations, spiking over 280% this week and 131% today alone, after being listed in Binance’s “Vote to Delist” program. The project’s unique parent-child blockchain architecture caught traders’ interest, with many seeing long-term potential despite delisting concerns. ARDR’s recent volume and price jump are fueled by speculation, social media support, and a belief in the token’s overlooked fundamentals.

Market Cap: $122.32M 24-Hour Trading Volume: $701.05M Circulating Supply: 998.46M ARDR

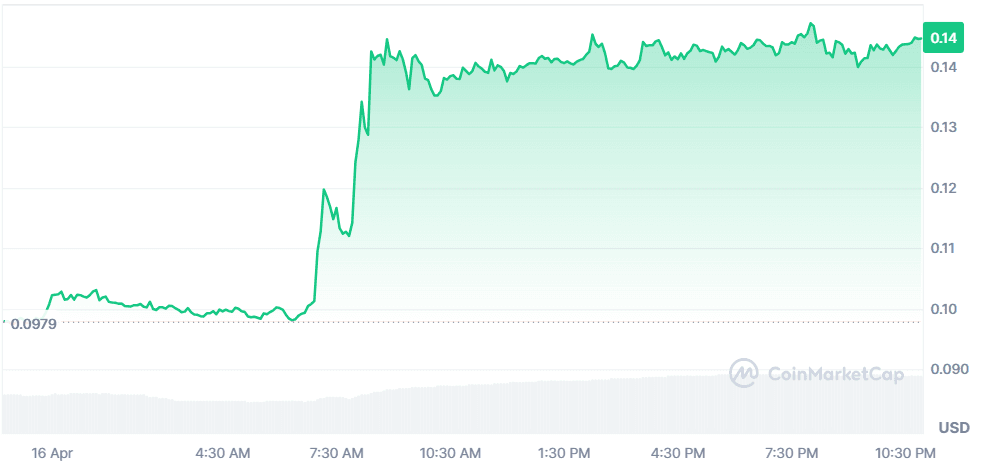

PumpBTC (PUMP)

Price Change (24H): +48.18% Current Price: $0.1445

What happened today

PumpBTC, the governance token of its ecosystem, posted an almost 50% gain today. While there’s limited public information driving the surge, the price movement appears to be driven by speculative demand and accumulation following recent low-volatility periods. With over $25M in volume, traders are betting on short-term breakout potential amid broader market rotations.

Market Cap: $41.19M 24-Hour Trading Volume: $25.11M Circulating Supply: 285M PUMP

Global Financial Snapshot

Wall Street extended its downward streak today after Federal Reserve Chair Jerome Powell acknowledged that U.S. growth appears to be slowing in Q1.

Powell highlighted growing uncertainty tied to trade policies and inflation risks, especially due to newly introduced tariffs. The S&P 500 dropped over 2%, with chip stocks and tech-heavy Nasdaq leading the losses. As traditional markets reel from policy concerns, crypto continues to show isolated bullish momentum—potentially as a speculative hedge or a sign of sectoral decoupling.

Closing Thoughts

As traditional equities falter under macroeconomic uncertainty, investor sentiment in crypto appears to be diverging. The coins dominating today's trends suggest a rotation into high-volatility, low- to mid-cap tokens that offer fast gains and narrative-driven upside. Ardor (ARDR) especially reflects how traders are willing to rally behind underdog tokens even when faced with potentially negative headlines. Meanwhile, DeFi-related interest is heating up again, evident in SPA’s run driven by its yield-focused stablecoin ecosystem.

This surge across speculative and infrastructure-related tokens indicates that while global markets are retreating in caution, crypto traders are leaning into momentum and narratives. Increased participation is clustering around sectors like governance tokens, modular chain architecture, and passive income DeFi - sectors that promise not just gains, but utility. Despite Powell’s grim tone, the crypto market is finding its own rhythm, possibly fueled by hedging behavior, opportunistic trading, or simply the classic crypto risk appetite kicking back in.