Traditional financial institutions increasingly adopt Ethereum blockchain despite retail users favoring alternatives

What to Know:

- Ethereum currently controls 57% of tokenized real-world assets with major institutions like BlackRock choosing it for security and decentralization

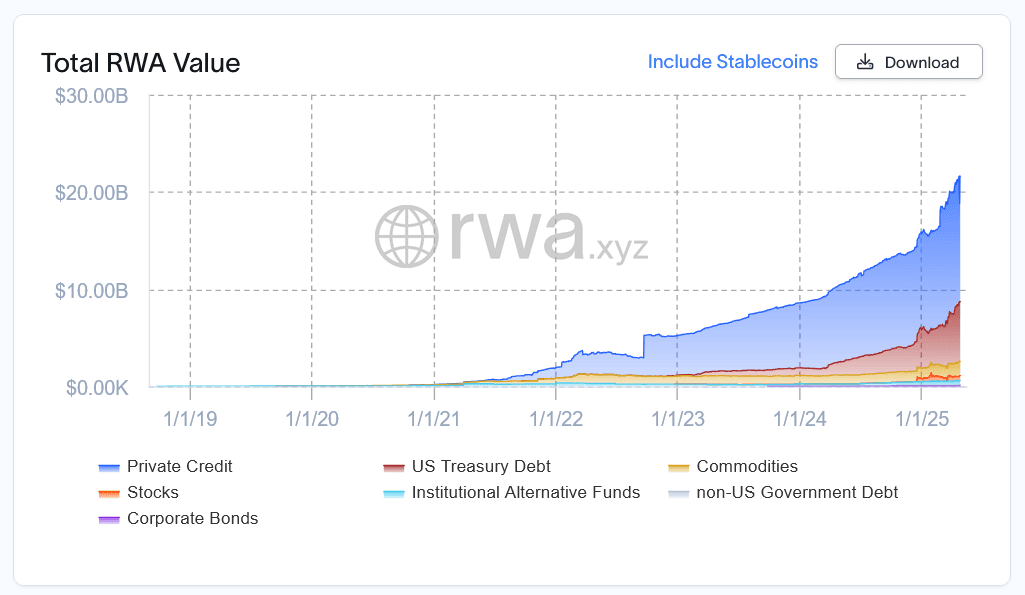

- 2025 appears to be decisive for Ethereum's dominance as tokenized assets surged 57% to $21 billion since recent U.S. election

- Some experts warn Ethereum must position itself more aggressively as the only legitimate settlement layer to maintain its competitive advantage

For years, Ethereum proponents have predicted the blockchain would become the global settlement layer for finance. Recent developments suggest this vision is materializing as major financial institutions increasingly adopt Ethereum for their blockchain strategies.

BlackRock, Fidelity, Deutsche Bank, UBS and Coinbase have all positioned Ethereum at the core of their blockchain initiatives. Last week, Ethereum-based platform Blocksquare announced a $1 billion deal with Vera Capital to tokenize U.S. real estate, while Securitize and Ethena launched Converge L2 to tokenize billions in real-world assets.

"Every stock, every bond, every fund — every asset — can be tokenized. If they are, it will revolutionize investing," said BlackRock chair Larry Fink.

Ethereum Over Others?

The financial services industry is gravitating toward Ethereum despite retail traders choosing faster, cheaper alternatives. Boston Consulting Group projects the tokenization market will reach $16.1 trillion by 2030, with Ethereum currently capturing the majority of institutional interest.

Sam Kazemian, founder of stablecoin project Frax Finance, believes Ethereum offers the best platform for institutions but warns against complacency.

"I think that the complacency of like, 'It's just gonna happen because Ethereum is so good,' that's not true," he said. Kazemian argues Ethereum maximalists must position the blockchain as the only acceptable settlement layer for tokenized assets. "If it's on anything else, it's bullshit."

A recent post by Ethereum Foundation co-director Tomasz Stanczak suggests this approach may gain traction. He wrote that a major priority for Ethereum will be insisting on the requirement to "always mint assets on the L1."

Data shows Ethereum currently dominates the tokenized assets landscape. Even though BlackRock's BUIDL fund is available on seven blockchains, 93% of its $2.4 billion in assets under management resides on Ethereum. Most of those assets flowed in during the past six weeks, despite negative sentiment toward ETH reaching new lows.

"There was no question that the blockchain we would start our tokenization on would be Ethereum and that's not just a BlackRock thing. That's the natural default answer," BlackRock's head of digital assets, Robbie Mitchnick, said in March. "Clients have clearly made the choice that they really do value decentralization, credibility and security."

Global Picture

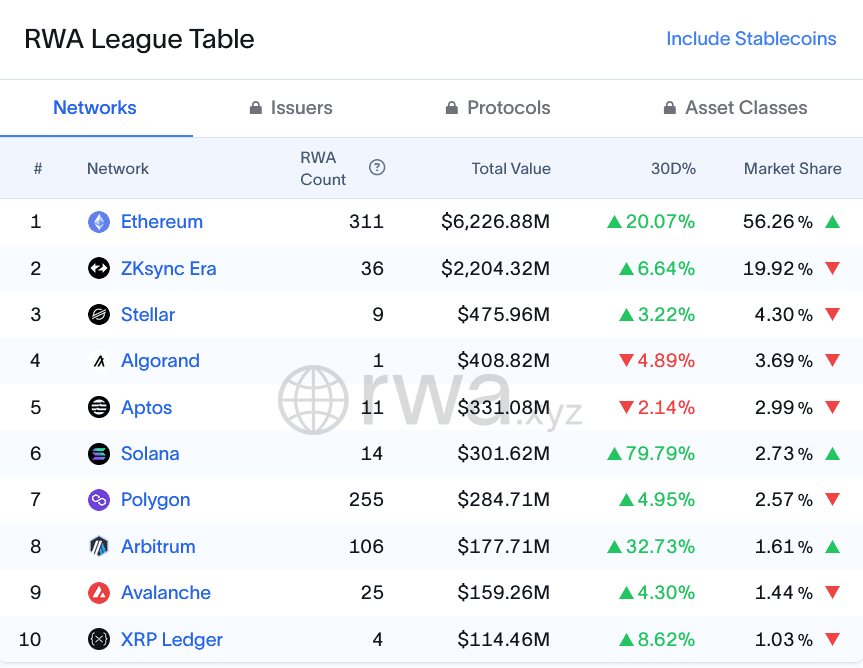

Ethereum currently accounts for 57% of all tokenized real-world assets, with its layer-2 scaling solution ZKsync Era adding another 21%. Competitors lag significantly behind, with Stellar holding 4.5% market share, Aptos 3.2%, Algorand 3.1% and Solana 2.9%.

Henrik Andersson, founder of crypto fund Apollo Capital, says Wall Street's primary concerns extend beyond decentralization.

"I'd argue 80% of activity across stablecoins and DeFi happens on Ethereum — this is in our view why Ethereum will be the natural home of TradFi assets," Andersson said. "At the end of the day, there is little point in tokenisation if you're creating a walled garden onchain on a 'ghost chain.'"

Some experts hold contrasting views.

Crypto educator DBCrypto believes Ethereum's dominance won't last.

"It may win some battles but there is zero chance that it will truly be the main tokenization layer long term," he said. "Other chains will catch up in terms of decentralization and some are arguably already there or close while offering a 100x improvement in everything else."

Ethereum's base layer operates more slowly than modern blockchains, sacrificing speed for decentralization. This limitation has led some analysts to predict a market bifurcation.

Danny Chong, co-founder of Tranchess, foresees major institutions using Ethereum "as a secure, neutral base layer," while high-volume and retail-facing applications migrate to faster networks like Solana or Aptos.

"TradFi institutions prioritize security, technical familiarity and regulatory confidence, which outweigh low-cost and fast transactions," Chong said. "Ethereum is likely to remain the 'main highway' for high-value institutional assets, while faster chains may capture smaller, high-volume segments."

Vivek Raman, founder of Etherealize, counters that Layer-2 solutions built on Ethereum can address these concerns. "The more high-value the assets are, the more global the network, the more regulatory needs that the institution has, the more Ethereum's decentralized, global value proposition shows itself."

Despite Ethereum's growing institutional adoption, traditional finance hasn't rushed to invest in its native cryptocurrency.

Ethereum ETFs hold just $4.57 billion in assets after seven weeks of outflows, compared to Bitcoin ETFs with $94.5 billion.

Raman acknowledges that Ethereum presents a more complex investment narrative than Bitcoin but suggests the anticipated approval of staking for Ether ETFs could provide a crucial differentiator.

"I don't think it's intuitive that everyone knows ETH has a staking yield, but I do know that institutions and TradFi, the whole world, everyone loves yield, everyone loves fixed income instruments," Raman said.

Despite Ethereum's current dominance in tokenized assets, the financial industry's blockchain adoption remains nascent. While Ethereum accounts for $4.1 billion of $5.75 billion in tokenized U.S. treasuries, these figures represent a tiny fraction of the $28.6 trillion U.S. Treasury market.

Closing Thoughts

As traditional financial institutions continue exploring blockchain technology for asset tokenization, Ethereum has established an early lead through its emphasis on security, decentralization and institutional trust. Whether it maintains this advantage depends on addressing scaling challenges and convincing Wall Street that its complex value proposition offers long-term benefits over competing networks.