In a week defined by chaos and comebacks, crypto watchers saw it all—flash crashes, surprise listings, and bold governance plays. OM collapsed by over 90% in one of the most dramatic price drops this year, while tokens like SPA and COMBO pulled off impressive rebounds thanks to renewed staking interest and strategic rebranding.

Meanwhile, AERGO dominated headlines again with its unexpected Binance Futures listing, defying earlier delisting threats. As memecoins cooled off slightly, enterprise blockchains and governance-driven tokens began to reclaim the spotlight. Here are the 10 coins everyone’s been watching this week.

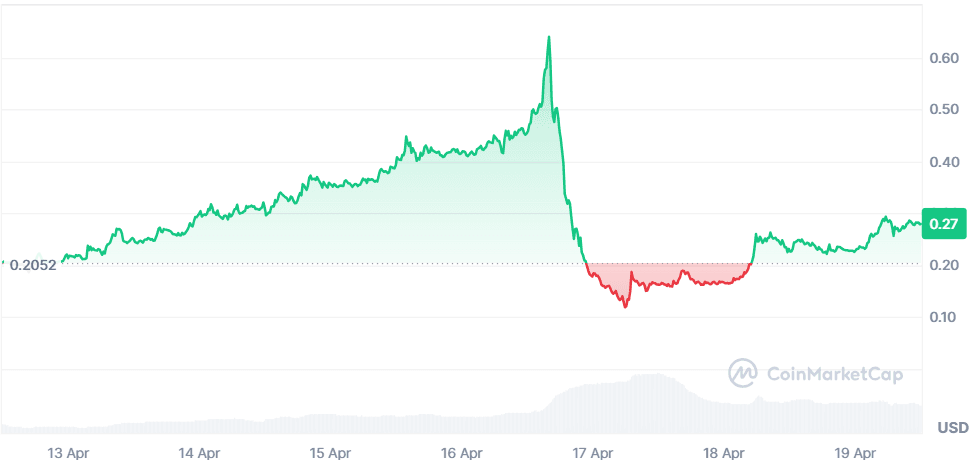

AERGO (AERGO)

Price Change (7D): +36.09% Current Price: $0.2793

News

AERGO remains in the spotlight for the second week, following Binance’s unexpected U-turn - after announcing a delisting, the exchange launched AERGOUSDT perpetual contracts with 15x leverage. Backed by Samsung and partnered with Shinhan Bank and Hyundai, Aergo's enterprise positioning continues to draw attention. Moreover, its recent integration with BitGo for institutional-grade custody signals a strong commitment to secure, compliant blockchain infrastructure. This has sparked renewed investor confidence, positioning AERGO as a hybrid enterprise blockchain contender with deep institutional ties and robust infrastructure.

Forecast

AERGO saw a sharp rally following its Binance Futures listing, but it's now consolidating after reaching local highs. RSI hovers around 64, showing mild overbought conditions. As long as it maintains support above $0.24, a bullish continuation towards $0.33 remains possible. If RSI climbs back above 70 and volume supports the move, short-term breakout potential is strong. However, failure to hold $0.24 may trigger a dip toward $0.21. Monitor leverage liquidations for any reversal signals.

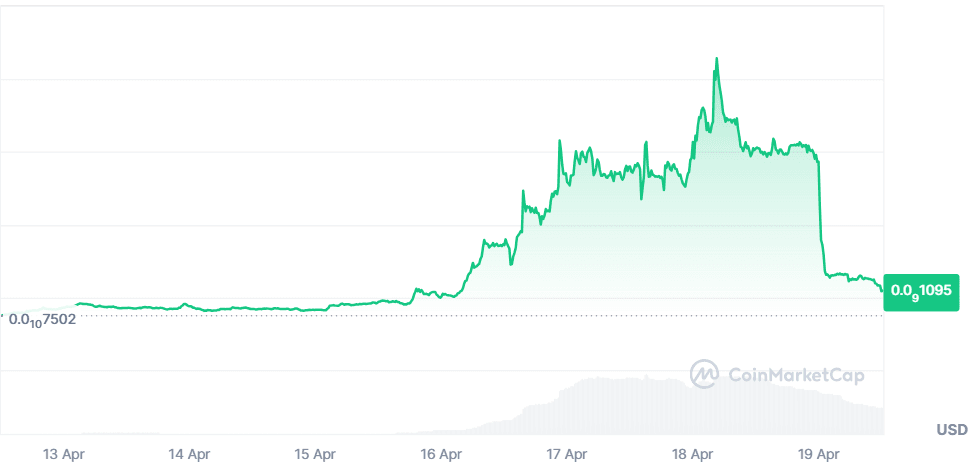

ArbDoge AI (AIDOGE)

Price Change (7D): +46.06% Current Price: $0.0000000001093

News

ArbDoge AI saw a brief surge after its USDT Futures listing on Bitget, which offered 20x leverage and bot trading support. However, massive whale concentration (84.39%) and recent user concerns over reward distribution, staking withdrawal issues, and broken web infrastructure have raised red flags. Despite being marketed as fully decentralized, its founder admitted stepping away temporarily due to personal issues, leaving the project without clear leadership. The project’s transparency and viability are now under scrutiny, as user trust sharply declines.

Forecast

Technically, AIDOGE is in a free fall post-surge, with RSI dropping below 30, indicating extreme oversold conditions. However, buy-side volume remains thin. The next demand zone could be around $0.000000000097. If the price stabilizes and RSI recovers above 40, short-term relief to $0.00000000013 is possible. Whale sell pressure and lack of operational clarity may cap gains. Risk remains very high—expect volatile swings or even a dead cat bounce scenario before any sustainable move.

COMBO (COMBO)

Price Change (7D): +266.03% Current Price: $0.03174

News

After being previously overlooked and nearly delisted, COMBO surged nearly 300% in a week, riding the momentum of its rebranding from Cocos-BCX. The rally was supported by a staggering 581% increase in trading volume and speculative whale interest, with a single transaction of $581K raising eyebrows. Market optimism is also high, with 61% of the community expressing positive sentiment. While enthusiasm is palpable, questions remain about long-term sustainability, as concrete updates on product development and utility remain limited.

Forecast

COMBO’s RSI recently touched 78, signaling significant overbought pressure. The correction from $0.06 to $0.03 reflects cooling speculative demand. If RSI dips below 60 without reclaiming strong volume, a fall back to $0.026 support is likely. However, if COMBO holds above $0.03 and bullish divergence emerges, a retest of $0.045 could be in play. Volatility is high—only short-term traders should consider entry at this stage, while long-term entries should wait for confirmation near the $0.025 zone.

Stratis [New] (STRAX)

Price Change (7D): +52.11% Current Price: $0.0638

News

STRAX made headlines this week with a near ~70% price explosion, driven largely by speculation and rumor-fueled momentum. Unconfirmed chatter around potential Web3 gaming or AI partnerships, along with possible network upgrades or a hard fork, spurred major capital inflow. Trading volume surged over 5x compared to last week’s average, confirming heightened interest. STRAX broke through key technical resistance levels, with no official confirmation yet from the team. The rally is being fueled by FOMO and technical traders chasing the breakout.

Forecast

STRAX's RSI is hovering around 71—teetering at overbought territory. If momentum sustains and news materializes, STRAX could retest the $0.075–$0.08 zone. However, in the absence of confirmation, profit-taking might kick in. Expect short-term retracement to the $0.058–$0.062 support range. Volume remains critical: declining buy-side pressure may lead to a sharper correction. A strong daily close above $0.065 with continued volume could extend the uptrend briefly.

Ardor (ARDR)

Price Change (7D): +76.70% Current Price: $0.1144

News

ARDR defied expectations after being listed under Binance’s “Vote to Delist” initiative. Instead of fading, it became a top gainer on Binance with a weekly gain exceeding 110%. This surprising strength is attributed to renewed interest in ARDR’s “parent-child chain” modular architecture, which is built on the Nxt blockchain and touted as energy efficient. With mounting on-chain discussions and speculation around potential upgrades, the market is reacting not just out of protest, but potentially because of rediscovered fundamentals.

Forecast

ARDR is riding high on speculative interest, with RSI approaching 68. The token could push toward $0.125–$0.13 if volume remains above average. However, delisting risk looms, and any official Binance removal could trigger a sharp correction. If support at $0.105 fails, a drop toward $0.09 is plausible. Traders should watch for bearish RSI divergence or MACD crossover to signal weakening momentum. Tight stop losses are advised in this highly reactive setup.

Raydium (RAY)

Price Change (7D): +24.20% Current Price: $2.22

News

Raydium has reignited excitement with the launch of LaunchLab, its native token creation platform, designed to rival Pump.fun. This comes after Pump.fun shifted away from Raydium’s liquidity pools, leading to a dip in volume. LaunchLab introduces novel features like LP token locking, passive SOL rewards via referrals, and automatic liquidity migration—alongside a 25% RAY buyback mechanism. Following this launch, RAY’s price spiked to $2.33 and daily trading volume jumped over 180%, signaling a potential comeback in ecosystem dominance.

Forecast

Raydium shows a bullish structure on the daily chart with RSI at ~60—leaving room for more upside. If price reclaims the $2.30 zone with strong volume, $2.45 is the next resistance. Consolidation between $2.15–$2.22 could offer a decent accumulation window for bullish setups. A breakdown below $2.10, however, might shift momentum toward $1.95. Volume trends and RSI movement above 65 would confirm sustained bullish control.

Threshold (T)

Price Change (7D): +37.86% Current Price: $0.01969

News

Threshold Network surged after announcing DAO restructuring and reinvestment strategies through T token buybacks, following TIP-103. The handover of key responsibilities to tLabs—including development, marketing, and DeFi integrations—marks a strategic shift toward sustainability. This also slashes operational costs by over $1.1M annually. The DAO has already completed a 30M T token buyback, fueling strong demand. With $8–9M in reserves and ~420M T tokens under multisig, Threshold is gearing up for expansion—especially with tBTC usage climbing across DeFi platforms.

Forecast

T’s breakout above $0.017 resistance turned heads, with RSI at ~67—suggesting continued bullish bias. A close above $0.02 could target $0.023 next. If RSI crosses 70, short-term overheating might cause a pullback toward $0.017–$0.018. On-balance volume (OBV) remains strong, signaling accumulation. As long as support holds, Threshold could continue its bullish structure into the next week.

Gomble (GM)

Price Change (7D): +25.38% Current Price: $0.02481

News

GM received a boost from its multi-exchange listings, including Binance Alpha and Coinone, alongside airdrop events and token claiming challenges. Bitget also launched a special $4,600 GM earning event. The unique claiming system allows community members to either vest or engage in a multiplier-based “challenge” for early access. The transparency around investor and team token unlocks has been well-received, reinforcing trust. These mechanics seem designed to retain user attention while preventing rapid token dumps.

Forecast

GM’s RSI sits at a healthy 59, suggesting it still has room to run. After rejecting resistance near $0.035, it’s now finding support at $0.023–$0.025. If this range holds, and volume picks up again post-Binance airdrop, GM could retest $0.03. If momentum fails and RSI dips below 50, expect a correction to $0.021. While short-term sentiment is bullish, cautious optimism is advised given the project’s novelty and speculative tokenomics.

Sperax (SPA)

Price Change (7D): +42.64% Current Price: $0.02068

News

SPA rallied after a new governance proposal (SIP-70) was introduced, seeking to pause token minting and renounce contract ownership - a strong decentralization move. This followed the failure of SIP-69 due to quorum issues, prompting adjustments in voting configurations. The listing on Pionex and updates showing healthy protocol activity - like $8.48M TVL, 4.083% APY, and 343M SPA locked in veSPA - strengthened confidence. The token burn of nearly 15K SPA this week and consistent staking engagement also signaled commitment to deflationary supply and community alignment.

Forecast

SPA’s RSI is around 62, supporting its bullish momentum. The coin has retraced from a high near $0.027 and is consolidating near $0.020 support. A sustained push above $0.022 could open room for a climb toward $0.025. However, waning volume and a rising wedge pattern may suggest near-term pullback risk. Watch for RSI divergence or MACD crossovers—these could hint at upcoming exhaustion. Support sits at $0.0185 in case of correction.

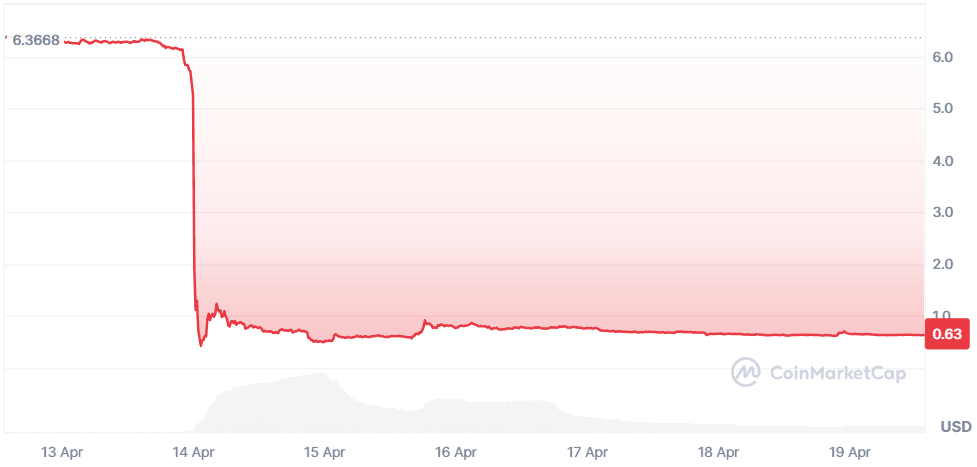

MANTRA (OM)

Price Change (7D): -89.95% Current Price: $0.6396

News

OM experienced a catastrophic crash of over 90%, plunging from above $6.30 to under $0.50 due to forced liquidations during low-liquidity hours. The sell-off was traced to legacy ERC-20 tokens, not team allocations, which remain locked on the MANTRA Chain mainnet. In response, the MANTRA team launched a multi-step recovery plan including token buybacks, burns (300M OM burned), and a transparency dashboard. While regulatory approval in Dubai and RWA partnerships remain bullish long-term indicators, investor sentiment is shaken.

Forecast

OM is in a fragile recovery zone, trading around $0.63 with RSI near 35, signaling oversold territory. If it holds above $0.60, a technical rebound toward $0.75 is possible, but broader structure remains bearish. A bear pennant pattern is forming, and failure to break above $0.70 with conviction could result in a drop to $0.55 or lower. Until confidence returns through execution of its roadmap, traders should expect continued volatility and sharp intraday moves.

Closing Thoughts

This week’s crypto market painted a stark contrast between meme-fueled hype and protocol-driven utility. Governance and infrastructure tokens like AERGO, SPA, and T saw renewed investor trust, largely due to active ecosystem upgrades, staking metrics, and structured reforms. These coins drew in more community and institutional participation, especially as traders moved away from volatile meme sectors after AIDOGE's selloff and OM’s crash exposed liquidity gaps.

While sectors tied to real-world assets and DeFi infrastructure (like Raydium and MANTRA) saw heavy activity, it was the hybrid blockchain and tokenomic reform stories that stole attention. Coins backed by strong narratives—be it decentralization, token burns, or ecosystem expansion—continued to outperform. As we move forward, market sentiment appears to be shifting toward sustainable growth plays over speculative pumps, setting the stage for a more utility-driven bull cycle.