PI Network's native cryptocurrency shows volatility as analysts project possible recovery despite looming token unlocks that could depress prices.

What to Know:

- PI token has seen extreme price swings since its February launch, falling from $3 to below $0.70

- Analysts predict potential short-term gains to $2-$5 despite recent downtrend

- Over 90% of PI's maximum supply remains undistributed, with 121 million tokens scheduled for unlock within 30 days

PI Network Token Faces Price Uncertainty Amid Bullish Predictions

The native token of Pi Network has experienced significant price volatility since its February launch, with analysts forecasting a potential short-term recovery despite concerns about upcoming token releases that could flood the market.

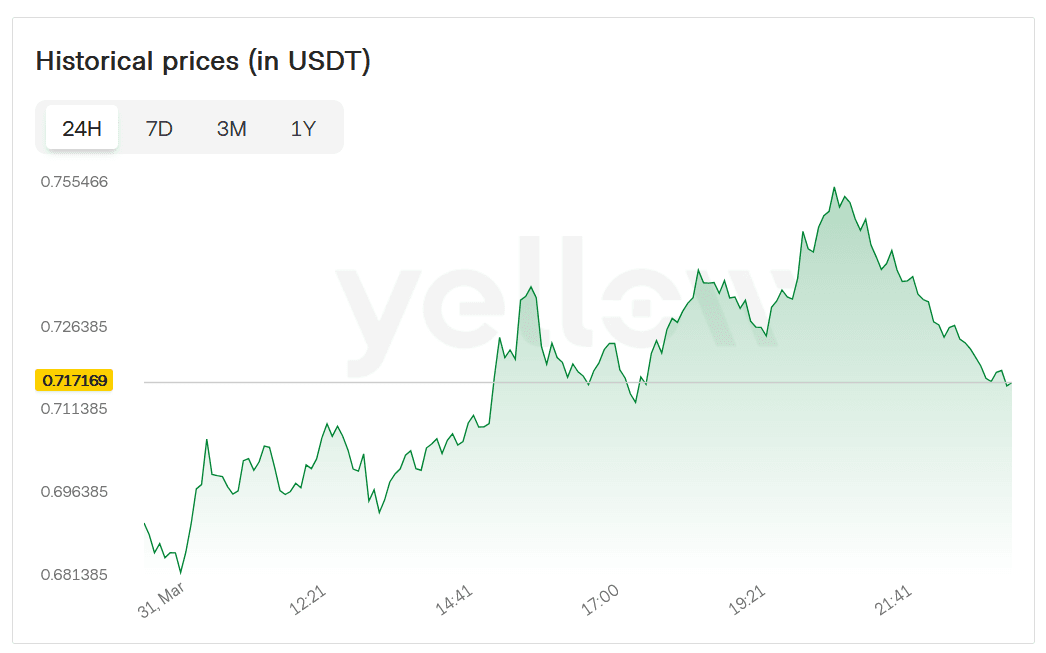

PI, which debuted on February 20 when the project launched its Open Network, has swung dramatically in price over its short trading history. The cryptocurrency hit an all-time high near $3 over a month ago before plunging to $0.68 on March 31, according to market data.

Several market observers remain optimistic despite this downward trend. Crypto analyst "Crypto King" suggested on social media platform X that PI could see a 2 to 2.5-fold increase, potentially reaching around $2 when "the market volume returns."

Another prominent Pi Network commentator who goes by "MOON JEFF" highlighted forecasts from crypto tracking platform Coincodex predicting PI could climb to $2.73 by month's end. The platform also set a long-term price target of $27 by 2050, though such distant predictions carry significant uncertainty.

"The only support left is at $0.60," MOON JEFF noted several days ago, suggesting PI might find its bottom at that level.

The analyst added that reaching this price floor could potentially trigger a major rebound, sending the token to a new all-time high of $5.

PI has shown signs of stabilization in recent trading. The token currently trades at approximately $0.72, according to data from cryptocurrency tracking site CoinGecko, representing a modest 1% increase over the past 24 hours. This marks a slight recovery from recent lows, though well below previous highs.

Token Supply Concerns Loom Over Market

The broader market outlook for PI remains complicated by tokenomics and distribution schedules that could significantly impact price action in coming weeks.

PI was designed with a maximum supply of 100 billion tokens, but its current circulating supply stands at less than 6.8 billion. This means more than 93% of the total supply has yet to enter circulation, a factor that has prompted some analysts to predict downward pressure on prices.

Crypto market observer "Whale.Guru" recently highlighted that over 121 million PI tokens are scheduled to be unlocked within the next 30 days. Such unlocks typically increase available supply and can depress prices if market demand doesn't keep pace.

Data from the Pi Network block explorer further illustrates this concern, showing that of the migrated mining rewards—which constitute the current available supply—approximately 5 billion tokens remain locked while only 1.7 billion have been unlocked.

This significant imbalance between locked and circulating tokens raises questions about price stability when additional tokens become tradable. Historical patterns in cryptocurrency markets suggest that large token unlocks often coincide with increased selling pressure.

The contrast between optimistic price predictions and supply-based concerns highlights the speculative nature of the relatively new PI token. While some analysts see potential for significant gains, the fundamental tokenomics suggest caution may be warranted.

Final Thoughts

PI Network's price trajectory remains uncertain as bullish technical predictions compete with bearish supply fundamentals. Whether increased trading volume can absorb upcoming token unlocks will likely determine if PI can recover its previous highs or face continued downward pressure.