Cryptocurrency markets remained largely unchanged during Asian trading hours Monday, with Bitcoin maintaining its position above $94,000 while the CoinDesk 20 index of major digital assets showed minimal movement. But Monero was the asset that surprised us the most.

What to Know:

- XRP gained 4% following ProShares ETF approval with three futures-tracked products launching April 30

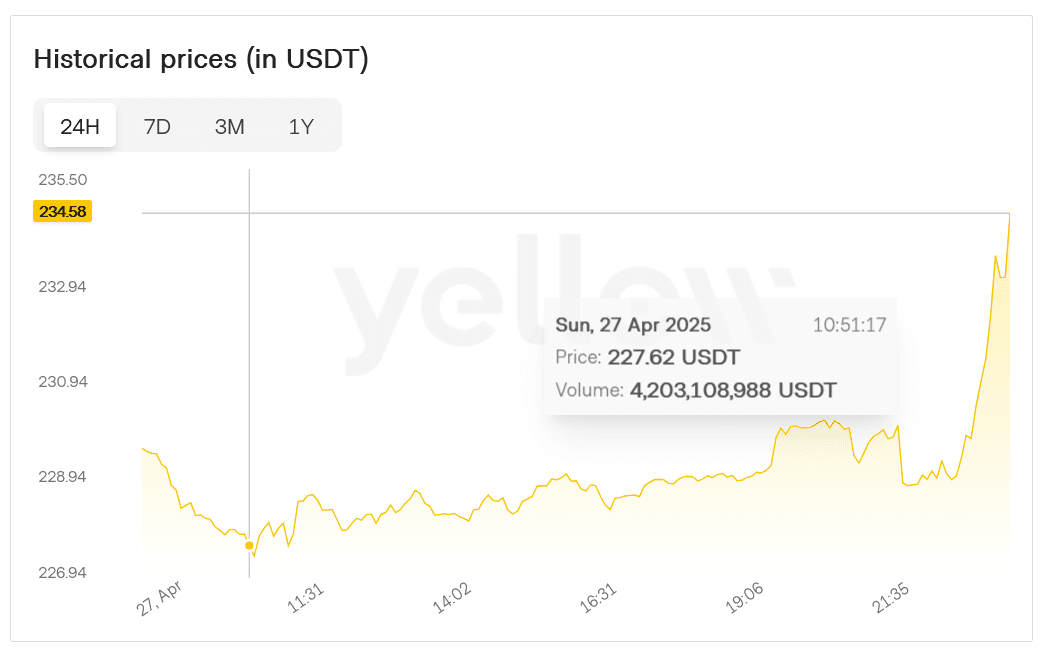

- Privacy coin Monero (XMR) surged over 40% in 24 hours, reaching $320, its highest level since May 2021

- Analysts note Trump administration's softened crypto policies may help digital assets develop independently from traditional equity markets

The stability comes amid mixed performance across global equity markets, with Asian indices showing little change while U.S. futures suggest a potential end to a four-day rally in American stocks.

Key Movers and Market Dynamics

XRP led gains among major cryptocurrencies with a 4% rise over the past day, buoyed by regulatory developments that will see three ProShares ETF futures-tracked products launch on April 30. Other significant digital currencies showed modest movement, with Cardano's ADA, BNB Chain's BNB, and Ether (ETH) posting gains between 1-3%.

Standing in stark contrast to the otherwise quiet market, privacy-focused cryptocurrency Monero (XMR) skyrocketed more than 40% in the past 24 hours. The token reached $320 during Monday's Asian trading session, a price level not witnessed since May 2021, representing a dramatic reversal in its recent price action.

Trading volumes for Monero exploded from an average of $50 million on a seven-day rolling basis to over $220 million in the previous 24 hours. The sudden surge has left analysts searching for explanations.

"There appears to be no clear catalyst behind $XMR's recent rally," Min Junng, a research analyst at Presto, told CoinDesk in a Telegram message. "Network activity remains consistent with typical levels, suggesting the move may be more speculative in nature."

Monero, which operates on the CryptoNote protocol, has long distinguished itself from other cryptocurrencies through its robust privacy features that ensure all transactions remain unlinkable and untraceable. This privacy-centric approach has historically appealed to users seeking confidential financial transactions.

Broader Market Context

Sentiment among cryptocurrency traders appears to be carrying over from the previous week, maintaining a cautiously optimistic outlook despite ongoing macroeconomic challenges. The relative stability comes as market participants process recent political developments.

Jupiter Zheng, Partner at Liquid Fund and Research, HashKey Capital, provided context for the market's performance. "Bitcoin has maintained a relatively stable range above $92k as Trump's administration soften tariff policies of the crypto industry," Zheng told CoinDesk via Telegram. "This crypto-friendly attitude can boost Bitcoin and other cryptocurrencies to develop their own market direction, less correlated with US equities, and enable more growth and innovation in the industry."

Meanwhile, traditional financial markets displayed mixed signals on Monday. A regional gauge advanced 0.6% while futures for the S&P 500 declined 0.6%, suggesting the four-day U.S. equities rally might be drawing to a close. Gold retreated from its recent record-breaking rally, giving back some of last week's gains.

Hong Kong's Hang Seng index remained flat, mirroring the lack of significant movement across other major Asian indices.

Final Thoughts

As cryptocurrency markets stabilize with Bitcoin above $94,000, attention turns to regulatory developments and potential decoupling from traditional markets. While most major digital assets trade within narrow ranges, Monero's unexpected 40% surge highlights the sector's continued volatility and speculative nature.