A fabricated report about a potential U.S. tariff pause triggered a massive market surge exceeding $2 trillion on Monday, revealing investors' eagerness for trade tension relief amid ongoing economic uncertainty.

What to Know:

- A false social media post claiming President Trump considered a 90-day tariff pause caused major indexes to spike 6-9%

- The White House quickly debunked the rumor, after which markets retreated from their sudden gains

- Analysts suggest the incident demonstrates significant sidelined capital ready to enter markets if tariff policies soften

Market Reacts Dramatically to False Tariff Pause Rumor

The erroneous claim originated from a verified "Walter Bloomberg" X account with over 852,000 followers, which falsely attributed statements to Trump economic adviser Kevin Hassett about a potential 90-day tariff pause for countries excluding China.

Despite having no affiliation with Bloomberg News, the account's post gained immediate traction when it appeared on CNBC and was subsequently amplified by Reuters.

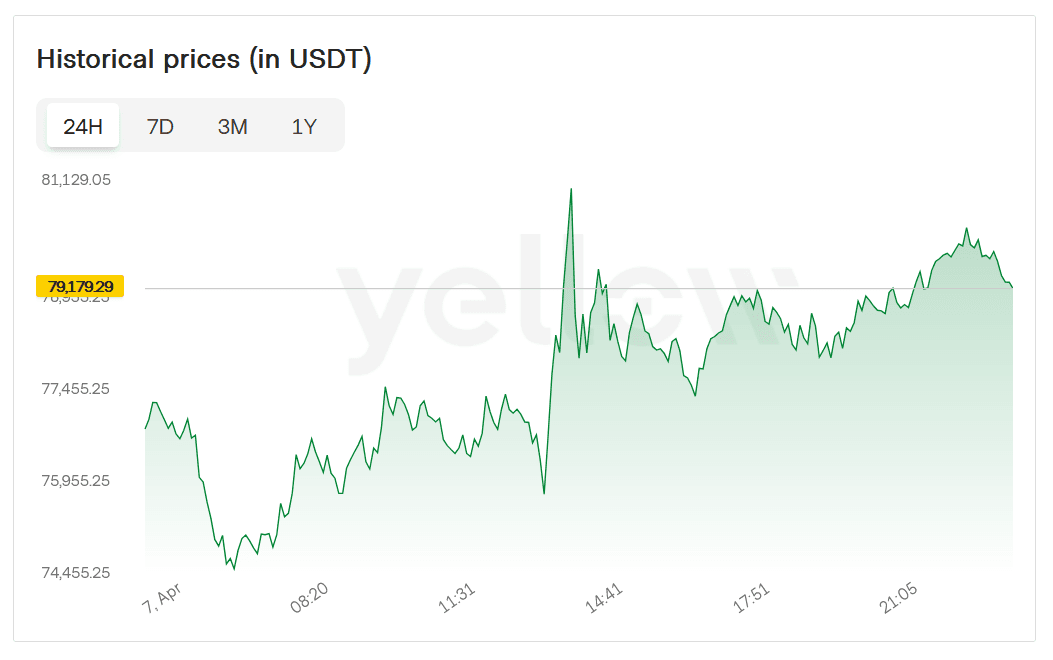

Market response was swift and dramatic. The S&P 500 surged more than 8% from its daily low while the Nasdaq composite shot up 9.5% in under an hour. The Dow Jones Industrial Average climbed 7%. Bitcoin similarly spiked 6.5%, briefly exceeding $80,000 before retreating as the White House "Rapid Response" account officially refuted the claims.

The scale and speed of the reaction have prompted significant commentary from market observers. Cryptocurrency commentator Lark Davis noted the episode revealed crucial market dynamics. "The market is ready to accept prolonged China negotiations as long as most deals can be resolved," Davis stated, adding that "the market is ready to ape, even a lame 90-day delay sent markets soaring."

Davis further emphasized the substantial capital poised to enter markets, saying: "Now imagine what happens when dozens of deals are made with top players ie, India, Canada, and the UK. Shit tons of money is on the sidelines, ready to ape in at a moment's notice."

Social media user Geiger Capital suggested the market response might actually embolden the administration's tariff strategy. "That fake headline might actually give Trump, Navarro, and Lutnick more confidence to keep pushing this further," they commented. "They now know that at any point they can announce a pause and the market will rally ~10% in a single day."

What Hassett Actually Said

The misinformation stemmed from a mischaracterization of Hassett's Fox News interview. When asked directly about the possibility of a 90-day tariff pause, Hassett provided a non-committal response that was far from the definitive statement later fabricated in social media posts.

"I think the president is gonna decide what the president is gonna decide," Hassett told Fox News. He contextualized potential trade impacts by adding, "Even if you think there will be some negative effect from the trade side, that's still a small share of GDP."

Hassett dismissed extreme market concerns in his actual statements. "The idea that it's going to be a nuclear winter or something like that is completely irresponsible rhetoric," he said during the interview.

The confusion occurred during a particularly sensitive period in U.S.-China trade relations.

Shortly after the false 90-day tariff pause post was removed, President Trump took to Truth Social with decidedly different messaging, threatening China with increased tariffs rather than suggesting any pause.

"If China does not withdraw its 34% increase above their already long-term trading abuses by tomorrow, April 8th, the United States will impose additional tariffs on China of 50%, effective April 9th," the president wrote.

The stark contrast between the fabricated pause and Trump's actual escalation threat highlights the challenges facing investors navigating a complex geopolitical landscape. Markets have remained particularly sensitive to trade policy announcements as tensions between the world's two largest economies continue to impact global economic forecasts.

Final Thoughts

The market's dramatic response to even false news of trade tension relief demonstrates the significant anxiety surrounding current tariff policies. As U.S.-China trade conflicts continue intensifying, investors appear poised to rapidly redeploy capital at any sign of resolution, suggesting substantial untapped bullish sentiment despite ongoing economic uncertainties.

Alt Text: