XRP cryptocurrency is currently trading at $2.11 after declining more than 40% from recent highs, while a critical on-chain metric suggests a possible macro trend change may be underway. Despite the significant drop, XRP has demonstrated relative strength compared to other alternative cryptocurrencies, many of which have lost over 60% of their value during the same period.

What to Know:

- XRP has fallen more than 40% from its recent high but outperformed many alternative cryptocurrencies

- The cryptocurrency's MVRV Ratio has dropped below its 200-day moving average, historically signaling potential trend shifts

- Bulls must defend the critical $2 support level and reclaim $2.40 resistance to maintain positive momentum

Market Conditions and Technical Indicators Point to Crucial Juncture

Global financial markets continue to struggle under the weight of inflation concerns, geopolitical tensions, and interest rate uncertainty, creating a risk-averse environment that has impacted the cryptocurrency sector.

These macroeconomic factors have dampened sentiment and slowed momentum across most digital assets in recent months.

On-chain data from analytics firm Santiment has revealed a potentially significant development for XRP. The Market Value to Realized Value (MVRV) Ratio has dipped below its 200-day moving average—a crossover that has historically preceded major directional moves in XRP's price action. This technical signal could indicate either the beginning of an accumulation phase or a deeper correction, depending on how prices respond in the coming weeks.

"The XRP MVRV Ratio has dipped below its 200-day moving average," noted analyst Ali Martinez on X. While not inherently bearish, this crossover has often signaled substantial price movements in either direction.

The $2 mark represents both a psychological and structural support level for XRP. Market analysts warn that failure to maintain this threshold could trigger accelerated selling and push XRP into a more pronounced downtrend. The cryptocurrency community remains divided on the outlook, with sentiment growing increasingly volatile as price action develops.

Some investors maintain optimism, suggesting XRP could reclaim previous range highs once broader market conditions stabilize. They cite XRP's comparative resilience against other alternative cryptocurrencies as evidence of underlying strength that could fuel a rapid recovery when market confidence returns.

More cautious observers point to weakening momentum and deteriorating price structure as reasons for concern. A growing contingent of analysts believes XRP may be entering a new bearish phase, particularly if support at $2 fails to hold under continued selling pressure.

Bulls Face Critical Test as Selling Pressure Mounts

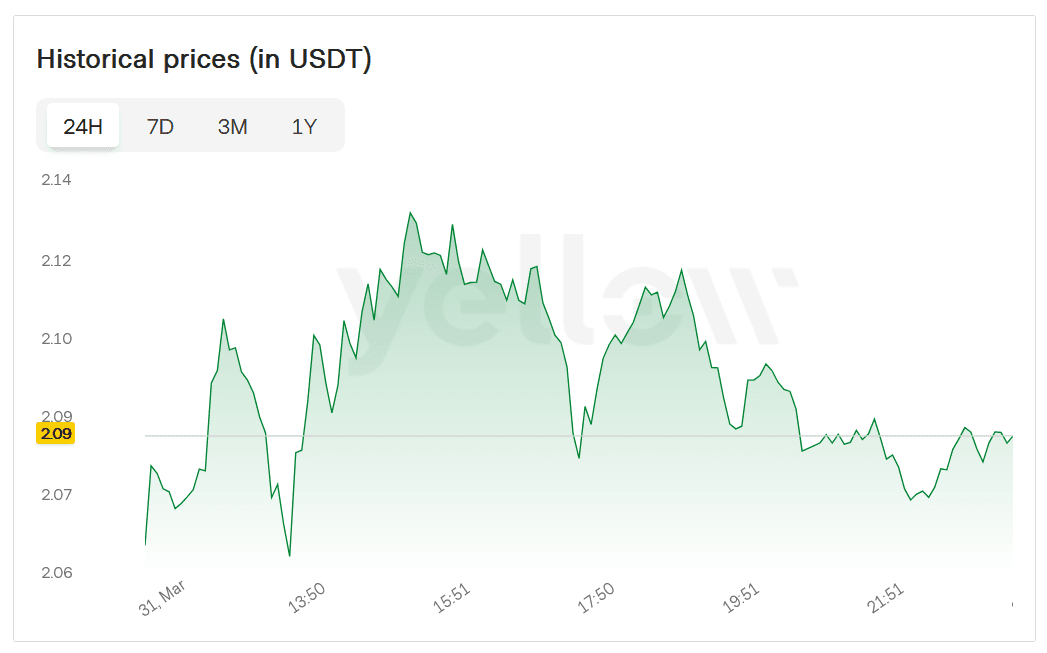

XRP has experienced sustained selling pressure over the past two weeks, declining more than 21% since March 19. This downward movement has placed bulls in a defensive position, with the $2 level now functioning as a critical support zone that must be defended to prevent further deterioration in market structure.

For bullish momentum to resume, holding the $2 support level is necessary but insufficient on its own. XRP must also overcome the $2.40 resistance level, which has repeatedly capped upward price movement during recent recovery attempts. Successfully breaking above this resistance could reinvigorate buying interest and potentially position XRP for a move toward new highs.

The cryptocurrency's recent price action has unfolded against a backdrop of fragile market conditions and shaky investor confidence.

A definitive break below $2 would likely accelerate selling and confirm that recent upward movements represented only temporary bounces within a larger corrective pattern rather than the beginning of a sustainable recovery.

Technical analysts emphasize that the coming days will be decisive for XRP's short-term trajectory. The ability of bulls to defend the $2 support level while reclaiming lost technical ground will determine whether the cryptocurrency can maintain its relative strength or succumb to broader market pressures.

Outlook Hinges on Key Support and Technical Signals

The combination of XRP's price hovering near critical support and the MVRV Ratio crossing below its 200-day moving average creates a particularly significant juncture for the cryptocurrency. Historical precedent suggests major price movements often follow such technical developments, though the direction remains uncertain.

What happens in the coming days may define XRP's price trajectory for the remainder of the quarter. If support holds and momentum rebuilds, XRP could recover relatively quickly compared to its peers. However, if current support levels fail, a more prolonged bearish phase may unfold, potentially testing lower support zones.