This week’s crypto market soared to a $3.66 trillion capitalization, with daily volumes surpassing $240 billion. The Fear & Greed Index hit 82, reflecting heightened investor excitement, while an Altcoin Season reading of 85 underscored growing interest beyond Bitcoin. ETF inflows reached $422 million, spotlighting institutional demand. Bitcoin’s dominance remained near 54%, even as Ethereum’s network strength and stable gas fees supported steady growth. Implied volatility levels indicated cautious optimism amid overall market exuberance.

Bitcoin (BTC)

Price Change (7D): +3.29% Current Price: $99,800.63

News: Bitcoin surged past $100,000 this week, a historic moment that solidifies its position as the leading cryptocurrency. However, the rally wasn’t without turbulence. The U.S. government transferred 19,800 BTC ($1.9 billion) to Coinbase, sparking backlash from industry experts. Critics, including U.S. Space Force Major Jason Lowery, called the sale a “strategic mistake,” comparing it to the 1933 gold confiscation under Executive Order 6102. Coinbase CEO Brian Armstrong also opposed the decision, emphasizing Bitcoin’s strategic importance.

Meanwhile, South Korea’s declaration of martial law briefly caused panic in the markets, leading to a sharp 28% drop in BTC/KRW trading on local exchanges. Quick intervention by the National Assembly to invalidate the decree helped Bitcoin recover, stabilizing its price near the $100,000 mark. Additionally, Federal Reserve Chair Jerome Powell’s comments likening Bitcoin to “digital gold” further validated its role as a speculative asset, drawing attention from institutional investors.

Forecast: Bitcoin’s price is testing the critical $100,000 level. A breakout could push it toward $105,000, with $97,000 serving as strong support if momentum falters. On-chain data shows whale accumulation, signaling confidence in further gains. RSI indicates slight overbought conditions, suggesting a short-term pullback is possible before another upward push. A sustained rally may target $110,000 in the coming weeks.

Nano (XNO)

Price Change (7D): +44.23% Current Price: $2.00

News: Nano (XNO) saw an impressive 44% price surge this week, fueled by growing adoption and renewed interest in its fee-less, eco-friendly transaction model. The Nano Foundation’s recent partnership campaign gained traction showcasing how Nano eliminates credit card processing fees, which can range from 1.1% to 3.15% per transaction. This promotional effort has reinforced Nano's appeal as a cost-effective, instant payment solution for both businesses and consumers.

Nano also benefited from its positioning as an environmentally sustainable cryptocurrency, leveraging its Open Representative Voting (ORV) consensus model to offer energy-efficient transactions. This distinction is particularly relevant as mainstream cryptocurrencies like Bitcoin face increasing scrutiny over their environmental impact. With its legacy dating back to its origins as RaiBlocks, Nano's emphasis on simplicity, security, and scalability continues to resonate with its community.

Forecast: Nano's sharp rally has positioned it near key resistance at $2.20. If it breaks above this level with sufficient trading volume, it could target $2.50 in the short term. However, RSI readings indicate overbought conditions, suggesting a potential pullback toward $1.80 before resuming its upward trend. The coin's strong fundamentals and renewed attention could fuel long-term momentum, especially if adoption by payment platforms increases.

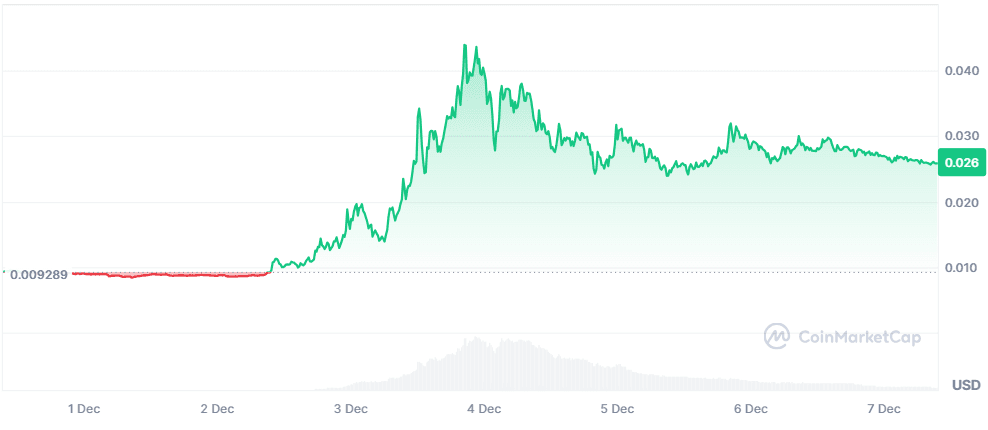

XYO (XYO)

Price Change (7D): +9.49% Current Price: $0.02586

News: XYO has experienced a significant surge of 177% over the past week, driven by strategic initiatives and partnerships reinforcing its position in the Web3 ecosystem. The recent collaboration with Upland, a Web3 gaming platform, enables innovative gamified use cases that merge virtual and real-world locations, demonstrating XYO's ability to leverage geospatial technology in the metaverse. Additionally, XYO’s "Learn & Earn" initiative through the COIN App, boasting over 8 million installs and 5 billion tokens earned, has significantly increased user engagement. This program incentivizes real-world data collection, aligning with XYO's mission of building a decentralized data network.

The listing of XYO on Tapbit further fueled its momentum, coupled with a promotional airdrop campaign offering $2,500 worth of XYO. Such initiatives have driven both trading volume and user interest, with 24-hour trading volumes exceeding $22M. Partnerships like Hivello, targeting emerging markets, underscore XYO's commitment to expanding its decentralized infrastructure globally.

Forecast: XYO is currently trading near resistance at $0.026. A break above this level could set the next target at $0.030, aligning with psychological resistance and Fibonacci retracement levels. Trading volumes remain strong, but RSI indicates overbought conditions, suggesting the possibility of consolidation around $0.022 before another leg up. Long-term growth remains promising, backed by strategic integrations and increasing adoption of the COIN App.

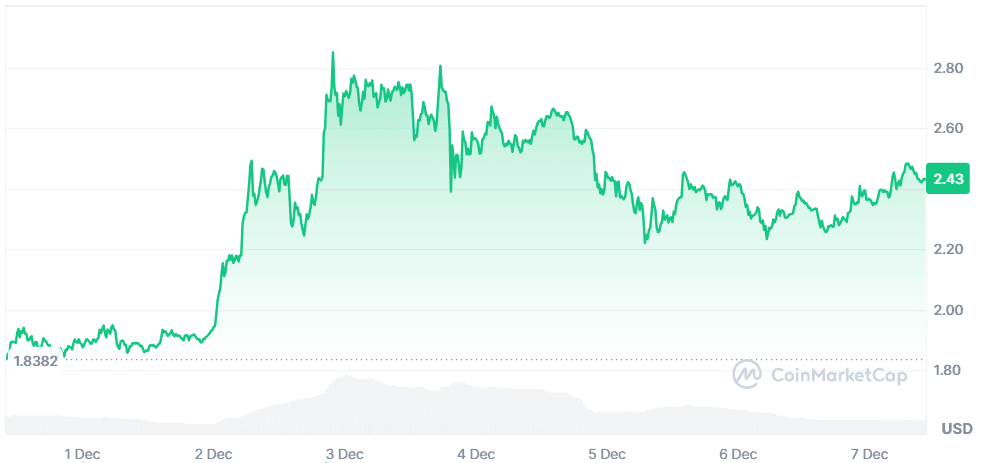

Ripple (XRP)

Price Change (7D): -6.28% Current Price: $2.43

News: XRP recently hit a peak of $2.82, its highest since January 2018, following a six-week rally but has since corrected to $2.43, reflecting a 6.28% drop in the last 24 hours. Analysts remain optimistic about its potential, with Fibonacci analysis suggesting an 80% breakout from current levels. Crypto analyst Dark Defender has highlighted critical price targets at $2.92 and $3.99, indicating XRP could surpass its all-time high of $3.40 by year-end. Meanwhile, Ripple’s RLUSD stablecoin launch and Automated Market Maker (AMM) functionalities on the XRP Ledger continue to attract institutional interest, reinforcing the platform’s reputation for reliability, efficiency, and sustainability.

Adding to its momentum, Worksport Inc. announced XRP’s inclusion in its corporate treasury, alongside Bitcoin, marking a strategic shift toward integrating crypto payments and inflation-resistant assets. XRP's role in decentralized finance was further underscored by the adoption of AMMs, which enhance liquidity and efficiency. The RLUSD stablecoin serves as a bridge between traditional finance and blockchain, increasing utility and adoption of the XRP ecosystem.

Forecast: XRP’s technical outlook suggests a potential rebound toward $2.92 in the short term, driven by strong institutional adoption and bullish sentiment. Fibonacci retracement indicates critical support levels at $2.27 and $2.13, with the latter aligning with the 161.8% extension level. If these supports hold, XRP could resume its upward trend, potentially testing the $3.00 psychological resistance. RSI indicates a cooling-off period is likely, providing consolidation before another rally. The growing adoption of RLUSD and AMMs strengthens the long-term bullish case for XRP, making it a strong contender for institutional and retail portfolios alike.

TRON (TRX)

Price Change (7D):+59.78% Current Price: $0.3261

News: TRON (TRX) has seen an explosive 90% rally this week, reaching a new all-time high of $0.4313 before retreating to $0.3261. Whale activity has been a major driver, with 4.85 million TRX ($1.85 million) withdrawn from Binance into private wallets, signaling strong accumulation and reduced selling pressure. Between Nov 30 and Dec 2, TRON witnessed net outflows of 104 million TRX from exchanges, further reducing circulating supply and fueling upward price momentum.

TRX’s growth is attributed to its expanding use cases in digital content creation, allowing creators to monetize their work directly via blockchain. Additionally, Justin Sun’s involvement as an advisor to World Liberty Financial (WLFI) has bolstered investor confidence. Speculation around regulatory clarity and TRX’s potential inclusion in Grayscale’s portfolio has also drawn institutional attention. Moreover, meme coins on the TRON blockchain, like FoFar, saw massive gains, reflecting growing demand for TRON-based assets.

Forecast: TRX is trading just below key resistance at $0.43, with indicators like the Money Flow Index (MFI) suggesting strong capital inflow. If buying momentum persists, TRX could rebound above $0.45, targeting $0.50 in the near term. In an extended rally, $1 is a potential target, contingent on sustained liquidity and whale activity. However, a profit-taking dip to $0.33 remains possible. Long-term growth is supported by TRON’s increasing adoption and expanding ecosystem.

Ethereum (ETH)

Price Change (7D): +2.74% Current Price: $4,001.56

News: Ethereum has surged past the $4,000 mark for the first time since March 2024, gaining 61% since early November. The rally is fueled by record-breaking inflows into U.S.-listed Ethereum spot ETFs, which saw $428 million in a single day on Dec. 5, the highest ever recorded. Institutional interest in Ethereum has grown significantly, with open interest in Ethereum futures on the CME hitting all-time highs. Alongside ETF activity, the network's Realized Cap reached a record $243.45 billion, signaling confidence among long-term holders.

This momentum comes as Ethereum benefits from a broader resurgence in the digital asset market following Donald Trump’s presidential win and the appointment of pro-crypto regulators like Paul Atkins. Additionally, Ethereum's recent fee recovery on its layer-1 network and developer focus on scaling solutions, such as the proposed native sequencer, strengthen its position as the leader in blockchain innovation. Despite competition from layer-2 networks, Ethereum’s adaptability and ecosystem growth keep it at the forefront of the crypto space.

Forecast: Ethereum is now testing resistance at $4,100, with technical indicators suggesting the rally has room to grow. The Relative Strength Index (RSI) at 71 indicates slightly overbought conditions, but continued ETF inflows and network activity could push ETH toward $4,500. A break above this level may set the stage for a mid-term target of $5,000–$7,000, contingent on sustained investor interest and market momentum. However, if profit-taking occurs, ETH could retest support at $3,700. Long-term trends remain bullish as institutional adoption and ecosystem innovation continue to drive demand.

Cardano (ADA)

Price Change (24H): -4.2% Current Price: $1.22

News: Cardano (ADA) has entered a consolidation phase after a remarkable 264% rally over the past month. Whales recently purchased 100 million ADA in a single day, showcasing strong accumulation despite short-term price volatility. The token’s price touched a weekly high of $1.24 before retreating slightly to $1.22. Meanwhile, Cardano's Hydra scalability solution achieved a milestone by processing over 2 billion transactions in under 4 hours, surpassing Visa’s daily transaction volume and reaching over 1 million transactions per second (TPS).

On-chain metrics, however, signal caution. The Market Value to Realized Value (MVRV) ratio has entered a danger zone at 37%, often a precursor to profit-taking. Trading volume and velocity have also declined, reflecting reduced investor participation. Adding to these concerns, the MACD indicator suggests a bearish crossover, potentially leading ADA to test support at $1. Despite these headwinds, analysts remain optimistic about the token’s long-term prospects, with some projecting a near-term target of $2.45.

Forecast: ADA faces critical resistance at $1.20–$1.24. A successful breakout could push prices toward $1.50, with $2.45 as the next major target in a bullish scenario. However, a failure to sustain momentum may result in a pullback to $1.01, a key support level. The MVRV ratio and declining volume suggest a period of consolidation or a minor correction before the next rally. Cardano’s ability to sustain interest from whales and execute on its ambitious roadmap will be crucial for future price action.

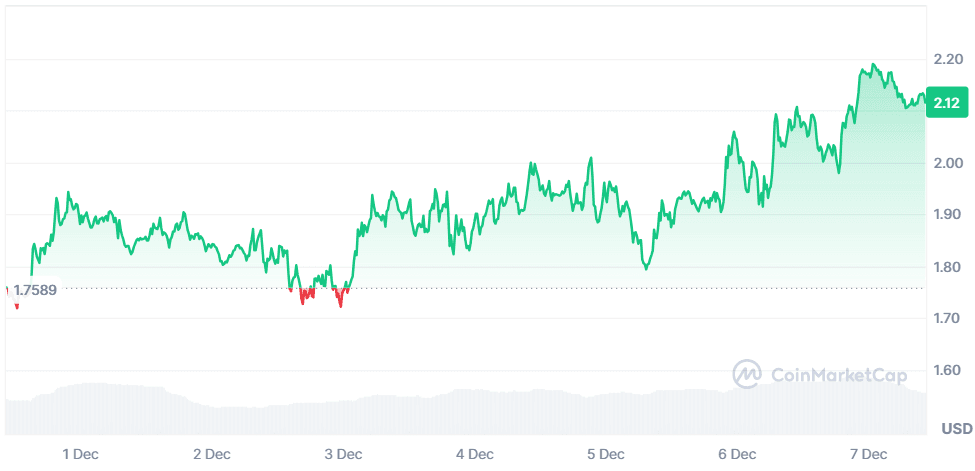

Artificial Superintelligence Alliance (FET)

Price Change (7D): +20.39% Current Price: $2.12

News: FET has experienced a robust rally this week, climbing to $2.12 after breaking out of a descending channel—a technical move that often signals the start of a sustained bullish trend. This breakout was accompanied by the announcement of the highly anticipated Earn-and-Burn mechanism, which aims to remove up to 100 million tokens from circulation in December. The deflationary pressure introduced by this mechanism is expected to drive further price gains as supply tightens.

On-chain data adds to the bullish narrative, with large transactions rising 7.44% and open interest surging 10.38% to $156.26 million, indicating growing institutional interest. Additionally, the Relative Strength Index (RSI) remains at a healthy 65, suggesting bullish momentum without signaling overbought conditions. FET’s breakout above $1.67 resistance has positioned it to test higher targets, with $2.56 as the next major milestone. Historical patterns also reinforce optimism, as a similar breakout in March 2024 preceded an all-time high of $3.10.

Forecast: FET is poised for further gains as long as it holds above $2.00. The next resistance at $2.56 could be tested in the short term, offering a potential 21% upside. If bullish momentum continues, a retest of the all-time high at $3.10 is possible in this cycle. On the downside, strong support exists at $1.85, which could act as a base for consolidation before another rally. The upcoming token burn, coupled with positive technical and on-chain indicators, suggests Fetch.ai could remain a top-performing asset in the near term.

NEAR PROTOCOL (NEAR)

Price Change (7D): +13.76% Current Price: $7.84

News: NEAR Protocol has continued its upward momentum, gaining 13.76% over the past week and consolidating near $7.84. This comes after successfully flipping the critical $6.20 resistance level into a support zone, fueled by strong fundamentals and market confidence bolstered by its Deutsche Telekom validator partnership. The collaboration has further solidified NEAR’s credibility in the blockchain ecosystem, attracting institutional interest.

Technically, NEAR is positioned for an upward breakout, with Bollinger Bands on the daily chart signaling increasing volatility. The price hovers near the middle band, suggesting potential for further gains. On-chain metrics are equally robust, with the Total Value Locked (TVL) holding at $243.36 million, reflecting sustained network activity and developer confidence. NEAR Protocol’s integration with DOGEFi also highlights its versatility, enabling swaps of native DOGE for assets like BTC, ETH, and NEAR, which enhances its ecosystem’s appeal.

Forecast: NEAR faces immediate resistance at $8.50, with $10 as the next significant target if bullish momentum continues. A break above $10 could pave the way for medium-term targets of $15-$20, contingent on market conditions and broader sentiment. The Relative Strength Index (RSI) at 62.76 indicates further upside potential before entering the overbought zone. On the downside, $6.20 serves as a strong support level. NEAR’s bullish trend remains intact, backed by solid technical indicators and strong on-chain fundamentals.

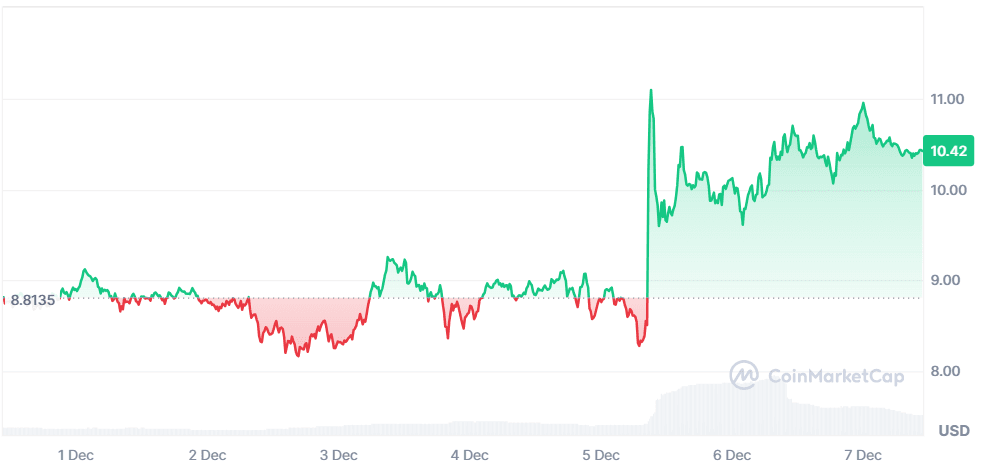

Render (RENDER)

Price Change (7D): +18.13% Current Price: $10.43

News: Render (RENDER) has continued its bullish momentum, gaining 18.13% this week and hitting a new key support level of $7.95. After a successful retest of the $7.31 level, the price surged past $10, forming higher lows and maintaining its upward trajectory. The listing of RENDER on Upbit (KRW pair) has further fueled demand, increasing trading volume significantly.

The coin’s bullish outlook is supported by strong market sentiment and rising interest from institutional and retail investors. RENDER's consistent ability to retest and hold higher support levels demonstrates a robust technical structure. This stability has attracted attention as RENDER aims to secure its position as a leading token in the 3D rendering and decentralized computing sector.

Forecast: RENDER faces its next major resistance at $11.50. If momentum persists, the price could rally to $13–$15, especially with continued buying pressure and positive sentiment from the recent Upbit listing. However, a failure to hold $10 as support may lead to a retest of $7.95, which has previously acted as a strong base for recovery. With bullish technical indicators and rising trading volume, RENDER is well-positioned for further growth, but traders should watch key levels closely for signs of consolidation or pullbacks.

Closing Thoughts

The past week’s substantial rallies paint a picture of intensifying market confidence and evolving investment theses. Bitcoin’s firm hold above $100K sets a powerful precedent, while the thriving altcoin landscape and surging DeFi and Web3 projects suggest that capital is flowing into areas promising long-term utility and innovation. This newfound equilibrium - where established blue chips coexist with rising, utility-driven tokens - indicates a market less prone to knee-jerk reactions and more anchored by institutional guidance and liquidity depth.

Even amid persistent volatility, the steady climb in values and investor conviction hints at a more structurally sound market trajectory. As regulatory clarity improves and technological milestones are met, the crypto sector appears poised to navigate its next growth phase with increased resilience, sophistication, and global relevance.