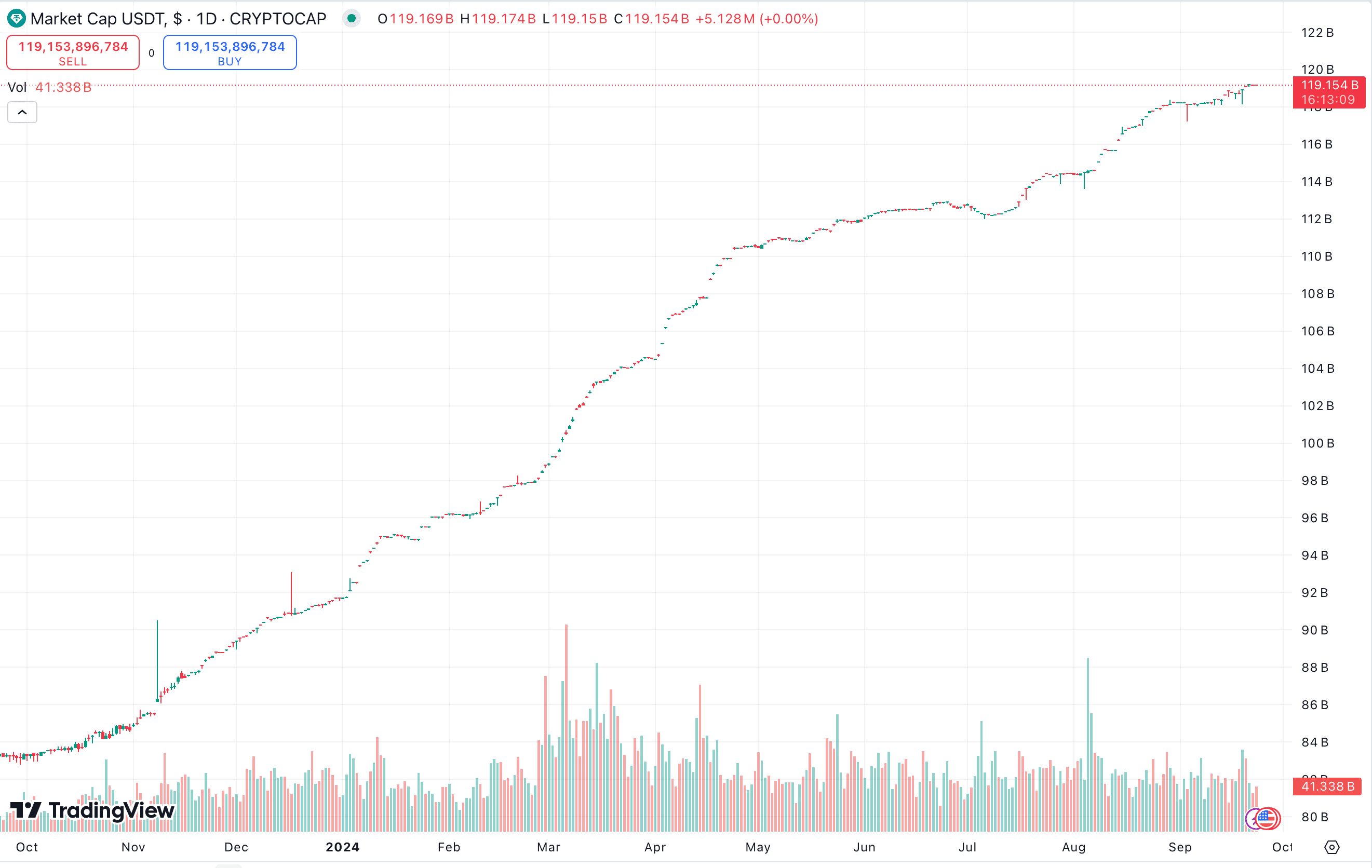

Tether's USDT, the world's largest stablecoin, is approaching a significant milestone: its market capitalization is nearing $120 billion. This comes amid a surge in demand for stablecoins, which are rapidly becoming the driving force of the crypto market.

The recent data speaks for itself. Users have invested more than $1 billion in stablecoins just over the last seven days. No surprise, but the vast majority of these funds have gone into Tether (USDT), the stablecoin that now dominates 70.4% of the market.

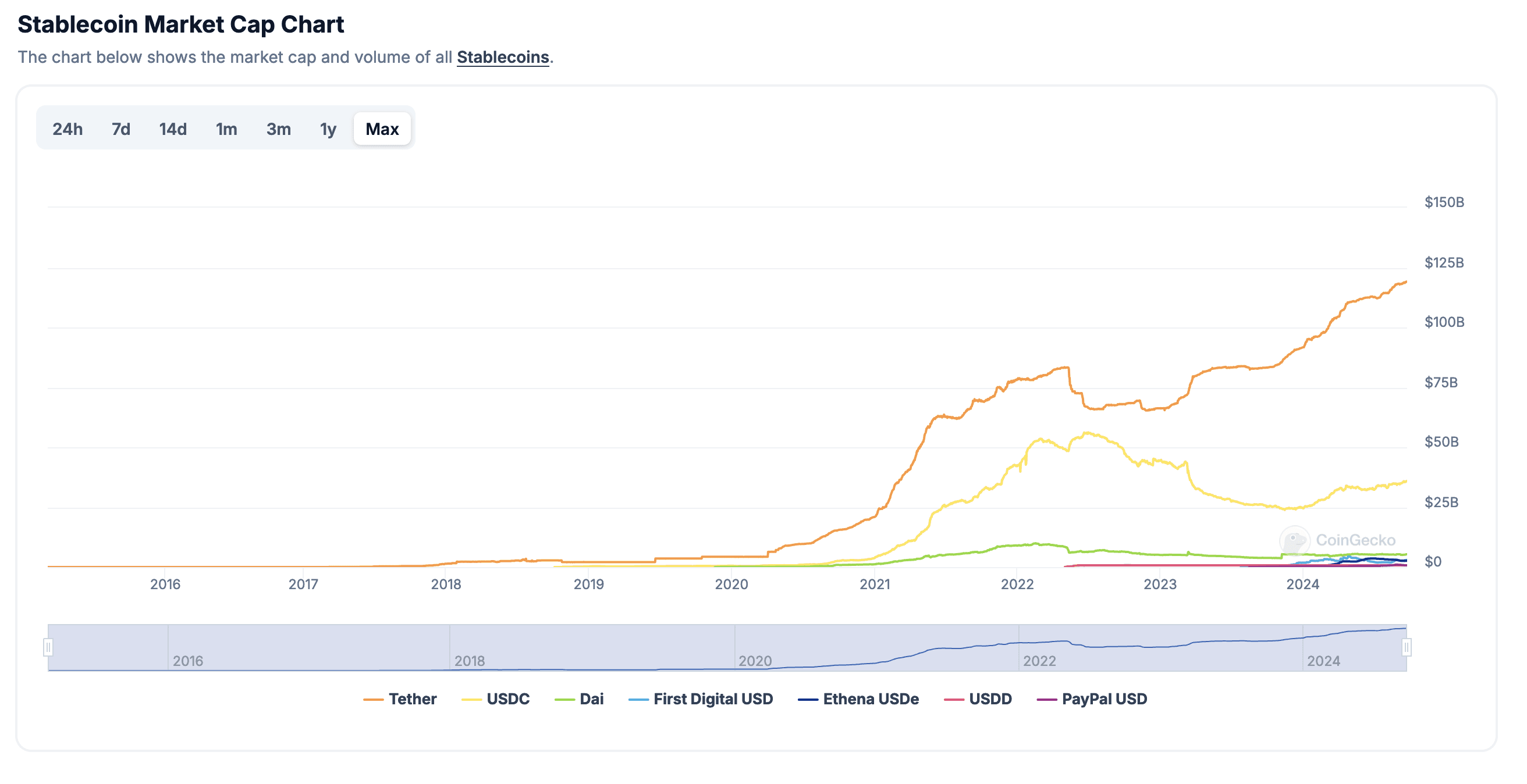

Stablecoins have seen rapid growth since the start of the year. Their market cap has risen from $122 billion in October 2023 to over $169 billion in September 2024, and this represents a whopping 38.5% increase.

"The influx of capital into stablecoins highlights growing interest in stable digital assets," said a market report from IntoTheBlock.

This trend is partly driven by inflation concerns and weakening fiat currencies in developing countries, as people tend to hedge the risks with stablecoins. Digital money are becoming the only viable alternative to the fiat money, issued and controlled by the governments.

Tether's growth has outpaced its competitors.

USDC, the second-largest stablecoin, has a market cap of $35.88 billion. And Tether's dominance is expected to continue growing, most analysts predict.

The Tether Treasury recently minted $1 billion USDT on Ethereum, it also added $100 million USDT on the Tron blockchain. These moves reflect the increasing demand for the stablecoin.

But smaller stablecoins are also benefiting from this trend. For instance, first Digital USD (FDUSD) has seen its market cap increase by 47% in the past month, and now stands at $2.94 billion.

Ripple, the company behind XRP, has announced plans to enter the stablecoin market. Its Ripple USD (RUSD) aims to connect global financial firms and institutions. Industry experts anticipate significant growth for RUSD post-launch. This follows other recent prominent stablecoins announcements, like PayPal’s.

Stablecoins have evolved beyond their initial use case of cryptocurrency trading. They are now increasingly used in lending platforms and for payments, and this expansion has contributed to their rapid adoption.

Tether's ability to maintain its dollar peg has been crucial to its success. This stability has made it attractive to traders seeking refuge from market volatility. It has also positioned Tether as a reliable digital alternative to traditional currencies.

As Tether approaches the $120 billion milestone, it cements its position as a major player in the global financial landscape. Its growth reflects the increasing integration of digital assets into mainstream finance.