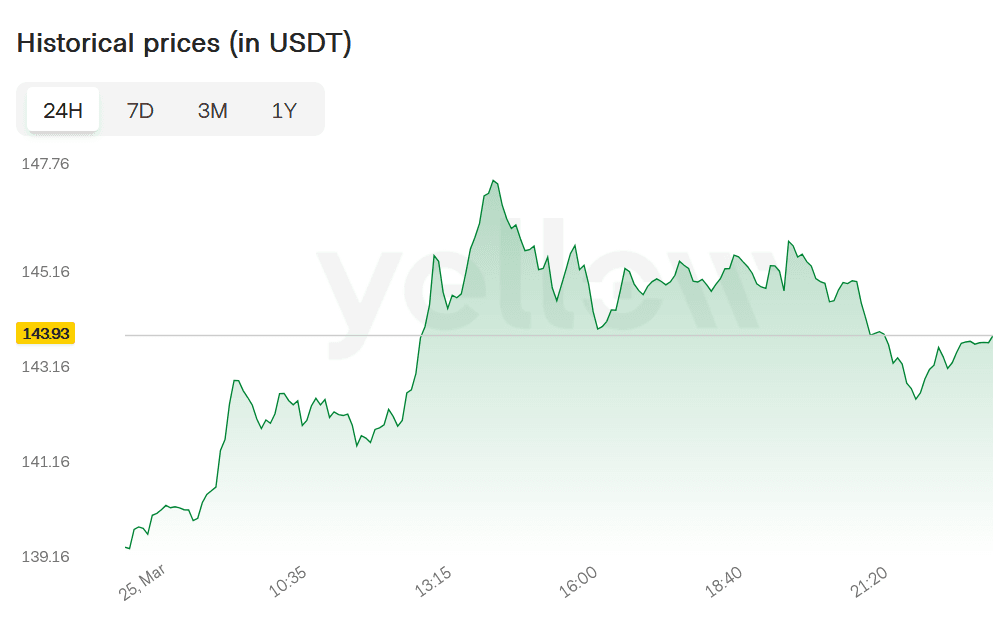

Solana (SOL) continues to struggle at the critical $148 support level, failing to maintain momentum despite an 11% price increase over the past four days.

What to Know:

- Solana's NVT ratio has reached a 5-month high, indicating network speculation outpacing actual transaction activity

- A potential "Death Cross" between 50-day and 200-day EMAs threatens to end Solana's 16-month Golden Cross period

- Price needs to breach $148 resistance to reach $161, but failure could push SOL down to $135 or even $125

Solana Faces Bearish Signals As Price Struggles Below $148

The cryptocurrency currently trades at $142, showing significant weakness in its attempt to break through the $150 psychological barrier. Technical indicators suggest an imminent reversal that could threaten recent gains and potentially push prices significantly lower.

Market sentiment surrounding Solana shows concerning divergence between network hype and actual usage. The Network Value to Transactions (NVT) Ratio for SOL recently hit a 5-month high, revealing that network valuation is outpacing genuine transaction activity. This disparity indicates surface-level optimism may not be translating into meaningful adoption or engagement on the Solana blockchain.

Fidelity's recent filing for a spot SOL ETF with CBOE has generated some positive sentiment among investors. However, this development has not catalyzed substantial growth for the network itself, raising questions about the sustainability of any price appreciation based primarily on speculation rather than fundamental usage.

Potential Reversal

Solana's macro momentum faces a significant challenge as key technical indicators approach a critical inflection point. The 50-day and 200-day Exponential Moving Averages (EMAs) are converging toward a "Death Cross" formation, where the 200-day EMA crosses below the 50-day EMA. This technical pattern typically signals a bearish reversal and could mark the end of Solana's 16-month-long "Golden Cross" period.

If confirmed in the coming days, this Death Cross could significantly impact Solana's price trajectory. The bearish technical signal, combined with current market sentiment weakness, could accelerate downward pressure on SOL prices.

The cryptocurrency's inability to breach the $148 resistance level remains a primary concern for bulls. As long as this resistance holds, Solana will likely continue struggling to reach the $150 mark, limiting its potential for short-term appreciation.

Analysts predict a potential pullback to the $135 support level in the coming days. From there, SOL may either consolidate or experience further declines toward $125, which would erase most of its recent gains and reinforce bearish sentiment.

Alternative scenarios depend heavily on broader market conditions. If investor sentiment strengthens across the cryptocurrency market, Solana could potentially breach the $148 resistance. Such a move would open the path to $161, potentially invalidating the bearish thesis and offering the altcoin a chance at sustained recovery.

The current price action remains trapped between these competing scenarios, with technical indicators suggesting the bearish case may have stronger momentum in the immediate term.

Network fundamentals will play a crucial role in determining which direction Solana ultimately takes. The divergence between network valuation and actual usage suggests that without increased adoption and transaction activity, sustainable price appreciation may remain elusive regardless of short-term technical movements.

Market participants are closely monitoring both the potential Death Cross formation and whether SOL can maintain support above $135 in the coming trading sessions. These factors will likely determine whether Solana can avoid the predicted reversal and maintain its position as one of the leading alternative cryptocurrencies.

Final Thoughts

Solana's price action remains precarious as it struggles below $148 while facing an imminent Death Cross. Despite positive developments like Fidelity's ETF filing, the divergence between network valuation and actual usage suggests caution is warranted for investors considering positions in SOL.