In a day when Wall Street is reeling from Trump’s fresh attacks on the Fed and the Dow tumbles over 1,000 points, crypto markets are holding their own, and in some cases, roaring back to life.

Bitcoin (BTC) stayed resilient above $88K as institutional buyers circled, while Boba Network (BOBA) rocketed over 50% amid renewed interest in Layer 2 and RWA narratives. ENJ and CVX followed with solid double-digit gains on the back of adoption news and DeFi TVL strength. Meanwhile, XRP climbed steadily as Ripple’s $1.25B acquisition and SEC pause shaped a cautiously bullish outlook. With the stock market bleeding and gold hitting record highs, investors seem to be hedging into digital assets with renewed confidence.

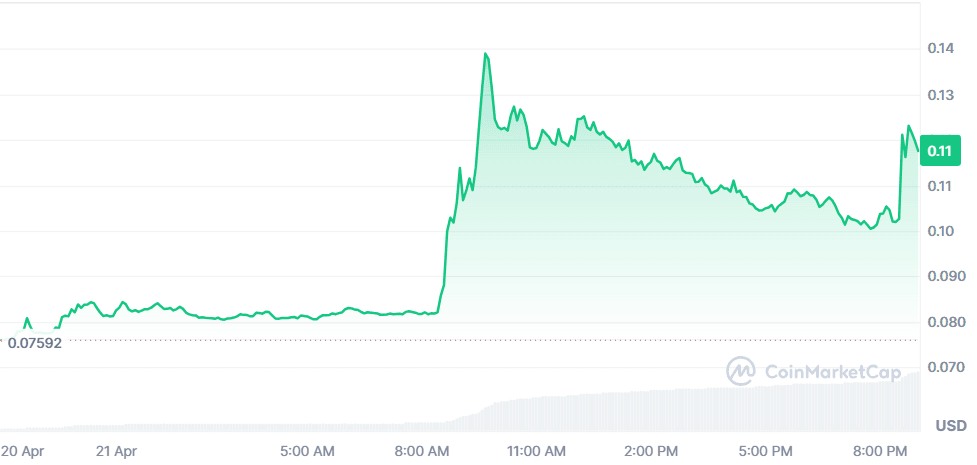

Boba Network (BOBA)

Price Change (24H): +54.39% Current Price: $0.1173

What happened today

BOBA surged over 50% as investor interest revived in Layer 2 scaling solutions, particularly those aligned with the Real World Asset (RWA) narrative. Boba Network's hybrid compute model, allowing smart contracts to interact with off-chain APIs, makes it highly relevant as tokenized assets and multichain demand rise. With 50M+ transactions processed and 114K active addresses, Boba’s architecture positions it as a utility-focused alternative to mainstream rollups like Arbitrum and Optimism. The price rally appears to be driven by strategic ecosystem alignment rather than hype, signaling a potential long-term accumulation trend.

Market Cap: $20.13M 24-Hour Trading Volume: $60.9M Circulating Supply: 171.62M BOBA

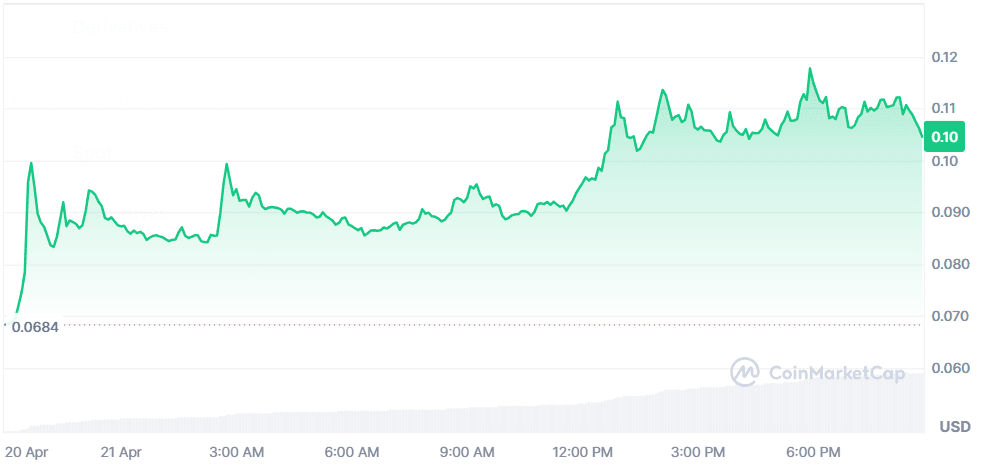

Enjin Coin (ENJ)

Price Change (24H): +51.64% Current Price: $0.1040

What happened today

ENJ rallied after Substreak integrated it into its Telegram-native dApp. With access to Telegram’s 1B+ users, the integration enables seamless tipping and NFT transfers without requiring wallets—removing a major friction point in adoption. As the Enjin Relaychain and Matrixchain stack enable lightweight, eco-friendly interactions, the news has rejuvenated interest in the ENJ ecosystem, especially for retail users and developers looking to gamify user engagement.

Market Cap: $190.28M 24-Hour Trading Volume: $510.8M Circulating Supply: 1.82B ENJ

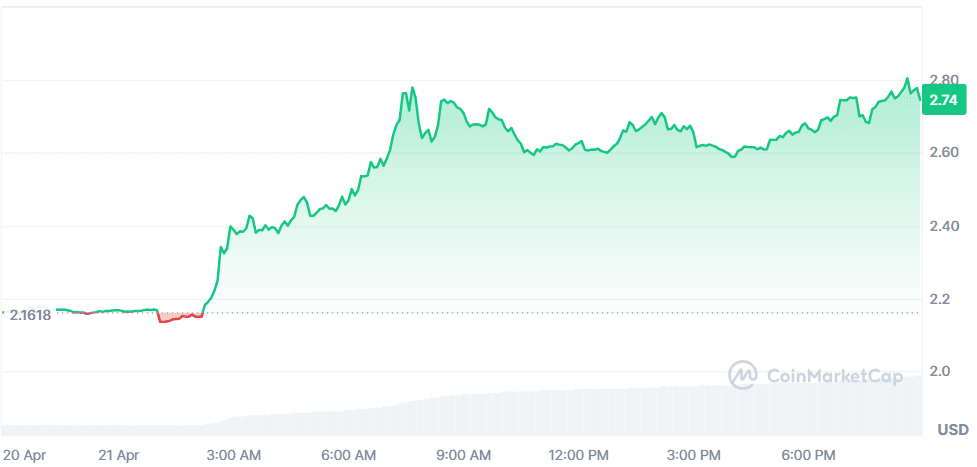

Convex Finance (CVX)

Price Change (24H): +26.94% Current Price: $2.74

What happened today

CVX saw strong momentum today, climbing nearly 27% amid rising Total Value Locked (TVL), which currently exceeds $924M. As a DeFi protocol that optimizes yields from Curve Finance, Convex is benefitting from renewed interest in DeFi infrastructure plays. The ratio of market cap to TVL (0.2891) indicates undervaluation relative to capital efficiency. Accumulation appears driven by institutional staking demand and renewed speculation on the next leg of DeFi protocols leading a new bull cycle.

Market Cap: $265.1M 24-Hour Trading Volume: $67.52M Circulating Supply: 96.54M CVX

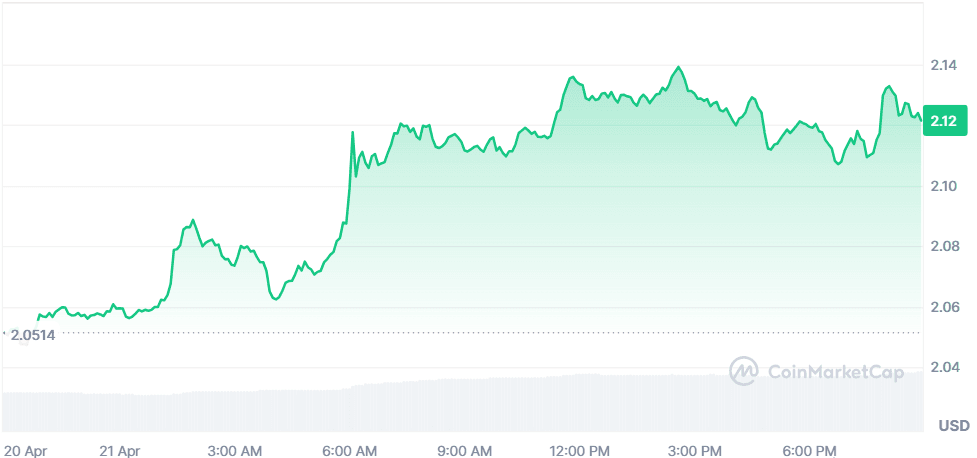

XRP (XRP)

Price Change (24H): +3.36% Current Price: $2.12

What happened today

Ripple’s acquisition of Hidden Road for $1.25B is reshaping the institutional utility of the XRP Ledger. With a temporary 60-day pause in the SEC legal case, market sentiment has turned cautiously optimistic. The acquisition enhances Ripple’s global financial presence and could boost XRP network usage. Meanwhile, rumors of potential XRP ETFs and supply shocks due to custodial demand are building bullish anticipation. Key resistance is at $2.20, and price action shows bullish signs despite legal uncertainty.

Market Cap: $123.87B 24-Hour Trading Volume: $2.45B Circulating Supply: 58.39B XRP

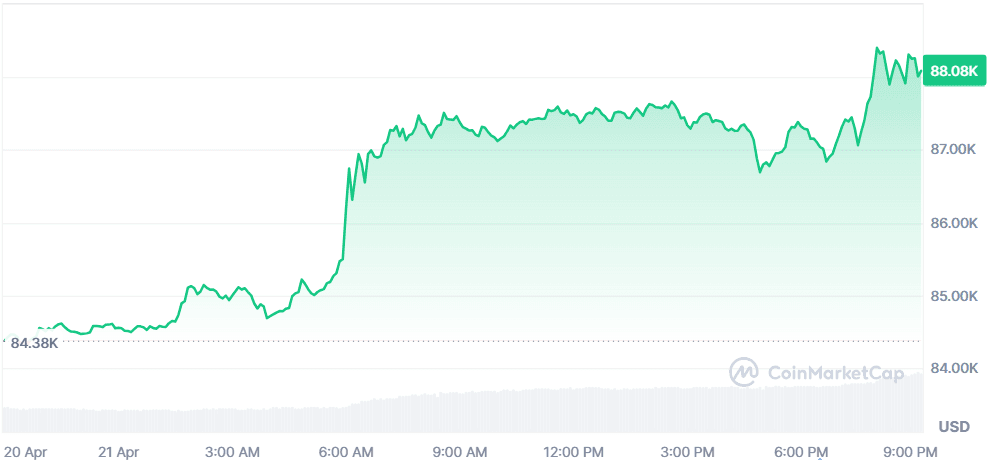

Bitcoin (BTC)

Price Change (24H): +4.31% Current Price: $88,082.56

What happened today

Bitcoin continues its bullish trend amid institutional buying signals. MicroStrategy may purchase up to $2B in BTC, and Semler Scientific is planning a $500M acquisition. Meanwhile, Texas has officially approved a $250M Bitcoin Reserve. These developments, coupled with a $1B liquidation in the derivatives market, are driving massive volatility. The strategic support from states and institutions contrasts sharply with regulatory anxiety elsewhere, giving BTC a resilient narrative amid macro uncertainty.

Market Cap: $1.74T 24-Hour Trading Volume: $34.49B Circulating Supply: 19.85M BTC

Global Finance Snapshot

Markets fell sharply today amid geopolitical uncertainty and rising tensions between President Trump and the Federal Reserve. The Dow dropped over 1,000 points, driven by Trump’s public attacks on Fed Chair Powell and growing concerns over Fed independence.

Meanwhile, the U.S. dollar hit a three-year low and gold soared past $3,400, signaling a flight to safety. The Magnificent Seven tech stocks also dragged markets down, with Tesla and Nvidia down 7% and 5%, respectively.

This heightened macro volatility is reshaping risk sentiment across asset classes including crypto.

Closing Thoughts

Today’s top gainers, BOBA, ENJ, and CVX, suggest strong participation in infrastructure-focused and utility-driven tokens. The Layer 2 and DeFi ecosystems appear to be pulling ahead, with narratives around real-world asset integration, scalable smart contract functionality, and cross-chain usability attracting capital.

Even meme-heavy or hype-based coins took a backseat, as market attention zeroed in on protocols building foundational pieces of the next-gen blockchain stack.

On the macro front, the collapse in U.S. equity markets and record gold prices point to a flight from traditional assets. Crypto, led by BTC and XRP, is benefiting from this churn, especially as institutional narratives (ETFs, state-level Bitcoin reserves, and corporate acquisitions) take hold. The divergence between crypto resilience and stock market fragility is growing more visible, and today's data hints that capital may increasingly look to blockchain—not just as speculation, but as shelter from a storm brewing in traditional finance.