**The cryptocurrency market has experienced a sharp correction today, with most assets facing significant declines. As expected, Bitcoin (BTC) remains the focal point of market movements, showcasing its strong influence on the broader crypto ecosystem. **

While some altcoins like Movement (MOVE) have managed to buck the trend with impressive gains, others, such as Moo Deng (MOODENG), faced substantial losses despite positive developments. Meanwhile, governance and strategic reforms in projects like Cardano (ADA) and innovation in DeFi protocols like Usual (USUAL) highlight the sector's dynamic nature amid ongoing volatility.

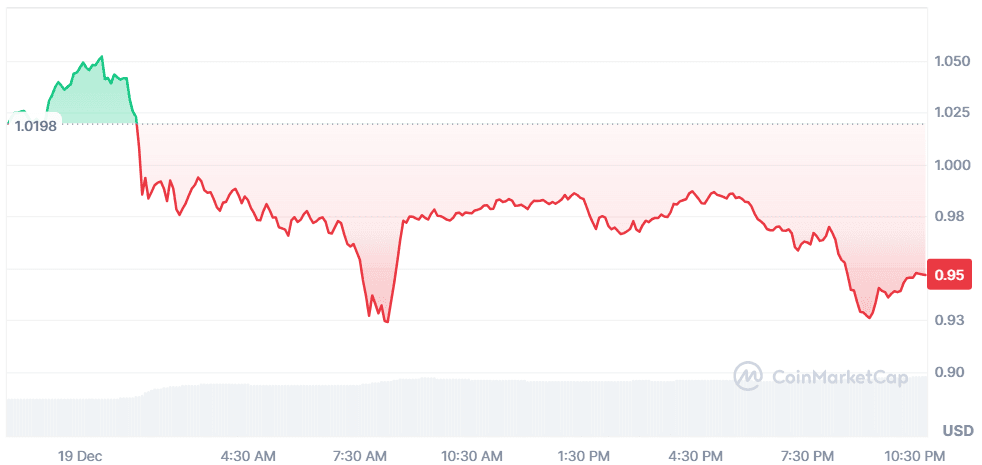

Cardano (ADA)

Price Change (24H): -7.24% Current Price: $0.947

What happened today: Charles Hoskinson, founder of Cardano, called for governance reforms at the Cardano Foundation, criticizing its Swiss-based model for excluding community input in board elections. He suggests relocating to jurisdictions like Abu Dhabi or Wyoming, which support community-driven governance structures. Meanwhile, Input Output (IO), Cardano’s research arm, unveiled a Strategic Research Agenda to guide development through 2030, focusing on nine areas to enhance scalability, governance, interoperability, and security. On the market side, ADA faced a recent price dip. Whales, having sold between $1.15 and $1.33, re-entered near $0.91, accumulating 160 million ADA tokens. This suggests that some major investors remain confident in Cardano’s long-term prospects despite short-term volatility.

Market Cap: $33.25B 24-Hour Trading Volume: $2.3B Circulating Supply: 35.11B ADA

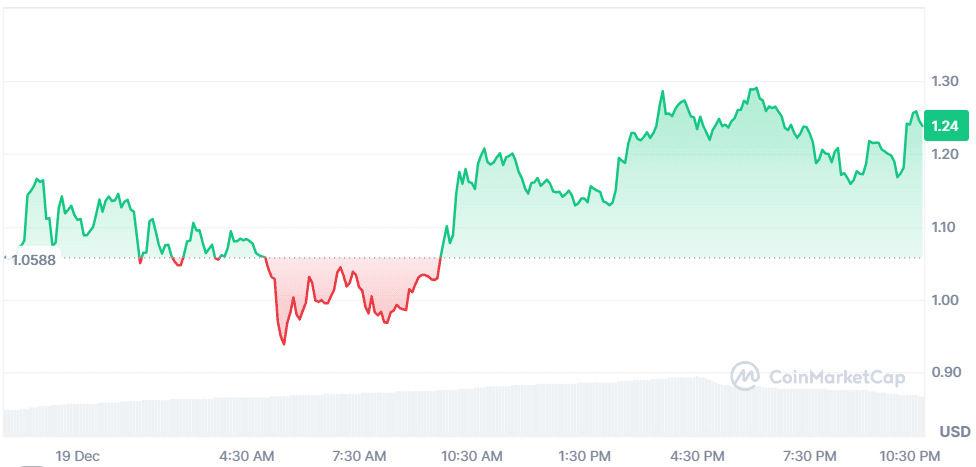

USUAL (USUAL)

Price Change (24H): +8.50% Current Price: $1.25

What happened today: Usual Labs continues to make waves in DeFi with its focus on real-world asset (RWA) integration and its governance token pre-launch. Recently hitting $1 billion in Total Value Locked (TVL), the protocol is gaining serious traction. Its stablecoin, USD0, backed by US Treasury Bill tokens sourced from prominent asset managers like BlackRock and Ondo, aims to enhance verifiability and accessibility. In addition, Usual’s “Pills” campaign is underway, encouraging users to earn pre-launch points convertible into USUAL tokens by issuing USD0, holding USD0++, and referring others. Long-term staking opportunities, boasting APYs as high as 18,000%, further demonstrate the team’s commitment to rewarding loyal participants and solidifying the ecosystem’s growth.

Market Cap: $558.69M 24-Hour Trading Volume: $1.45B Circulating Supply: 447.38M USUAL

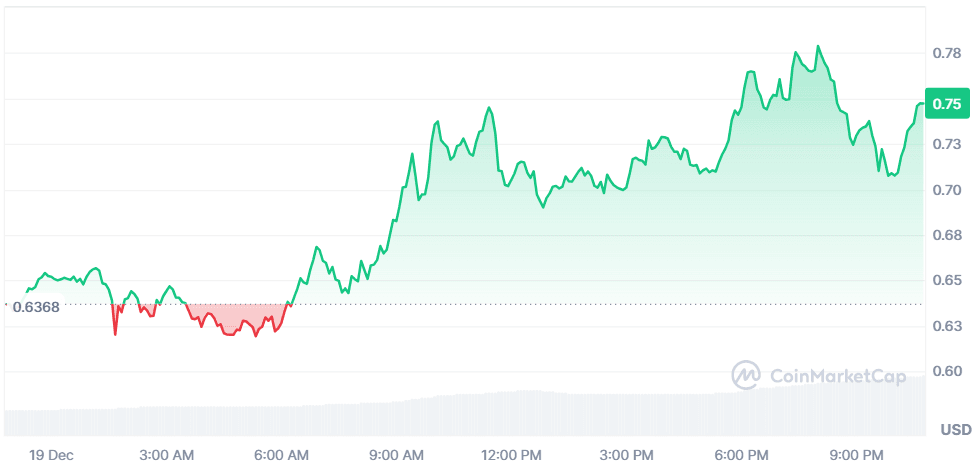

MOVEMENT (MOVE)

Price Change (24H): +17.54% Current Price: $0.7499

What happened today: Movement (MOVE) is capturing market attention as it bucks the broader downward trend, posting strong gains in the last 24 hours. Analysts highlight a recent breakout above a bullish pennant pattern, a technical formation that often signals further upside. With MOVE holding steady despite general market volatility, prominent analysts predict a 40-50% price surge in the coming days. Key resistance lies around $0.78; surpassing this level may open the path toward $1.00 and higher targets like $1.20-$1.40. Growing trading volume, supportive moving averages, and steady investor confidence suggest continued momentum. Traders are watching closely to see if MOVE can maintain this performance, setting the stage for potentially significant gains.

Market Cap: $1.68B 24-Hour Trading Volume: $1.29B Circulating Supply: 2.25B MOVE

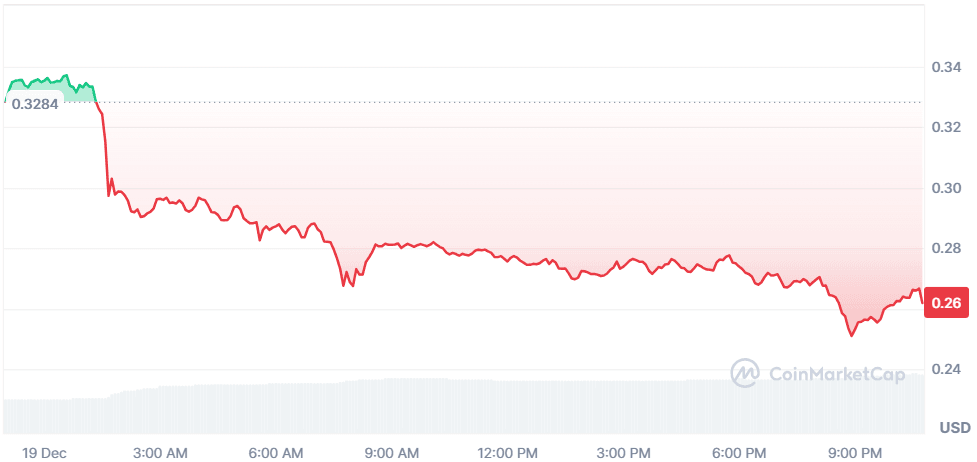

Moo Deng (MOODENG)

Price Change (24H): -20.70% Current Price: $0.2618

What happened today: Moo Deng, a cryptocurrency linked to a popular internet sensation, faced a sharp price decline despite its listing on the Kraken exchange. After achieving exposure on a major trading platform, the token saw increased trading volume, which spiked by over 74% in the last 24 hours. However, the heightened activity did not translate into sustained gains, as the price tumbled nearly 21% amid volatility and profit-taking by early investors. While Moo Deng’s unique branding - tied to a pygmy hippopotamus named “Moo Deng” - attracted initial market curiosity, the token now confronts typical post-listing turbulence. The coming days will test the coin’s resilience and whether it can find stability or rebound from its current downturn.

Market Cap: $259.13M 24-Hour Trading Volume: $174.16M Circulating Supply: 989.97M MOODENG

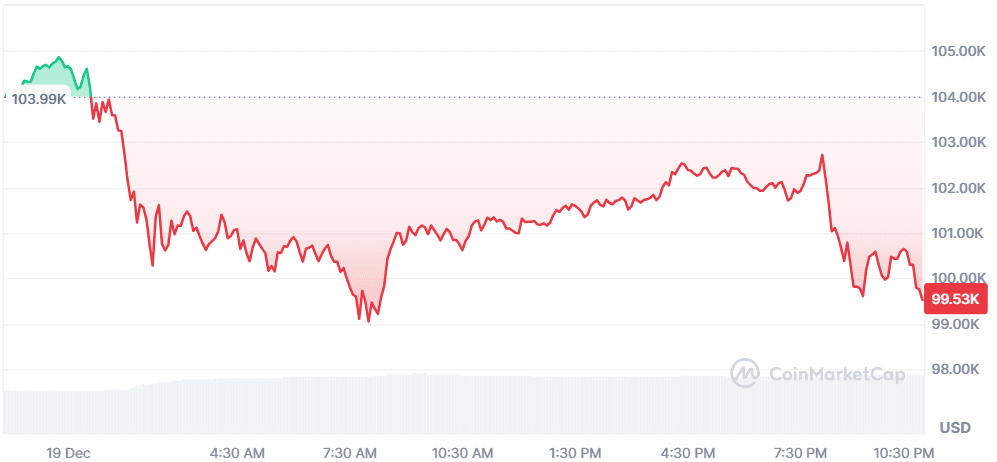

Bitcoin (BTC)

Price Change (24H): -4.37% Current Price: $99,773.86

What happened today: Bitcoin retreated sharply following the Federal Reserve’s interest rate cut and subsequent cautious messaging on future monetary policy. After hitting a record high above $108,000 earlier in the week, BTC fell nearly 6% within 24 hours. Fed Chairman Jerome Powell’s comments indicating a slower pace of rate reductions in 2025 dampened investor enthusiasm, triggering a sell-off across crypto markets. Over $690 million in crypto derivatives were liquidated, with Bitcoin long positions suffering significant losses. While lower interest rates typically benefit risk assets, the Fed’s reluctance to commit to more aggressive cuts introduced uncertainty. Bitcoin’s volatility reinforced its sensitivity to macroeconomic factors and its increasingly intertwined relationship with traditional financial markets.

Closing Thoughts

Today's market correction reflects the ongoing uncertainty and cautious sentiment among investors. Although widespread corrections can jolt near-term trading, the market’s overall sentiment remains cautiously constructive. The persistently elevated Fear & Greed Index signals that many participants see these price dips as part of the ongoing cycle rather than a fundamental trend reversal. With their eyes on long-term developments and underlying network growth, investors appear ready to re-engage once conditions stabilize.

Market Cap: $1.97T 24-Hour Trading Volume: $99.38B Circulating Supply: 19.79M BTC