The rise of cryptocurrency exchange-traded funds (ETFs) has transformed the digital asset industry, with U.S. regulatory approvals in early 2024 unleashing over $12 billion into spot Bitcoin ETFs within the first quarter alone. BlackRock's iShares Bitcoin Trust gathered $10 billion in under two months – reportedly the fastest an ETF has ever reached that milestone – as Bitcoin surged past $70,000 to new highs. So should we consider ETF flows as key market sentiment indicator now?

What to Know:

- U.S. spot Bitcoin ETFs gathered over $12 billion in Q1 2024, with BlackRock's fund reaching $10 billion faster than any ETF in history

- Nearly 1,000 traditional financial institutions held Bitcoin ETF shares by mid-2024, marking widespread institutional adoption

- Experts warn fund flows may lag rather than predict price movements, representing only a slice of the overall crypto market

Traditional investors have poured capital into crypto markets through these familiar investment vehicles at unprecedented rates. The entry of financial giants like BlackRock, Fidelity and other asset managers has legitimized the once-fringe asset class.

"The approval of the spot Bitcoin ETFs in the U.S. has signalled to investors that crypto is a legitimate asset class," says Daniel Krupka, Head of Research at Coin Bureau.

These products allow institutions and individuals to gain Bitcoin exposure without directly handling tokens, and their growth has been explosive. By mid-2024, nearly a thousand traditional financial firms—from banks to pension funds—held bitcoin ETF shares. Bitcoin's liquidity deepened and volatility eased amid "consistent BTC accumulation by the ETFs," Krupka notes, adding that major players like BlackRock have fostered a sense that "crypto more generally has matured."

A crucial question has emerged: Do crypto ETF inflows and outflows reliably indicate market sentiment? When money rushes into these funds, does it signal investor bullishness – and do large withdrawals forecast bearish periods? In traditional markets, fund flows often reflect risk appetite. In volatile crypto markets, weekly ETF investment patterns have quickly become closely watched metrics.

What Are ETFs and Crypto ETFs?

An exchange-traded fund trades on stock exchanges and typically tracks an underlying asset or basket of assets. Investors can buy and sell ETF shares like stocks, gaining convenient exposure to particular markets.

Crypto ETFs transform digital tokens into familiar financial instruments with regulatory oversight and institutional custody. A Bitcoin ETF holds or links to Bitcoin, mirroring the cryptocurrency's price movements, allowing investors to participate in bitcoin's performance through traditional exchanges without directly purchasing or storing cryptocurrency.

Crypto ETFs come in several varieties. "Spot" crypto ETFs directly hold cryptocurrency or equivalent claims. When investors buy shares, fund managers acquire actual Bitcoin, increasing the fund's asset base. Selling pressure leads managers to liquidate holdings as shares are redeemed. Share prices closely track cryptocurrency market prices through this creation-redemption mechanism.

Futures-based crypto ETFs don't hold physical coins but invest in futures contracts tied to cryptocurrency prices. This structure gained U.S. regulatory approval first – with ProShares Bitcoin Strategy ETF (BITO) launching in October 2021 – as it operates within regulated futures markets. These ETFs provide crypto price exposure but can diverge from spot prices due to contract contango, roll costs and other complexities.

The primary distinction is that futures ETFs track expected future prices via contracts, while spot ETFs directly hold the asset – meaning spot ETF investors effectively own portions of actual bitcoin.

Bitcoin remains the most common underlying asset for crypto ETFs, with Ethereum following suit.

U.S. regulators approved the first ether-linked ETFs in late 2023, initially futures-based before approving spot funds in 2024. Some ETFs hold multiple cryptocurrencies or follow indices, offering broad exposure through single tickers.

Crypto ETFs have significantly lowered market entry barriers. Buying cryptocurrency directly requires digital exchange accounts, wallet management, and navigating custody risks many find daunting. ETFs wrap crypto in traditional formats, offering convenience, familiarity and regulatory safeguards. Investors receive simplified portfolio reporting and avoid hacking or self-custody issues.

For institutional investors, ETFs provide exposure compatible with investment mandates and compliance requirements; pension funds prohibited from holding actual bitcoin might be permitted to hold regulated ETF shares. These advantages have made crypto ETFs attractive capital conduits – explaining why their launch marked a watershed moment for mainstream adoption.

A Brief History of Crypto ETFs

The path to today's crypto ETF landscape was challenging and regulation-heavy. The Bitcoin ETF concept first emerged in 2013 when Tyler and Cameron Winklevoss filed for a NASDAQ-traded product. Years of regulatory skepticism followed.

In 2017, the SEC rejected the Winklevoss proposal and several others, citing market manipulation concerns and bitcoin trading venue regulation issues. It seemed the U.S. might never approve cryptocurrency ETFs holding actual crypto.

Meanwhile, other regions moved faster: Europe launched exchange-traded notes tracking crypto as early as 2015, and Canada approved North America's first bitcoin ETF in February 2021. These international products demonstrated market demand and provided real-world precedents that eventually strengthened the U.S. case.

A breakthrough came in October 2021 when U.S. regulators permitted bitcoin futures-based ETFs. ProShares' BITO debuted on the New York Stock Exchange to overwhelming interest. Pent-up demand drove BITO's assets beyond $1 billion in just two days – the fastest an ETF had ever reached that milestone. Trading volumes soared as bitcoin's price jumped to record highs around $67,000 that week.

Several other Bitcoin futures ETFs launched soon after, though none matched ProShares' initial inflows. Nevertheless, a clear message emerged: billions awaited any approved crypto investment fund.

Throughout 2022-2023, pressure mounted on the SEC to approve spot Bitcoin ETFs. Grayscale Investments even sued the regulator over its refusals. Optimism surged in mid-2023 when BlackRock filed for a spot Bitcoin ETF, signaling institutional confidence in eventual approval.

By January 2024, the SEC relented, simultaneously approving about a dozen spot Bitcoin ETFs from major firms – a watershed industry moment. These U.S. spot ETFs began trading mid-January 2024 with massive initial inflows. Within weeks, approximately $7 billion flowed into the new bitcoin funds, lifting cryptocurrency prices and attracting institutional investors who disclosed positions.

By March 2024, BlackRock's IBIT fund alone exceeded $10 billion in assets – reaching that figure in roughly two months, unprecedented ETF growth. Total assets across U.S. crypto ETFs swelled, with global crypto ETF/ETP assets reportedly surpassing $60 billion by mid-2024.

Other milestones followed globally. In May 2024, the U.S. approved the first spot ether ETFs, adding the second-largest cryptocurrency to ETF offerings. Europe's market, already featuring several physically-backed crypto ETPs, expanded with new products including altcoin basket funds. Markets like Brazil and Australia introduced local exchange crypto ETFs.

By 2025, crypto ETFs had firmly established themselves in global financial markets. This "ETF era" allows retail and institutional investors to adjust exposure to bitcoin, ether, or niche digital assets with unprecedented ease. With this integration, ETF flows have become integral to crypto market analysis, similar to how equity fund flows reflect stock market sentiment.

Fund Flows as Sentiment Signals: Bullish Inflows vs. Bearish Outflows

Logic suggests investors optimistic about crypto markets will invest more in crypto funds – while nervous or pessimistic investors withdraw capital. This dynamic has frequently played out with crypto ETFs, supporting the notion that flows indicate sentiment.

During bull markets or positive news cycles, crypto ETFs attract strong inflows, which analysts cite as mounting bullish sentiment. Conversely, market downturns or macroeconomic fears typically trigger fund outflows, suggesting deteriorating sentiment.

Recent examples illustrate this relationship. In late June 2023, after nine consecutive weeks of minor outflows, crypto investment funds suddenly received approximately $199 million in a single week – the largest weekly inflow in a year. Bitcoin-focused products received nearly all these funds.

CoinShares analysts attributed this turnaround directly to improving sentiment sparked by high-profile spot ETF filings from BlackRock and others. Bitcoin had just reached a one-year high, and the fund influx was interpreted as bullish positioning anticipating a friendlier regulatory environment. Notably, "short bitcoin" funds saw simultaneous outflows as bearish positions were reduced.

"We believe this renewed positive sentiment is due to recent announcements from high profile ETP issuers," the CoinShares report noted, connecting headlines to measurable investor mood shifts.

The massive investments accompanying U.S. spot bitcoin ETF launches in January 2024 provided another powerful sentiment indicator. Net inflows of approximately $7–12 billion into bitcoin ETFs over just months reflected resurging enthusiasm among retail and institutional investors. Bitcoin prices reached all-time highs amid this optimism.

"The fact there's regulated vehicles now" unleashed pent-up demand, one analyst noted, with rapidly growing fund sizes evidencing widespread interest in safer crypto exposure options. The bullish sentiment extended beyond U.S. borders, with crypto ETPs in Europe, Canada and other regions reporting rising inflows as global investors gained confidence in broader crypto market recovery.

Even on shorter timeframes, traders monitor ETF flows for sentiment shifts. A streak of weekly inflows into crypto funds generally suggests building upward momentum. CoinShares data in late 2024 showed a remarkable 19-week streak of consecutive digital asset fund inflows, signaling sustained optimism that coincided with recovering crypto prices.

When that streak finally broke in early 2025 with sudden outflows, analysts viewed it as a sentiment inflection point. One report described "massive outflows" marking a significant shift after prolonged steady inflows – investors had grown cautious and begun reducing exposure, foreshadowing market cooling.

Geographical flow patterns offer additional sentiment insights. During a crypto market drawdown in first-quarter 2025, data revealed regional divergence: U.S.-based investors withdrew funds aggressively while European and Canadian investors maintained modest inflows. CoinDesk noted U.S. sentiment appeared "particularly bearish" with nearly $1 billion in U.S. provider outflows over weeks, while sentiment elsewhere remained more neutral or slightly positive.

Such differences often reflect local factors – U.S. investors potentially reacting to domestic regulatory crackdowns or macro concerns while international investors remained comparatively optimistic. Flow data analysis allowed analysts to conclude "investor sentiment in the U.S. is particularly bearish," identifying regional sentiment variations.

Inverse or short product flows provide additional signals. In October 2022, crypto funds experienced slight net outflows overall, but most withdrawals came from short bitcoin ETFs designed to profit from price declines. Those bearish funds saw approximately $15 million in redemptions, the largest short-product outflow on record, suggesting bears closing positions while modest inflows continued into long bitcoin funds.

CoinShares' head of research, James Butterfill, remarked: "This suggests sentiment remains positive," despite minor headline outflows. When money exits bearish bets, it often indicates bullish sentiment shifts, demonstrating flow analysis nuance: examining which fund types experience inflows or outflows matters. Rotation from "short" to "long" ETFs typically signals fading pessimism and growing optimism.

Multiple times, large inflows have coincided with or slightly preceded rallies, supporting their utility as sentiment gauges. When bitcoin broke above key price levels during recoveries, spikes in ETF buying often accompanied these moves. Market commentators frequently note correlations like "crypto fund inflows quadrupled last week, a sign of positive sentiment as bitcoin's price climbed."

Fund flow reports have essentially become sentiment scoreboards: substantial weekly inflows suggest rising bullish sentiment; net redemptions indicate declining sentiment. Media outlets and analysts rely on such data to explain price movements.

In April 2025, U.S. spot bitcoin ETFs recorded their highest daily inflows since January – $381 million in one day – coinciding with bitcoin approaching new highs, widely cited as evidence of strengthening investor confidence. This feedback loop can amplify trends: rising prices attract momentum-driven investors, adding buying pressure that potentially pushes prices higher.

Substantial evidence suggests crypto ETF inflows and outflows mirror prevailing market sentiment. Bullish investors increase fund allocations while bearish or fearful investors withdraw capital. Flow magnitude can indicate sentiment intensity: record-setting inflows typically occur during euphoria or high conviction periods, while record outflows often accompany panic or deep pessimism.

Why Crypto ETF Flows Can Mislead (Critiques and Counterarguments)

Despite the intuitive appeal of using ETF flows as sentiment indicators, several caveats warrant consideration. Market veterans caution that fund flows, especially in emerging markets like crypto, aren't always straightforward indicators – and sometimes function as contrarian signals.

Flows often follow rather than predict price trends. Investors typically chase performance; money usually enters after assets have risen (when bullish sentiment is widespread) and exits after prices have fallen (when fear predominates). This means by the time flows clearly indicate extreme sentiment, market moves may be well underway or approaching exhaustion.

A historical example: ProShares BITO launch in October 2021 attracted over $1 billion in two days amid bitcoin's surge to record highs. Within weeks of that euphoric inflow spike, bitcoin peaked and began declining sharply, with BITO interest waning as prices fell. The massive inflows reflected top-of-market exuberance – a lagging rather than leading indicator.

Similarly, some of the largest crypto fund outflows occurred during the 2022 bear market after prices had already collapsed from highs, essentially confirming bearish sentiment that had persisted for months.

In essence, fund flows often reveal current rather than future sentiment direction.

Additionally, crypto ETF flows represent only a segment of the overall market, with signals potentially distorted by factors unrelated to broader crypto holder sentiment. Most bitcoin and cryptocurrencies exist outside ETFs – on exchanges, in private wallets, and with long-term holders. These participants may behave differently from ETF investors.

During downturns, traditional investors might withdraw from ETFs (perhaps during broader cash flights) while crypto-native buyers or institutional arbitrageurs quietly accumulate coins at lower prices outside ETF structures. The ETF outflows would suggest bearishness even as other market segments turn bullish.

Early 2025 showed hints of this phenomenon: as U.S. ETF outflows continued for weeks amid macro concerns, bitcoin prices surprisingly maintained certain levels and even rallied temporarily. That rally stemmed from spot exchange buying (possibly overseas or by longer-term investors) despite U.S. fund investor selling.

Such divergences suggest ETF flows primarily reflect sentiment among specific investor segments (often Western, institutional-leaning participants) without capturing the complete global crypto market sentiment picture.

Macroeconomic forces further complicate interpretation. Crypto ETFs, as traditional financial instruments, exist within broader portfolio contexts. During risk-off environments – triggered by geopolitical tensions or recession fears – investors often reduce exposure across all assets. They might simultaneously sell stocks, commodities, and crypto ETFs to increase cash positions or reduce risk.

In such scenarios, crypto fund outflows might indicate general risk aversion rather than crypto-specific bearish views. A vivid example occurred in April 2025: President Trump's tariff announcement and subsequent market uncertainty triggered five consecutive days of U.S. spot bitcoin and ether ETF outflows, even as crypto prices temporarily rebounded on positive news developments.

Analysts noted that "dwindling demand" for ETFs stemmed from uncertainty, with macro-oriented investors "selling every asset, including crypto ETFs, for cash" amid turmoil. This underscores context importance: distinguishing whether crypto fund flows respond to crypto-specific developments (like regulatory decisions or security breaches) or broader market sentiment is crucial. When broader factors dominate, flows may reveal little about intrinsic crypto outlook.

Large fund flow movements can also result from idiosyncratic, one-time factors. A single major institutional investor allocating to or redeeming from an ETF can skew weekly data. If a large pension fund took profits by withdrawing $500 million from a bitcoin ETF, that would register as a major outflow (bearish signal) even if thousands of smaller investors were net buyers during the same period.

Conversely, inflow surges might occur when new ETFs launch and quickly gather assets (reflecting excitement or initial positioning). These mechanical or one-time flows may not represent "average" crypto investor sentiment.

History suggests caution: during risk-off environments, investors often sell indiscriminately, as one analyst observed, "narrative aside."

Not every outflow indicates long-term bearish crypto sentiment – sometimes it reflects temporary exposure reduction due to external needs or short-term concerns.

Rotation and substitution phenomena add complexity. The expanding crypto fund universe contains multiple overlapping products. Investors may move between funds, creating outflows in one product and inflows in another, obscuring sentiment signals.

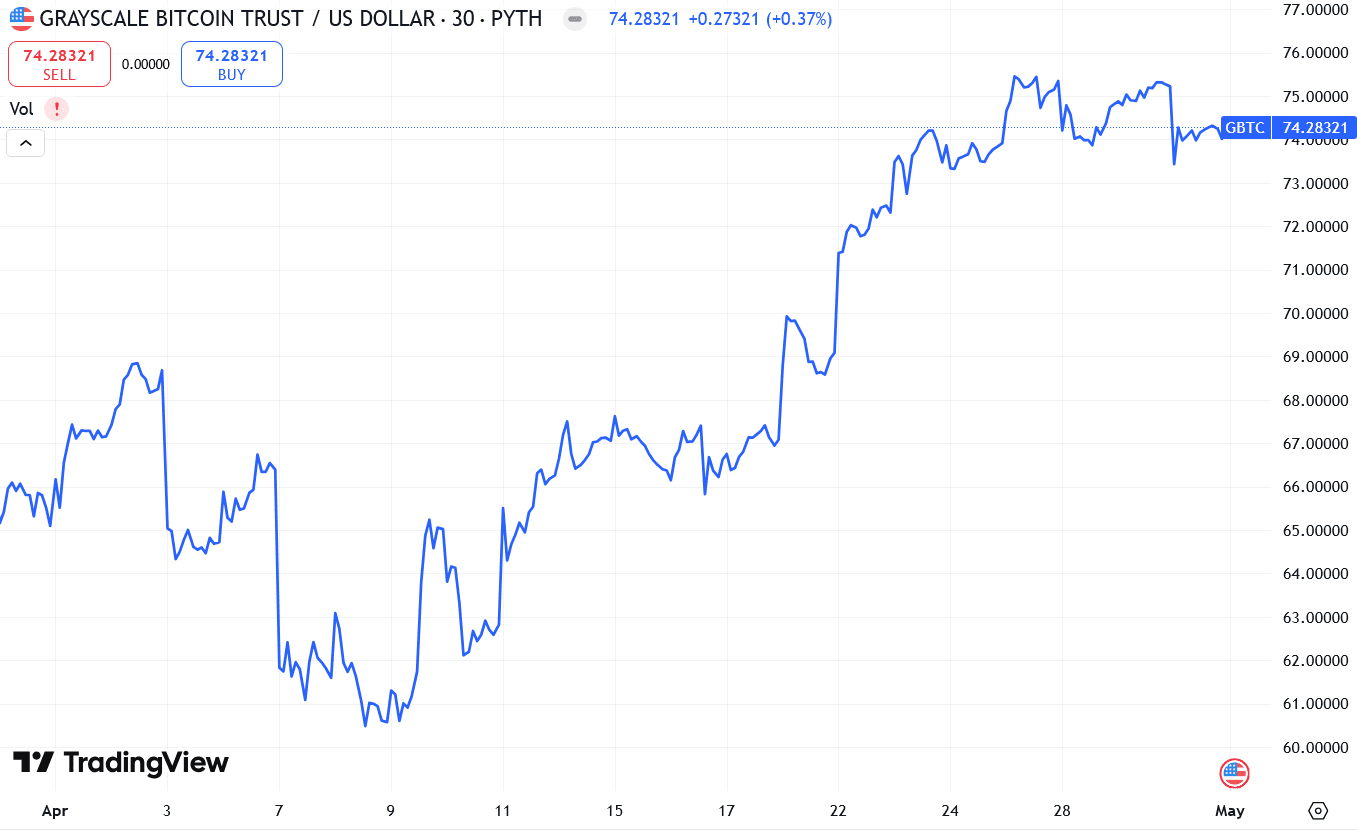

A prominent example occurred during late 2023 into 2024 when U.S. spot ETFs launched: many Grayscale Bitcoin Trust (GBTC) investors sold shares (causing what appeared as $12 billion in "outflows") and switched to new ETFs. Superficially, Grayscale's outflows appeared bearish, but these funds weren't exiting crypto – they were migrating to preferred structures.

Similarly, when investors shift from one provider's bitcoin ETF to a lower-fee competitor, flow data might misleadingly show large outflows from one fund and inflows to another that offset in terms of overall exposure. Such rotations necessitate aggregating flows across the ecosystem to gauge net sentiment rather than being misled by inter-fund movements.

Another pitfall: extreme inflow events sometimes mark euphoria – and counterintuitively precede downturns. Once everyone interested in buying has purchased (fully investing via ETFs), markets may lack fuel for continued rises.

Some analysts cite traditional market instances where record fund inflows coincided with market tops as final buyers rushed in.

Crypto markets experience intense hype cycles, so sudden massive inflows might indicate near-term overexuberance rather than guaranteeing continued gains. The 2021 BITO episode demonstrated this – blockbuster inflows and new price highs followed by trend reversal. Similarly, when crypto ETFs attracted approximately $7 billion in January 2024, initial euphoria gave way to a sharp 15%+ bitcoin correction from peak levels within months as enthusiasm cooled and profit-taking emerged.

Critics argue crypto ETF flows, while informative, shouldn't be viewed in isolation or as unambiguous sentiment signals. They represent one piece of a complex puzzle. Factors like investor profiles (retail vs. institutional), capital movement motivations (fundamental vs. macro vs. technical), and parallel developments (price action, on-chain trends) all matter.

As crypto markets mature with increasing cross-currents, simplistic flow interpretations – "big inflow = bullish, big outflow = bearish" – require greater nuance. Sophisticated investors monitor flows alongside multiple indicators to accurately gauge market sentiment.

Closing Thoughts

ETF flows serve as useful sentiment indicators, corroborating signals from price trends, surveys, and other metrics about market psychology. However, the relationship isn't perfectly linear. Crypto ETF flows reflect sentiment while simultaneously reinforcing and sometimes lagging it, potentially sending misleading signals without proper context. Large institutional investors, macroeconomic factors, and structural market shifts can all distort flow data.

Market participants should treat crypto ETF inflows and outflows as one sentiment gauge among many. While tangible and quantifiable investor action indicators, they should be interpreted cautiously. Just as driving requires more than rear-view mirror observation, predicting crypto's future requires more than yesterday's fund flow data.

Ultimately, crypto ETF flows reflect sentiment while simultaneously shaping it by signaling confidence or concern. As with many cryptocurrency aspects, the truth exists in feedback loops. Investors become bullish as others invest; they turn bearish as others withdraw. Recognizing this reflexivity is essential. ETF flows provide valuable sentiment insights without offering perfect predictive power – they reveal current investor feelings, leaving future implications for us to determine.