Buying the dip is one of the most reliable ways to build serious wealth in crypto. Timing the market is tough — but finding tokens with real utility, strong momentum, and long-term vision makes it a whole lot easier.

Infrastructure tokens are leading the charge in 2025. Built for speed, scale, and adoption, these projects are laying the groundwork for the next generation of decentralized finance and global payments.

From XRP’s institutional-grade settlement network to Onyxcoin’s DAO-governed financial ecosystem and Hyperliquid’s high-speed DeFi engine, these tokens aren’t just part of the future — they’re building it. Backed by bullish technicals and key catalysts, they’re well-positioned to deliver outsized returns.

Why do these tokens deserve attention right now? Let’s find out.

XRP: Institutional-Grade Infrastructure That’s Finally Breaking Out

Long considered one of the OGs of crypto, XRP has undergone a dramatic transformation from a controversial token embroiled in SEC litigation to a regulatory frontrunner now spearheading institutional blockchain adoption. Backed by Ripple’s aggressive global expansion and a series of groundbreaking partnerships, XRP is stepping into a new era. Here's why XRP is more relevant — and potentially more profitable — than ever before.

The Resurgence of XRP

After years of stagnation due to regulatory uncertainty, XRP has surged back to life. Trading at just $0.49 a year ago, XRP has rallied more than 334% to currently hover at $2.11, with a market cap exceeding $123 billion. That places it firmly in the top 5 cryptocurrencies by market cap.

This rise is not speculative fluff — it’s being driven by the clearing of massive regulatory roadblocks, renewed institutional interest, and Ripple’s aggressive ecosystem growth strategy.

What Makes XRP Stand Out?

- Battle-Tested Technology, Built for Banks

-

Decentralized Ledger (XRPL): Launched in 2012, the XRP Ledger is a high-speed, low-cost, energy-efficient blockchain capable of handling 1,500 TPS with 3–5 second settlement time and near-zero fees (~$0.0002).

-

Federated Consensus Mechanism: Unlike Proof of Work or Stake, XRPL uses a unique Byzantine Fault Tolerant model that achieves consensus without mining, ensuring sustainability and security.

-

Global Validator Network: Over 150 validators worldwide, including universities, exchanges, and financial institutions, maintain transparency and decentralization.

- Designed for Institutional Use Cases

-

Built for Payments: XRP was engineered as a bridge currency for cross-border transactions — it solves the remittance problem that SWIFT never could.

-

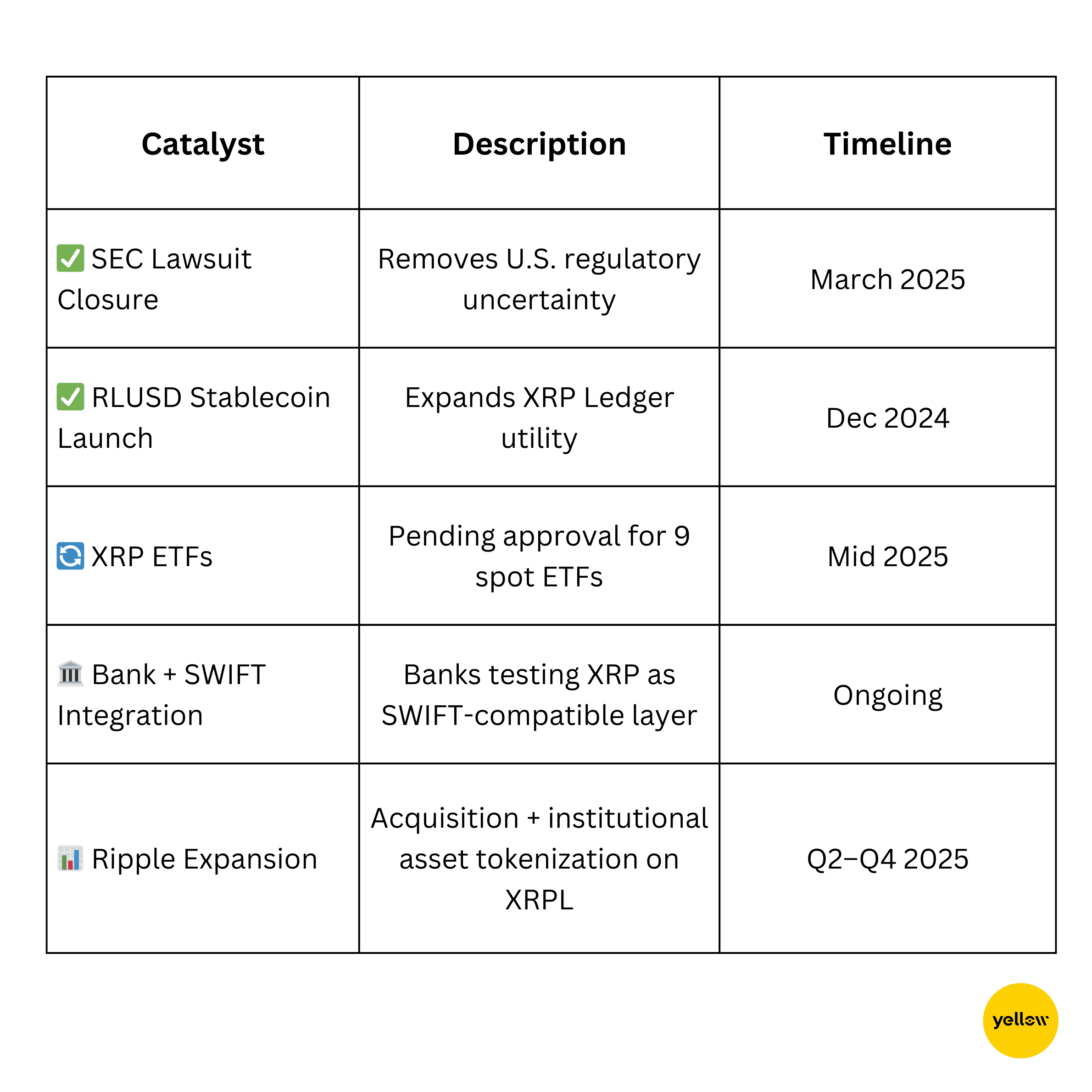

Stablecoin Ready: Ripple’s upcoming USD-backed stablecoin (RLUSD), approved in New York, is launching on XRPL in 2025.

-

CBDC and Tokenization: Active pilots with governments and institutions for CBDCs, and enterprise-grade support for real-world asset tokenization (e.g. commodities, real estate).

- Regulatory Clarity = Go Time

-

SEC Lawsuit Resolved: In March 2025, the SEC officially dropped its multi-year lawsuit against Ripple, removing the biggest barrier to XRP’s widespread adoption in the U.S.

-

ETFs Incoming: Nine XRP-based ETF filings are currently under review. Approval could open floodgates of institutional demand from traditional asset managers.

Why Now?

XRP is No Longer a “Speculative” Token — It’s Infrastructure

XRP’s price has decisively broken above the psychological $2 mark, with trading volume at $2.99B in 24h, and RSI still below overbought territory (~65), signaling more room for upside.

The Trump administration’s pro-crypto stance has accelerated regulatory clarity, boosting institutional confidence in Ripple’s roadmap.

Ripple just completed the largest acquisition in crypto this year, and banks are now openly testing SWIFT–XRP interoperability.

Technically Speaking

-

XRP’s historical price peaks in bull runs (2017 and 2021) were near $3.30. This gives the current breakout a clear runway to $3.50–$4.00 in Q2 2025.

-

On-chain activity has surged, with 58.3B XRP in circulation and a 2.42% volume-to-market-cap ratio, suggesting healthy liquidity and strong investor interest.

-

Macro indicators (like DXY weakening and broader crypto ETF momentum) favor altcoins with institutional relevance — and XRP leads the pack.

Key Catalysts to Watch

The Verdict

XRP is no longer the underdog — it’s the infrastructure play.

With its regulatory hurdles behind it, Ripple is unlocking the full power of the XRP Ledger. From bank-grade settlement to stablecoins and tokenized assets, XRP is laying the foundation for a future-proof financial system.

And with the price still far below its historic highs, this breakout could be just the beginning.

If you're looking to buy the dip — XRP might just be the safest moonshot on the board.

Onyxcoin (XCN): The High-Risk, High-Conviction Layer-1 Rebound

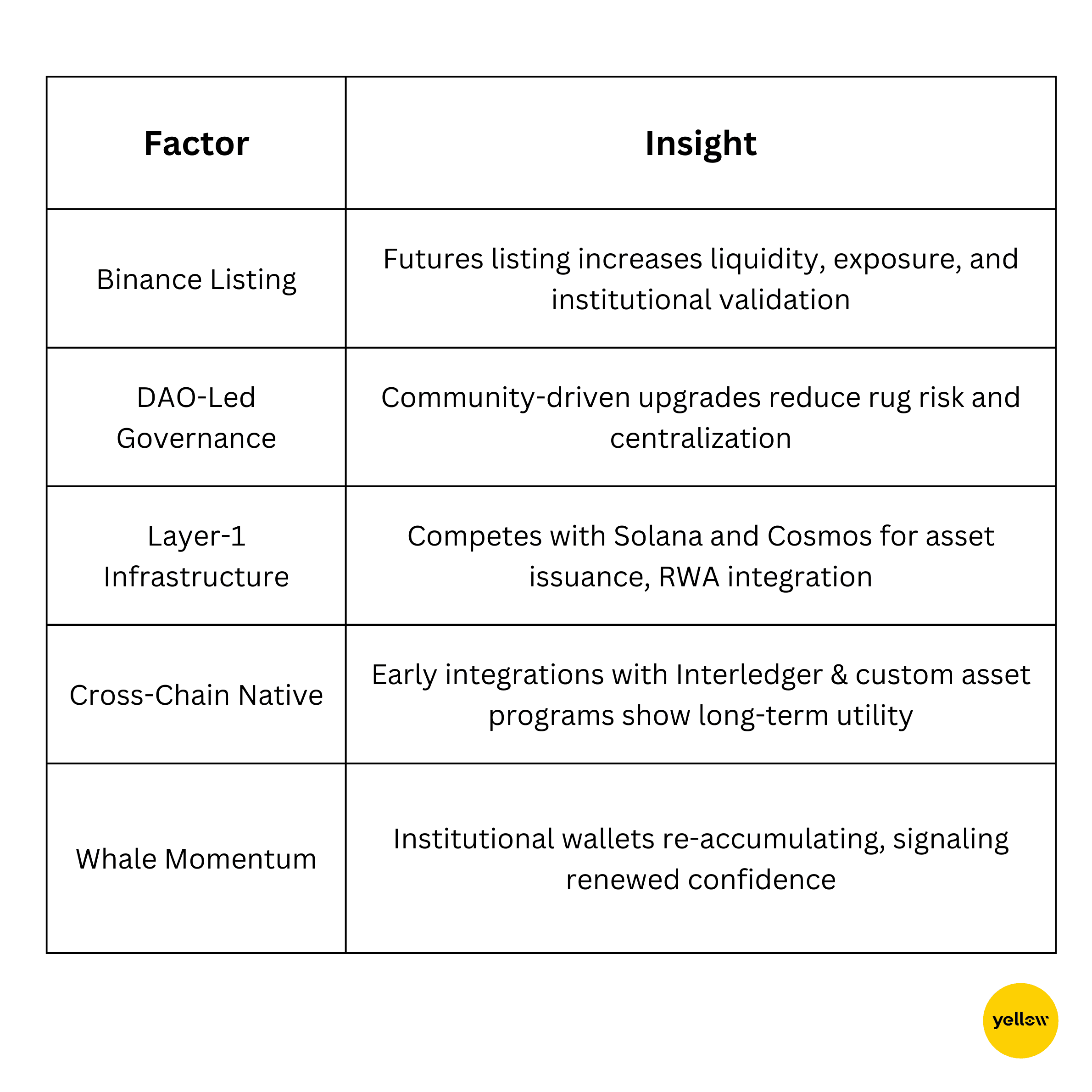

From whale-driven collapses to a Binance Futures listing and a breakout rally, Onyxcoin (XCN) has emerged as one of the most volatile — yet potentially rewarding — Layer-1 plays in 2025. With a scalable, DAO-driven protocol and an aggressively growing ecosystem, XCN is capturing fresh attention just as its price action is signaling a major turnaround.

From Bottom to Breakout

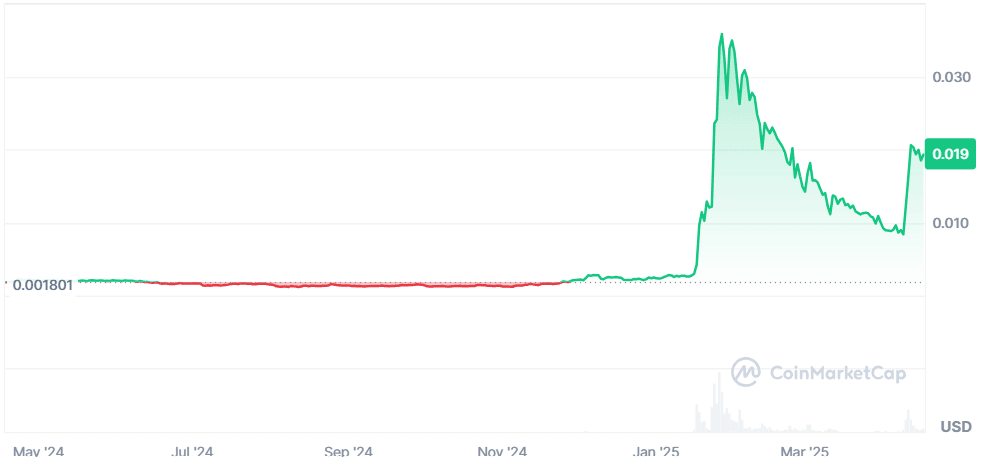

Onyxcoin was trading at $0.0076 as recently as April 7, 2025, after suffering an 85% drawdown from its January highs. Just one week later, it rallied to over $0.019, gaining 125% in just three days and nearly 970% YoY.

This rebound came after months of capitulation — driven by whale exits — but the narrative is now shifting: whales are returning, Binance has listed XCN Futures, and the protocol just flipped key resistance levels.

What Is Onyxcoin (XCN)?

- Purpose-Built for Financial Networks

-

Onyx Protocol: A modular Layer-1 blockchain tailored for multi-asset ledgers, cross-chain swaps, and custom digital asset issuance.

-

Federated Consensus: Uses a M-of-N block signer model (like a hybrid of BFT and Delegated PoS), enabling efficient yet decentralized validation.

-

Custom Virtual Machine (CVM): Executes deterministic bytecode with advanced introspection logic — enabling secure, programmable asset logic far beyond typical smart contracts.

-

Governance by DAO: Entire protocol governed by Onyx DAO, with proposal thresholds (100M XCN) and quorum requirements (200M XCN), plus self-custody staking contracts.

- Security and Scalability

-

Ed25519 cryptographic keys and pseudonymous public addresses ensure transaction privacy.

-

Compact proof validation: Reduces node resource consumption while enhancing transaction throughput.

-

UTXO-based ledger model allows for parallel transaction processing, boosting scalability.

- Unique Use Cases

-

Cross-chain token swaps using Interledger Protocol.

-

Asset tokenization with fine-grained control via "issuance programs."

-

Governance-driven upgrades using versioning and extensible fields.

Why Was XCN Crashing — And Why It’s Rising Again

The Fall: Whale Capitulation & RSI Collapse

Between January and March 2025, whale addresses (holding 10M–100M XCN) sold off over 50% of their holdings — dumping 637M XCN, worth around $76M.

Sentiment crashed, RSI hit a 7-month low, and price plummeted to $0.007.

The sell-off triggered a mass exodus of retail investors as confidence hit rock bottom.

The Comeback: Whale Re-entry + Binance Futures

On April 12, whales began re-accumulating, spurred by Trump's 90-day tariff pause and increased interest in Real World Assets (RWA).

Addresses holding 1M–10M XCN grew by 29 addresses in 3 days, reflecting institutional optimism.

Binance listed XCN Futures, confirming broader market validation.

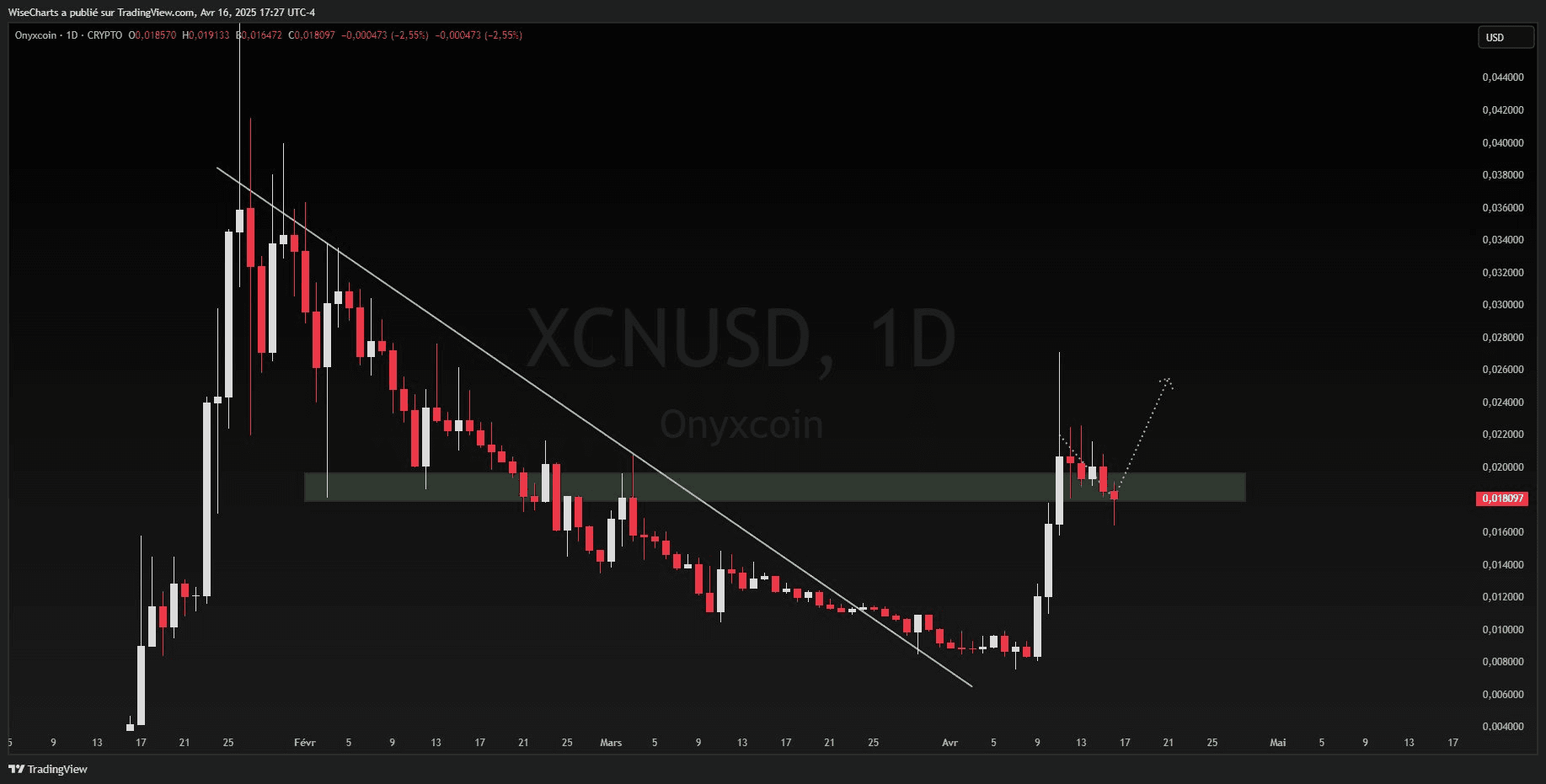

Technical Reversal Confirmed

XCN broke out from its descending resistance channel and surged above the critical $0.0150 and $0.0190 resistance levels.

RSI crossed above 50; MACD turned positive — classic signs of a trend reversal.

If it flips $0.023 as support, analysts expect targets of $0.033, $0.040, and even $0.048 in the coming months.

The Case for XCN Right Now

But Is the Rally Real?

According to Elliot Wave analysis, the recent rally may be wave B of an A-B-C corrective structure — implying we could see one more leg up before a deeper correction (Wave C).

But even a short-term move to $0.026–$0.033 could represent another 40–70% gain from current levels.

The Verdict: High Volatility, Higher Conviction?

Onyxcoin has been through hell and back — but it didn’t die.

Now backed by a recovering whale cohort, exchange listings, and DAO-driven momentum, XCN is staging a serious comeback. It’s still a risky bet — but for those who believe in infrastructure plays outside the Ethereum-Solana duopoly, XCN could be the dark horse of 2025.

If it breaks $0.023 cleanly, the next targets could come fast. For dip buyers looking for asymmetric upside, XCN is no longer a coin to ignore.

Hyperliquid (HYPE): The Ultra-Fast DeFi Engine Quietly Beating Centralized Exchanges

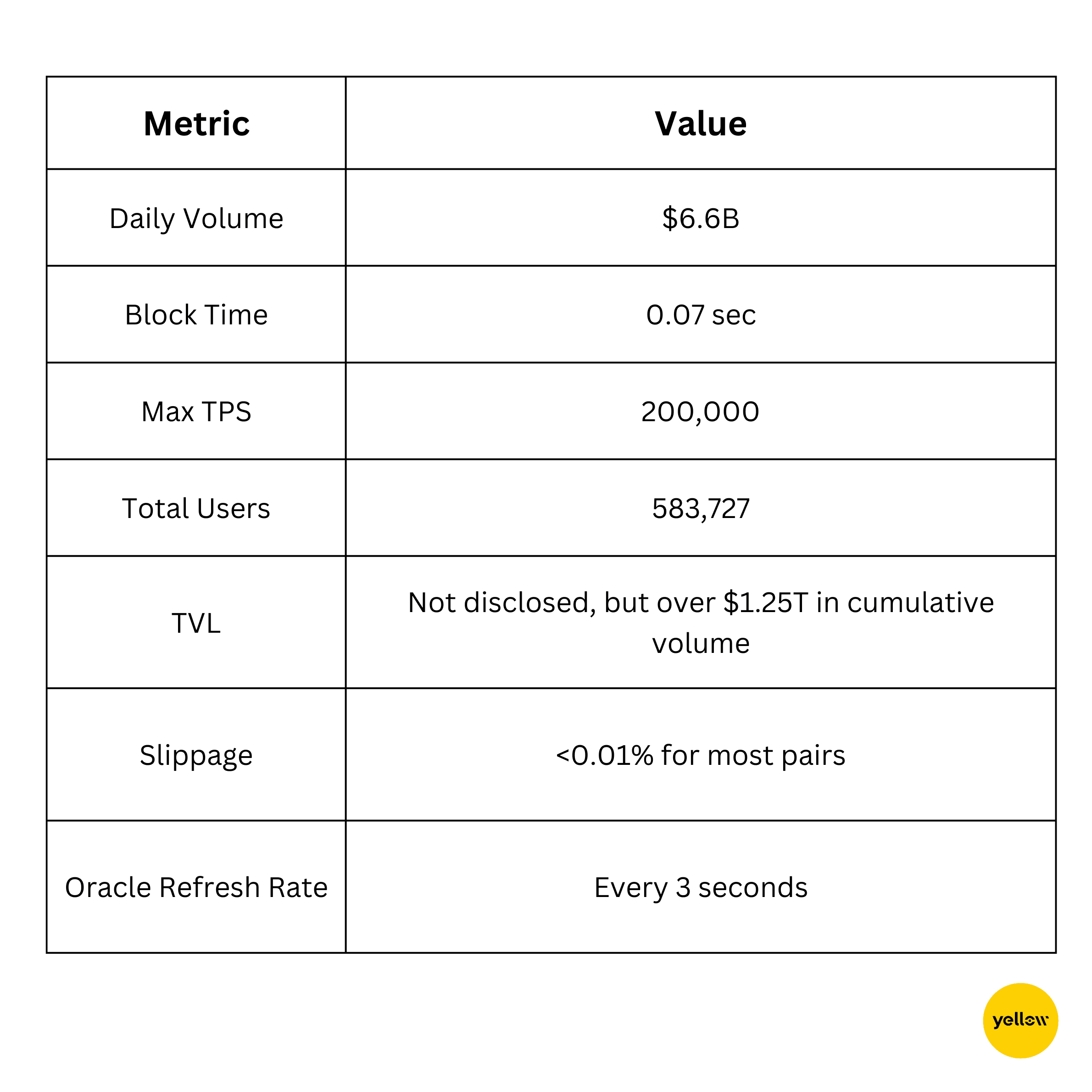

With sub-second block times, a 100% on-chain order book, and a $6.6B daily volume, Hyperliquid isn’t just “another L1.” It’s a fully decentralized trading infrastructure that's quietly becoming a direct competitor to the likes of Binance and dYdX — all while eliminating gas fees.

In 2025, Hyperliquid has gone from a low-key builder chain to one of the most promising ecosystems for high-frequency DeFi. Here’s why $HYPE might be the most overlooked breakout of the year.

The Momentum Is Building

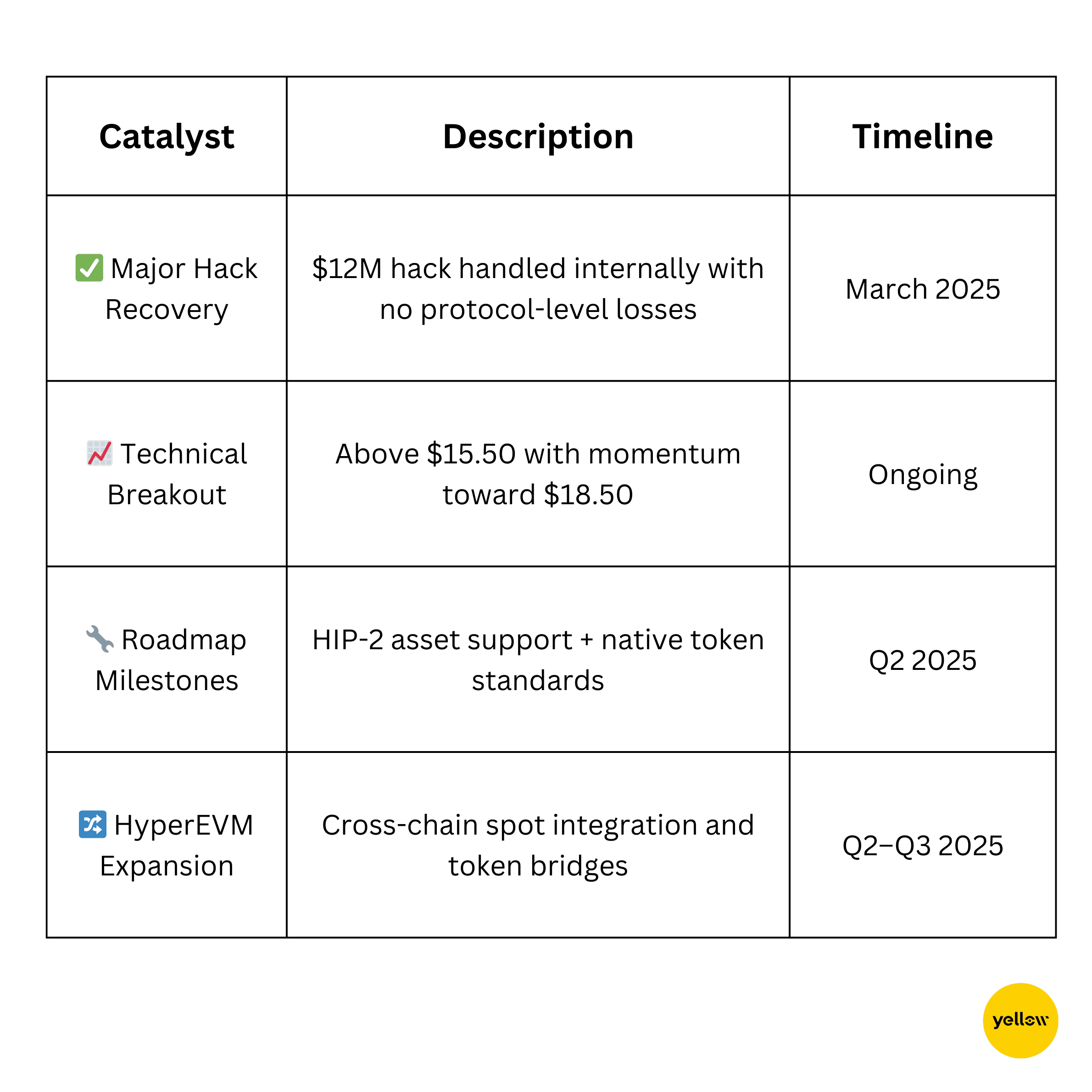

Hyperliquid has rallied 414% over the past year, with its current price at $16.47 and a market cap over $5.5B. The recovery from its March dip — following a near-$12M hack attempt — has only made it stronger, with both technicals and fundamentals now pointing to an incoming second leg of this rally.

As of mid-April 2025:

- Trading volume is up 22% daily

- RSI is ~55, trending upward but not yet overbought

- HYPE is forming a bullish continuation pattern, targeting $18.50–$20 in the short term

What Is Hyperliquid?

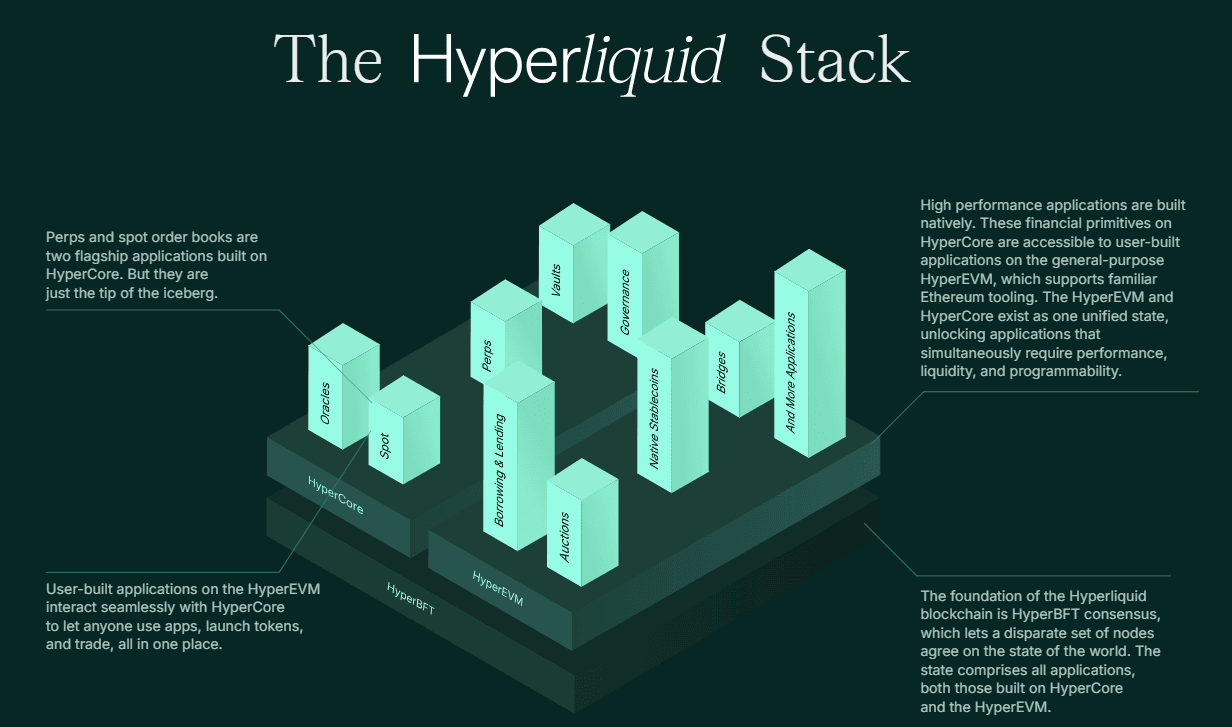

- A Custom-Built, Performance-Centric Layer-1 Chain

-

Consensus: HyperBFT — Derived from HotStuff (same as Facebook’s Libra), it delivers 0.07-second block time and ultra-fast finality.

-

TPS: 200,000+ — Engineered for high-frequency and algorithmic trading with EVM compatibility.

-

100% On-Chain Perpetuals Exchange — With a fully on-chain order book and zero gas fees, it matches the speed of CEXs without sacrificing decentralization.

- Deep Architecture, Real Usage

The Hyperliquid tech stack is truly modular and DeFi-native:

-

HyperCore: Hosts core financial primitives like perps, lending, auctions, and stablecoin vaults

-

HyperEVM: Runs smart contracts using Ethereum tooling, fully interoperable with HyperCore

-

Native Trading: High-throughput, low-slippage spot and perpetual trading up to 50x leverage

-

No Gas Fees: Traders pay nothing in gas and even get rebates as makers

This isn't just a DEX — it's a full-stack financial system built on its own L1.

Security After the JellyJelly Hack

In March 2025, Hyperliquid faced a near $12M exploit involving the JELLY token, which revealed unexpected centralization — validators froze trades and overrode prices to save the protocol.

While the response was criticized, it successfully averted a complete liquidity wipeout, saving $230M in the Hyperliquid Liquidity Pool. Since then:

- Validator rules have been revised

- Oracle manipulation controls enhanced

- Slippage and liquidation risk modeling improved

In a way, the hack exposed its weakness — but also its resilience.

Why Now?

Technical Breakout in Progress

-

HYPE broke past $15.00 resistance and is holding above its 50-day EMA

-

MACD just crossed into positive territory

-

RSI at 55.42 leaves room for continued upside

If the breakout sustains, targets are $18.30–$18.50, with a larger wave C potentially aiming for $22–$24

Performance Metrics That Crush Competitors

No other DEX — not even dYdX v4 — currently operates at this level of speed and scale while being truly on-chain.

Key Catalysts to Watch

The Verdict: The Next dYdX — Without the Compromises?

Hyperliquid isn’t a narrative coin — it’s an actual product that works better than most centralized exchanges.

Between its unmatched execution speed, deeply integrated DeFi stack, and zero-gas model, HYPE might be the fastest horse in the decentralized trading race.

The hack may have dented its image temporarily — but its ability to bounce back, retain users, and continue growing makes this a prime dip-buy for serious DeFi believers.

It’s still early. And HYPE is just getting started.

Closing Thoughts

Infrastructure is no longer a buzzword — it’s the foundation of real-world crypto adoption. XRP is making cross-border payments faster and more compliant. XCN is reviving its Layer-1 vision with whale support and DAO control. Hyperliquid is proving that on-chain trading can be fast, efficient, and completely gas-free.

These tokens stand out not just for what they promise, but for what they’re already delivering.

With strong fundamentals, bullish momentum, and major developments already in play, XRP, XCN, and HYPE are three tokens that make buying the dip a smart move — not a risky one.