Tether’s USDT is the obvious king of the stablecoins market. Why even bother asking which stablecoin to use, right? Wrong. There are many factors to consider and some alternatives that might be worth your attention. The most obvious is, of course, Circle’s USDC. But there are more promising contenders. One of the most promising is Hong Kong-born FDUSD.

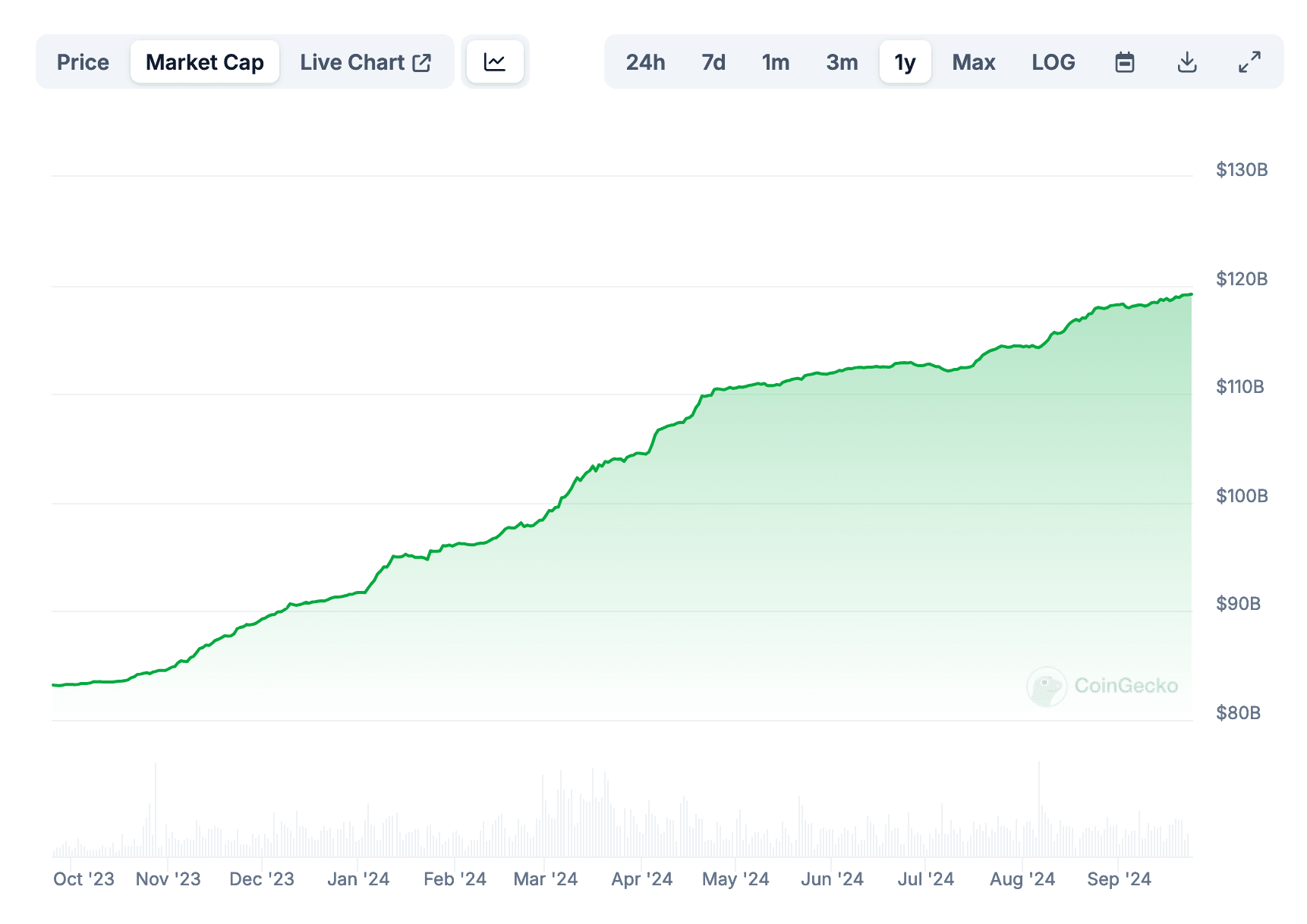

As we pointed out a bit earlier, Tether is on the verge of hitting a historical market cap of $120 billion.

It’s time we clashed the leading stablecoins head-to-head to see which stablecoin is worth using in 2024.

Introduction: What Are Stablecoins and Why Do You Need Them?

Stablecoins have rapidly evolved into indispensable components of the cryptocurrency ecosystem. Why? Because they are bridging the gap between the volatile world of digital assets and the stability of traditional fiat currencies.

Their significance lies in their ability to provide a stable medium of exchange and store of value within the crypto market. They mitigate the inherent price fluctuations of cryptocurrencies like Bitcoin and Ethereum. They always keep the same value, regardless of the overall crypto market fluctuations.

Thus, stablecoins are perfect for different purposes that traders, investors, and institutions might pursue. Stablecoins are reliable tool for transactions, hedging, and accessing decentralized financial services.

The rise of stablecoins has not only facilitated smoother trading experiences but has also played a crucial role in the expansion of decentralized finance (DeFi). They have become a cornerstone for liquidity in crypto exchanges and a safe harbor during periods of market volatility.

Among the multitude of stablecoins, Tether (USDT), USD Coin (USDC) have emerged as prominent players, each bringing unique features and approaches to stability, compliance, and market integration.

New contenders emerge constantly, defying the established leaders, like First Digital USD (FDUSD) effectively does.

These stablecoins, while sharing the common goal of maintaining a stable value, differ in their operational models, regulatory compliance, transparency levels, and technological integrations.

Depending on your personal goals understanding these differences is crucial if you want to use stablecoins with maximum result.

Stablecoin Dominance and Recent Developments

Stablecoins are on the rise.

As of September 2024, the total market capitalization of stablecoins has soared to over $169 billion. This marks a substantial 38.5% increase from $122 billion in October 2023.

Tether (USDT) continues to dominate the stablecoin market, commanding a staggering 70.4% share with its market cap approaching the $120 billion milestone. This dominance is fueled by consistent capital inflows and widespread adoption across various exchanges and platforms.

And they don't miss the opportunity to use it to continuously build muscle mass.

In the past month alone, Tether minted an additional $1 billion on the Ethereum blockchain and $100 million on Tron.

Other stablecoins are also making significant strides.

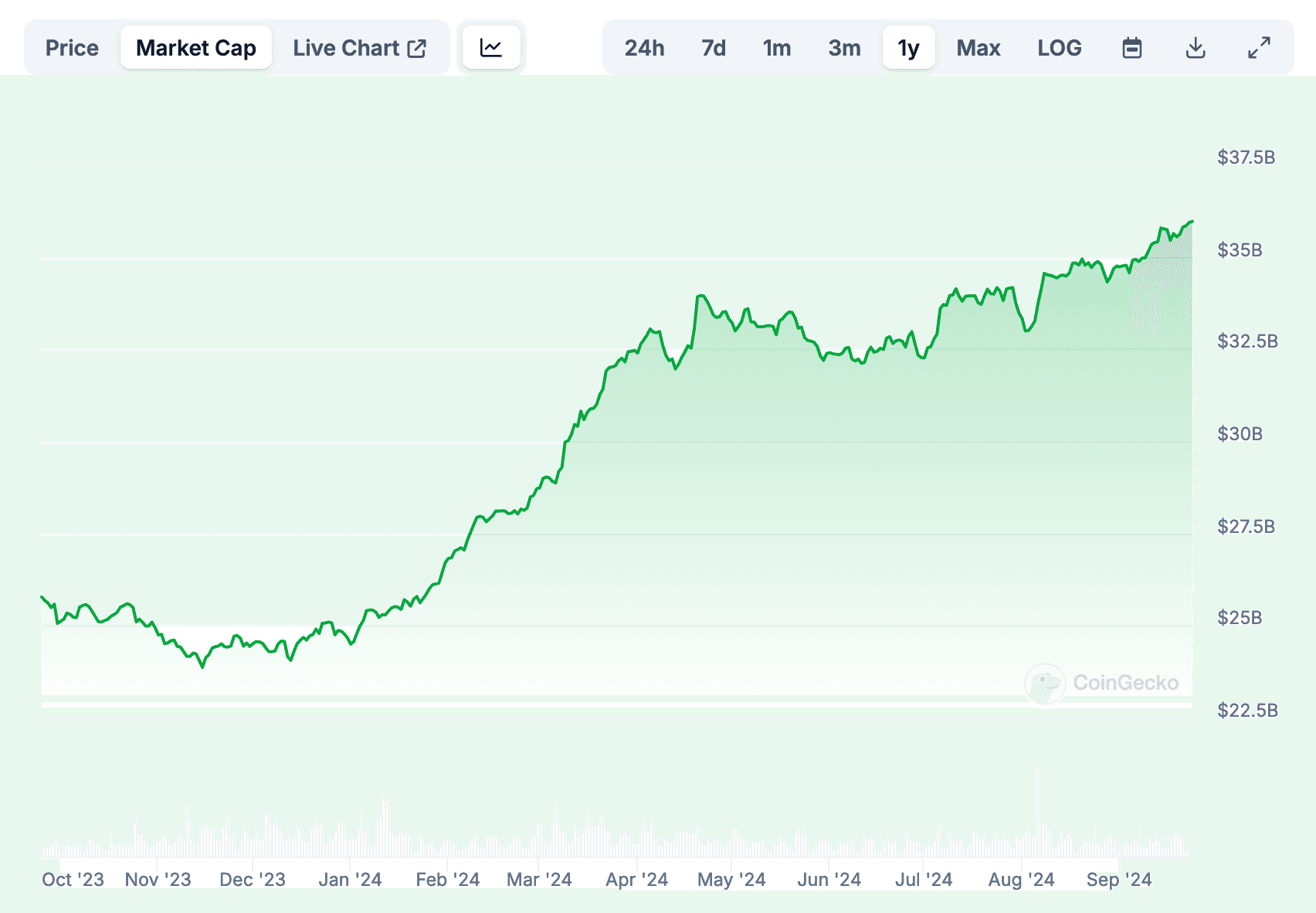

Circle’s USDC has been grown steadily, almost outpacing USDT in most terms.

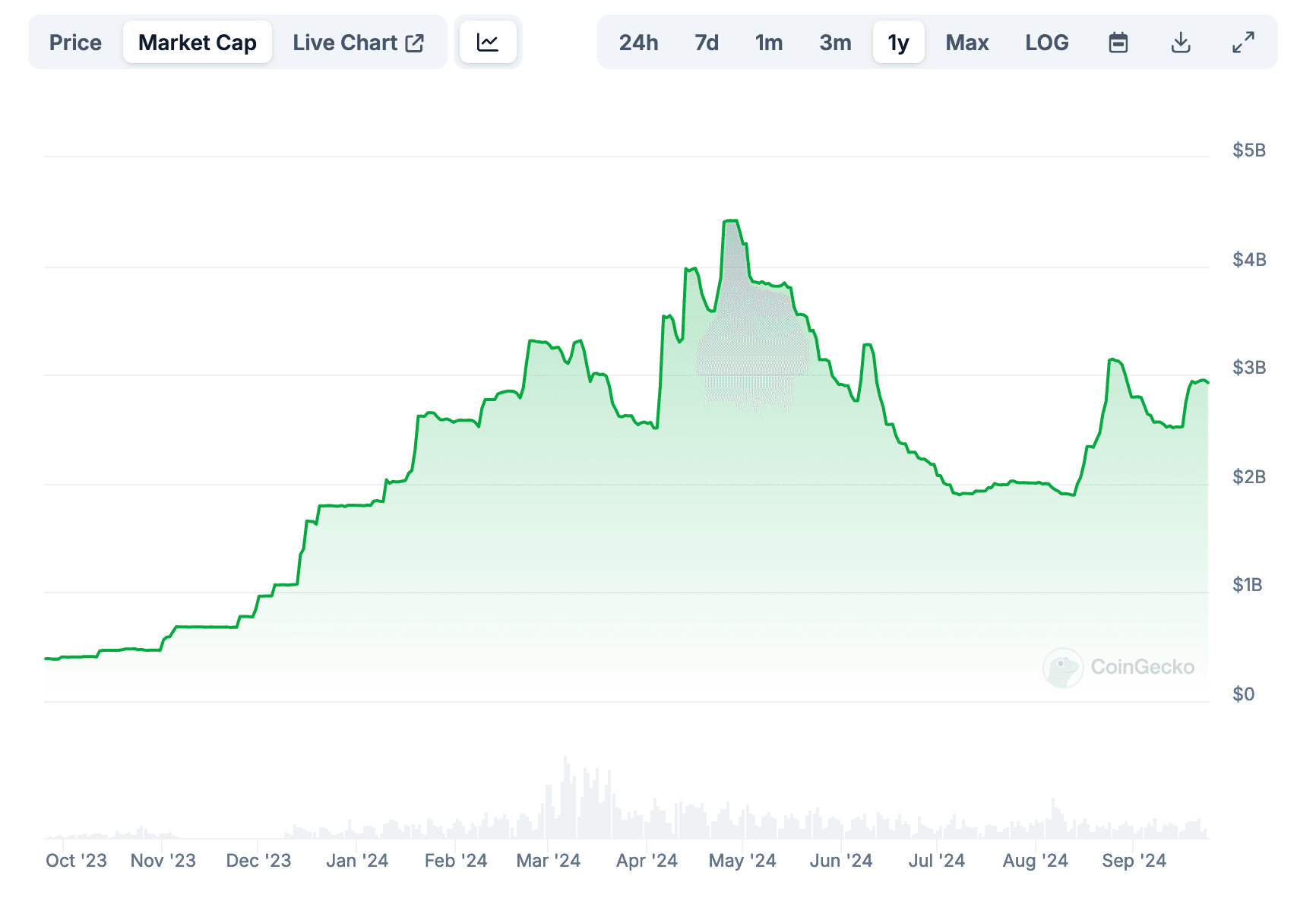

But it is First Digital USD (FDUSD), the new kid on the block, that has demonstrated remarkable growth.

Over the last 30 days, FDUSD's market capitalization increased by 47%, reaching $2.94 billion. This rapid expansion highlights the appetite for alternative stablecoins that offer different features or comply with regional regulatory frameworks (more about that in a minute).

The robust growth of stablecoins is influenced by several factors.

Global inflation concerns have prompted individuals and institutions to seek assets that can preserve value without exposure to the volatility of traditional cryptocurrencies. In countries like Argentina or South Africa people quickly learn to trust stablecoins, because of the fragile nature of their trust towards their governments and their fiscal policies.

Thus, weakening fiat currencies have led to increased adoption of stablecoins as a means of safeguarding wealth and facilitating international transactions without the constraints of traditional banking systems, often corrupted and fickle.

On the other hand, stablecoins have become a multifunctional tool for experiences trader on the DeFi platforms. Users can now lend, borrow, and earn interest on their stablecoin holdings, further embedding these assets into the fabric of digital finance.

Let’s take a look at how two leading stablecoins - USDT and USDC - compare to each other and to a pretty serious and fast growing contender - FSUSD.

Tether (USDT) - History and Financial Data

Tether (USDT), launched in 2014, pioneered the concept of stablecoins by introducing a digital token pegged to the U.S. dollar on a 1:1 basis.

At that time, the idea seemed pretty strange. Who would ever need a digital representation of a simple U.S. dollar, people asked.

Time has set things right, though.

Tether’s innovation provided a solution to the volatility problem in cryptocurrency trading. Allowing users to move in and out of crypto positions without reverting to fiat currencies, thereby saving time and reducing transaction costs.

USDT's market capitalization has seen exponential growth, now hovering around $119 billion. This growth reflects its widespread acceptance and the trust placed in it by the crypto community, despite ongoing controversies. Tether's ability to provide liquidity across various exchanges has cemented its position as a critical infrastructure component in the crypto market. To some users, USDT is the true blood of crypto market, rather than Bitcoin or Ethereum.

<u>USDT Market Cap, Last 12 Month / CoinMarketCap</u>

What’s even more compelling is the fact that USDT has surpassed Visa in terms of transaction value recently. A great deal of success is due to a wise decision to mint USDTs on different blockchains. With time, Tron happened to be faster than Ethereum for USDT transactions, and fees are significantly lower.

But every rose has its thorns. So does USDT.

Tether has faced significant scrutiny over its transparency and the nature of its reserves.

Critics and regulators have questioned whether Tether holds sufficient assets to back all USDT tokens in circulation fully.

In the past, Tether claimed that USDT was entirely backed by U.S. dollars held in reserve. Subsequent disclosures revealed that the reserves included a mix of cash, cash equivalents, and other assets, including commercial paper and loans.

In 2024, Tether reported net profits of $5.2 billion in the first half, primarily driven by investments in U.S. Treasury bills and other assets. Despite its profitability, questions about its reserve transparency persist.

Authorities have consistently pressured Tether to disclose detailed audits of its holdings, leading to regulatory tension. The lack of fully transparent and independently audited financial statements remains a contentious issue that could impact Tether's operations and user confidence in the long term.

And that is something you should definitely give a thoughtful consideration if you are about to trust Tether some of your assets and wealth.

USD Coin (USDC) - History and Financial Data

USD Coin (USDC) was introduced in 2018 through a collaboration between Circle and Coinbase, two prominent and respectable players in the cryptocurrency industry.

From its inception, USDC was designed with a strong emphasis on regulatory compliance and transparency, positioning itself as a trustworthy alternative to other stablecoins. And by other we mean, of course, Tether’s USDT, that was, by the time, already the leading cryptocurrency of its kind.

And Circle is doing many things in an absolutely different manner.

USDC maintains its peg to the U.S. dollar through a strict reserve policy, ensuring that each USDC token is backed 1:1 by U.S. dollars held in segregated accounts at regulated financial institutions. To reinforce trust, USDC provides monthly attestations from Grant Thornton LLP, a leading accounting firm, verifying the adequacy of its reserves.

As of 2024, USDC's market capitalization stands at approximately $35.88 billion, making it the second-largest stablecoin behind Tether. USDC has gained considerable traction, particularly among institutional investors and within the DeFi ecosystem, where its transparency and compliance are highly valued.

<u>USDC Market Cap, Last 12 Month / CoinMarketCap</u>

Simply put, to many users USDC is simply a more transparent and reliable option than USDT that is constantly surrounded by a halo of scandals and tussles with authorities and lawmakers.

USDC's integration into global financial systems is facilitated by strategic partnerships with major financial institutions and technology firms. Its compliance with the Markets in Crypto-Assets (MiCA) regulation in Europe exemplifies USDC's commitment to aligning with evolving regulatory standards. And once again marks the stark contrast with how USDT is evolving.

This proactive approach has not only expanded its user base but also positioned USDC favorably in discussions about the future of regulated digital assets.

Just like its arch enemy, USDC has been at the forefront of technological innovation, supporting multiple blockchain networks beyond Ethereum, including Algorand, Solana, and Stellar.

First Digital USD (FDUSD) - History and Financial Data

First Digital USD (FDUSD) is one of the newer additions to the stablecoin market. It was launched by First Digital Trust, a Hong Kong-based financial institution specializing in custody and asset servicing solutions. FDUSD aims to provide a secure and compliant stablecoin option, particularly catering to the Asian market.

Despite its relatively recent entry, FDUSD has already achieved significant growth.

Over the last 30 days, its market capitalization surged by 47%, reaching $2.94 billion.

This rapid ascent can be attributed to several factors.

FDUSD emphasizes full compliance with regional regulations, appealing to users and institutions in jurisdictions where regulatory oversight is stringent. It’s much closer to USDC than to USDT in this regard.

Full Asset Backing is also a thing here. FDUSD is committed to maintaining full reserve backing, providing users with confidence that each token is redeemable for its equivalent value in U.S. dollars. That helps build trust, to say the least.

Also worth mentioning that FDUSD's integration into major offshore exchanges has enhanced its liquidity and accessibility, making it a viable alternative to established stablecoins like USDT.

<u>FDUSD Market Cap, Last 12 Month / CoinMarketCap</u>

Focus on Cross-Border Transactions is the killer feature of FDUSD. The new Asian-born stablecoin is designed to facilitate efficient cross-border payments, addressing a critical need in global finance, especially in regions where traditional banking services may be limited or costly.

While FDUSD's market share remains small compared to USDT and USDC, its growth trajectory and strategic positioning suggest that it could become a significant player in the stablecoin arena. Particularly within specific regional markets, but there a sign of the gaining popularity worldwide.

USDT, USDC, and FDUSD: Comparative Analysis - Resilience, Sustainability, and Reputation

The stablecoins USDT, USDC, and FDUSD, while sharing the fundamental goal of maintaining a stable value pegged to the U.S. dollar, differ markedly in their approaches to operational transparency, regulatory compliance, technological integration, and market strategies.

A deep analysis of these differences is essential to understand their respective positions in the market and potential future developments. This is how you define where to put your money.

Operational Transparency and Reserve Management

As we mentioned above, USDT has historically been less transparent about its reserve holdings.

While Tether has provided periodic attestations and reports, these have not always satisfied regulatory authorities or critics who demand full audits by reputable third parties. The composition of USDT's reserves has been a focal point of concern, with a significant portion previously held in commercial paper and other assets rather than cash equivalents. This lack of full transparency raises questions about Tether's ability to meet redemption demands during periods of high market stress. The more people withdraw their assets the more pressure Tether will experience.

In contrast, USDC has built its reputation on operational transparency.

Circle, the issuer of USDC, provides regular, detailed attestations of its reserves, conducted by Grant Thornton LLP. These reports include information about the types of assets held and confirm that reserves are held in segregated accounts. USDC's commitment to transparency extends to compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, which enhances its credibility among regulators and institutional users.

FDUSD also emphasizes full asset backing and regulatory compliance.

But as a newer stablecoin, FDUSD has yet to establish a long-term track record of transparency. Its association with First Digital Trust, a regulated entity, adds a layer of credibility. However, FDUSD will need to continue building trust through consistent, transparent reporting and independent audits to solidify its reputation. If it manages to go further with no scandals and questionable moments, it will further drift in the wake of USDC. This will mark contrast with USDT and make the competition even sharper.

Regulatory Compliance and Global Integration

Would you rather entrust your savings or operational assets to an entity that is 100% legal or to an entity that is regularly on the brink of a war with the authorities. Well, unless you are a Pavel Durov’s fan, the answer it kind of obvious.

Regulatory compliance is a critical differentiator among stablecoins, influencing their adoption and integration into the global financial system.

Once again, USDT has faced regulatory challenges, including investigations and fines related to its reserve disclosures and operations. These issues have led to restrictions in certain jurisdictions and have prompted some institutions to limit or avoid using USDT due to compliance concerns.

For instance, with the implementation of MICA, many European services and platforms are about to get rid of USDT. That includes even Binance in many countries of the EU.

That might mean nothing to you if you come from other parts of the world, but in Europe USDT seems to be on the verge of loosing its leading positions.

USDC has proactively engaged with regulators and designed its operations to meet regulatory requirements in key markets. Its compliance with the MiCA regulation in Europe and adherence to U.S. financial regulations position USDC as a stablecoin that can be confidently used by institutions and entities that operate within strict regulatory environments.

You might not like the fact that you have to explain to your business partners why are you choosing USDC instead of USDT, but in terms of legal hurdles, USDC looks a more clear choice.

FDUSD operates within the regulatory framework of Hong Kong and other Asian jurisdictions. Its focus on compliance in these regions makes it an attractive option for users and businesses operating in Asia. As global regulatory landscapes evolve, FDUSD's ability to navigate and comply with international regulations will be crucial for its expansion. Experts have no doubts that FDUSD is going to comply to all kinds of legal demand as the widespread adoption rises. That makes it a one more tough competitor to USDT.

Technological Integration and Ecosystem Participation

It’s difficult to directly compare transaction speeds and fees of USDT, USDC, and FDUSD due to the fact they operate on different blockchains. But still there is some info you should be familiar with.

USDT (Tether) is available on multiple blockchains, including Ethereum (ERC-20), Tron (TRC-20), and others like Solana and Binance Smart Chain.

On the Ethereum network, USDT transactions can experience slower speeds and higher fees due to network congestion and elevated gas prices (sometimes reaching a few dollars per 100 dollars sent). In contrast, USDT on the Tron network offers faster transaction speeds and significantly lower fees, making it a popular choice for users who prioritize cost-efficiency and quick transfers.

USDC (USD Coin) also operates on several blockchains such as Ethereum, Algorand, Solana, and Stellar. Similar to USDT, USDC transactions on Ethereum can be costly and slower because of network congestion.

However, on networks like Solana and Algorand, USDC transactions are much faster and incur minimal fees, often just fractions of a cent, thanks to these networks’ high throughput and scalability.

Anyway, in most cases USDT’s wider network allows cheaper fees than USDC (Tron vs Solana blockchain, for that matter). But for small transactions the difference is negligible. So to most common users they will seem adequately same.

FDUSD (First Digital USD) is a newer stablecoin, and specific data on its transaction speeds and fees is still somewhat limited.

FDUSD operates on Ethereum, a rather slow blockchain at the moment, and BNB Chain that emphasizes quick transaction times and relatively low fees to enhance its appeal for global payments.

Anyway, it would be safe to say, that in general transaction speed and fees are to be improved here, compared to USDT on Tron and USDC on Solana.

Market Strategy and User Base

The market strategies of these stablecoins influence their adoption and the demographics of their user bases.

USDT targets a broad user base, from retail traders to large institutions, offering high liquidity and availability across numerous exchanges. Its low transaction fees on certain networks, like Tron, make it attractive for high-volume traders and those seeking cost-effective transactions.

USDC focuses on institutional adoption and integration into regulated financial services. Its partnerships with established financial institutions and fintech companies reflect a strategy aimed at building trust and facilitating large-scale financial operations.

FDUSD is strategically positioning itself within the Asian markets, catering to users who require efficient cross-border payment solutions and compliance with regional regulations. Its growth in these markets indicates a successful alignment with the needs of its target user base.

Risk Assessment and Sustainability

Each stablecoin faces risks that could impact its sustainability and market position.

USDT's primary risks stem from regulatory scrutiny and the potential for legal actions that could limit its operations. Additionally, any significant loss of confidence due to reserve transparency issues could lead to a rapid decrease in its market capitalization and liquidity.

USDC's risks are associated with regulatory changes that could impose new requirements or restrictions on stablecoins. While its compliance stance is a strength, it also subjects USDC to the uncertainties of evolving regulations.

FDUSD faces the challenges of building market share in a competitive environment and establishing long-term trust. Regulatory changes in its operating regions or broader geopolitical shifts could also impact its growth.

Conclusion

In conclusion, while USDT, USDC, and FDUSD all serve the fundamental purpose of providing stability within the cryptocurrency market, their differences in transparency, compliance, technological integration, and market strategies cater to different segments of the market.

USDT's dominance is rooted in its liquidity and widespread adoption, making it indispensable for many traders and exchanges. However, ongoing concerns about transparency and regulatory compliance present potential risks. If you wish to have your assets in coin that is widely popular and is accepted literally everywhere on planet earth, USDT is the choice for you.

USDC's commitment to transparency and regulatory adherence appeals to institutions and users who prioritize security and compliance. Its technological integrations and support for innovation position it well for growth in regulated markets and advanced financial applications. If you are a law abiding citizen (especially, living in Europe) USDC is the way to go. Safe and solid.

FDUSD, as an emerging stablecoin, is capitalizing on regional opportunities, focusing on compliance and efficiency in cross-border transactions. Its success will depend on its ability to build trust and expand its integrations within the global financial system. But, as of now, it is already a pretty interesting choice for users in Asia where FDUSD has already become a local USDC of a kind.